Canopy Growth Corp (TSX: WEED) (NYSE: CGC) is off to a rough start this morning after Bank of America Merrill Lynch downgraded the equity from a rating of ‘Buy’ to “Neutral”, the latest in a series of reduced targets for the firm from analysts. The downgrade follows Canopy’s disappointing quarterly financials as of late, which have seen the purported leader of the sector post a continuous reduction in market share within Canada.

Concurrent with the rating downgrade, analyst Christopher Carey also reduced the price target for the US-traded ticker from $46 to that of $27, citing an anticipated flattening of sales for Canopy, as well as across Canada. The price target represents a multiple of ten times enterprise value to sales (EV/Sales), which is half of what was used in the previous model.

Carey also stated that he sees much risk being associated with the equity until estimates are re-calibrated, and that recent vaping concerns could act as a cloud over sector sentiment as a whole.

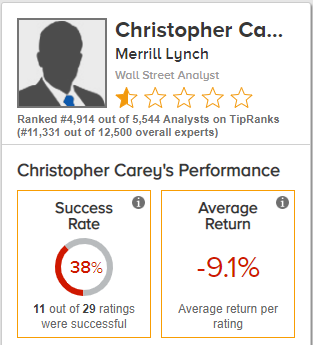

As has become a trend with those who follow the Canadian cannabis sector closely, its assumed that many will begin looking into Carey’s history as an analyst and his previous accuracy. While many retail traders are gleeful when any analyst gives their pick a ‘buy’ rating, they often dig into the history of the same analyst when the eventual downgrade arrives. As a result, we’ve dug up Carey’s performance record as a measure of saving time for investors. While not the best history – it still represents an official rating from one of the largest investment houses in the US market.

Canopy Growth Corp is currently trading at a price of $23.98 on the New York Stock Exchange.

Information for this briefing was found via The Fly and Canopy Growth Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.