Generally speaking, the current skeptical stock market environment is not the most propitious backdrop for a start-up electric vehicle manufacturer. After the close on May 10, Canoo Inc. (NASDAQ: GOEV) reported another quarter (1Q 2022) of sizable losses and giant cash burn. In addition, the company for the first time included the dreaded “going concern” language — “There is substantial doubt about the Company’s ability to continue as a going concern” — in its filings with the SEC.

Not surprisingly, the stock is trading down around 17% to US$3.00 per share. Even with this decline, the company still retains a lofty enterprise value of around US$635 million.

Canoo burned through about US$149 million in 1Q 2022 in combined negative operating cash flow and capital expenditures, as its cash balance fell to US$105 million on March 31, 2022 from US$225 million on December 31, 2021 (and from US$702 million just fifteen months ago). Remarkably given these first quarter results, the company expects its aggregate 2Q 2022 cash operating expenses and capital expenditures to range from US$180 million to US$220 million, even higher than they were in 1Q 2022.

| (in thousands of U.S. dollars, except for shares outstanding) | 2Q 2022E | 1Q 2022 | Full Year 2021 | 4Q 2021 | 3Q 2021 |

| Operating Income | ($140,786) | ($449,902) | ($141,480) | ($107,006) | |

| Cash Operating Expenses | ($95,000) to ($115,000) | ||||

| Operating Cash Flow | ($120,337) | ($300,816) | ($120,190) | ($71,803) | |

| Capital Expenditures | ($85,000) to ($105,000) | ($28,442) | ($162,728) | ($62,618) | ($71,457) |

| Adjusted EBITDA | ($117,428) | ($332,621) | ($120,274) | ($85,799) | |

| Cash | $104,926 | $224,721 | $414,904 | ||

| Debt | $25,758 | $13,826 | $14,032 | ||

| Shares Outstanding (Millions) | 239.9 | 238.6 | 237.6 |

As a stop gap, Canoo has entered into a Standby Equity Purchase Agreement with a hedge fund called YA II PN, Ltd. Under the agreement Canoo has the right to sell up to US$250 million of its stock (subject to a maximum cumulative sale of about 48 million shares) to YA at a 2.5% discount to the market price over the next 36 months.

This is not necessarily predictive, but in mid-2021, YA reached a similar rescue share purchase agreement with Lordstown Motors Corp. (NASDAQ: RIDE). Lordstown’s share price at the time was US$6.34; it now trades at US$1.60.

Canoo has also reached a subscription agreement with another investor, Aquila Family Ventures LLC, whereby Aquila will purchase about US$50 million of Canoo stock at US$3.65 per share.

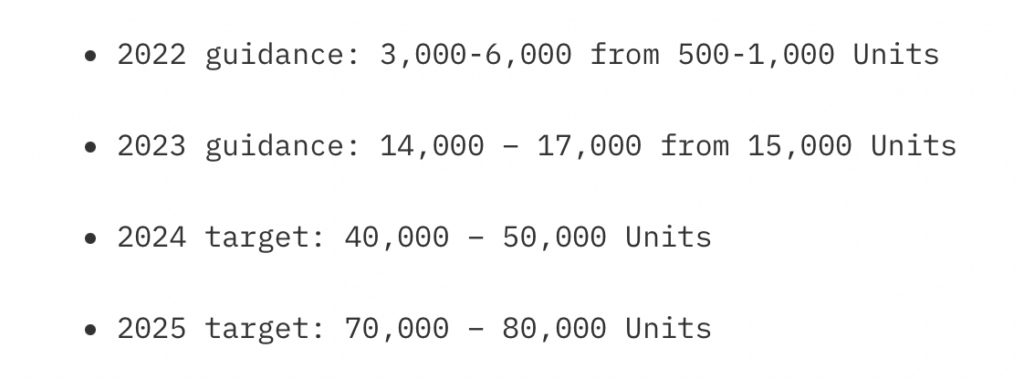

In mid-December 2021, Canoo boosted 2022 and 2023 production estimates of its flagship Lifestyle Vehicle. The electric car has a targeted starting sales price range of US$34,750 to US$49,950. It will initially be built at a facility in the U.S. state of Arkansas. In early 2024, manufacturing is expected to shift to its Mega Micro factory in Oklahoma.

An unavoidable issue for Canoo is that its 2022 revenue potential looks small versus its cash outlays. At the 4,500-unit midpoint of its production guidance, and assuming a US$45,000 average sales price per electric car, Canoo’s 2022 revenue would be only about US$200 million, or just above its 1Q 2022 cash burn rate alone. Canoo says it is currently producing up to 12 LifeStyle vehicles per week (equivalent to only a 600-unit annual pace).

It is of course possible that investors will in time decide to focus exclusively on Canoo’s out-year LifeStyle Vehicle manufacturing projections, and permit the company to raise needed equity at reasonable prices This would give the company more flexibility and options in managing its operations.

Canoo is facing an enormous cash squeeze and, surprisingly, seems not to be operating in cash preservation mode. Canoo’s stock price, down nearly 80% since its late November 2021 peak, reflects some of this uncertainty. However, its enterprise value is still more than US$600 million, remarkably high for a company in its situation.

Canoo Inc. last traded at US$3.00 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.