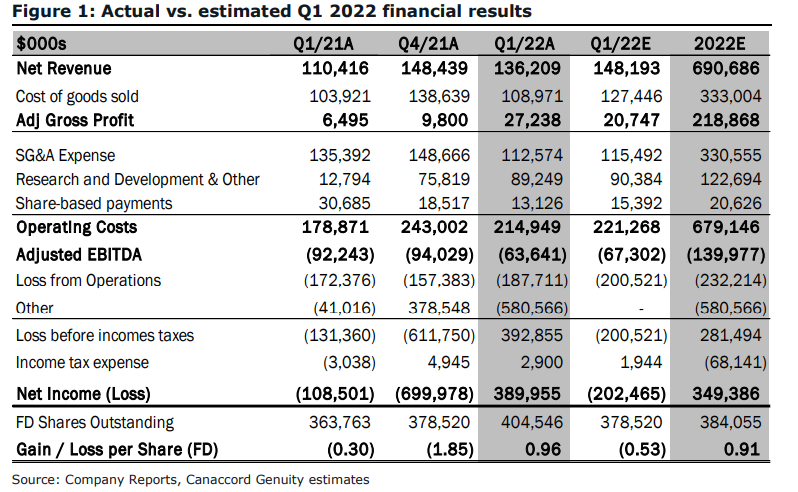

Last week, Canopy Growth Corp (TSX: WEED) (NASDAQ: CGC) reported their first fiscal quarter of 2022, the company reported net revenues of $136.2 million, an 8.2% sequential decrease. While gross profit grew almost 300% to $27.2 million, the company remains structurally unprofitable with selling, general, and admin expenses totaling $112.57 million for the quarter. The company reported a net income of $392.4 million, or an earnings per share of $1.02 million due to warrant revaluation.

Four analysts lowered their 12-month price target, which brings the average price target to C$28.57, down from C$31.97 a day before earnings. The street high sits at C$51 from MKM Partners while the lowest comes in at C$18. Canopy has 15 analysts covering the name, with 1 analyst having a strong by rating, 3 have buy ratings, 9 have holds and 2 analysts have strong sell ratings on the stock.

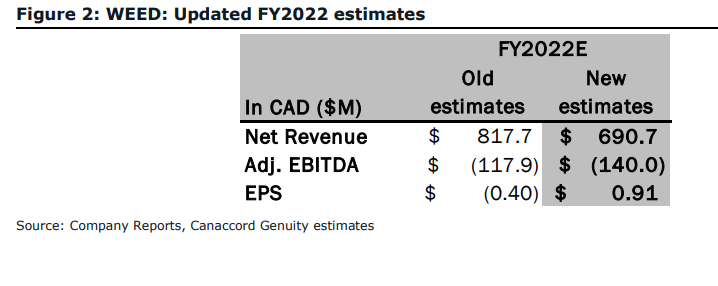

Canaccord Genuity was one of the firms to lower their price target to C$25 from C$30, citing “a fairly uninspired quarter.” They also reiterated their hold rating on the stock, while commenting that cash burn, lower revenue, and more headwinds also contributed to their price target change.

For the quarter, Canopy’s $136.2 million net revenue came in way below Canaccord’s $148.19 million estimates. Canopy’s $60 million in adult-use cannabis sales were down roughly 2% sequentially, and slightly below Canaccord’s $62.1 million estimate. The main reason for Canopy’s large top-line miss is due to the companies international segment, which generates most of the segment’s revenue from Germany, who’s still dealing with COVID-19 headwinds. The international segment reported a 27% decline, while its “other” segment also fell by 34% quarter over quarter.

Canopy ended the quarter with $2.05 billion in cash and equivalents, while the company’s free cash flow burn ballooned 50% quarter over quarter to $186.2 million.

The company recently closed on its Supreme Cannabis and Ace Valley acquisitions, helping to expand their product offerings with Canopy offering over 50 new SKU’s online year-to-date.

Below you can see Canaccord’s updated the fiscal full-year 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.