When it rains it pours and Canopy Growth Corp. (TSX: WEED) is finding that out firsthand after a series of blows to the company during the somber month of June.

It first started off with the news that S&P Global would be pulling its credit rating from Canopy after its decision to amend its 2022 credit agreement. Then the company reported fourth-quarter financial results, which were previously delayed due to management uncovering “misstatements” for the accounting treatment of BioSteel, its sports-drink segment.

And to much of no one’s surprise, Canopy’s earnings were abysmal. The company reported its third straight annual decline in revenue to $403 million. The results came with a gigantic loss of $3.3 billion, with Canopy also quietly noting that its once monster war chest of cash has been slowly dwindling. A balance that once sat at over $2.3 billion dollars only two years ago now sits at only $782.6 million.

This made Canopy’s auditors, KPMG LLP, issue a warning about its ability to continue as a going concern, which is just auditor speak warning investors about Canopy’s ability to stay solvent. At the same time, Canopy disclosed that the Securities and Exchange Commission was investigating it due to the BioSteel misstatements. And if that wasn’t enough, by the end of June, KPMG resigned from being Canopy’s auditor and, as a result, would not be standing for reelection at the next annual general meeting.

This has caused a run on Canopy shares, driving the stock down about 43% in June alone. Canopy, whose shares started the year off trading at C$3.14, is now trading at C$0.55, after having sunk as low as C$0.51.

And now, sell-side analysts are rushing in to clean up prior estimates. It first started off on June 26, when Benchmark’s analyst Mike Hickey cut his price target down to $0, citing uncertainty in management’s ability to turn the ship around. Hickey pointed to Canopy’s aggressive actions in the United States as some sort of an attempt to put lipstick on a pig, saying it “could be a signal of desperation, given that the U.S. market remains federally illegal.”

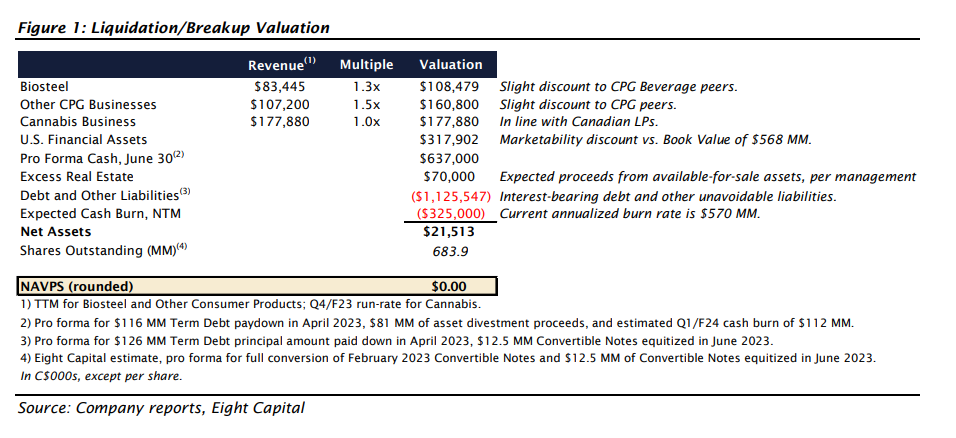

Fast forward to July 5th, and Eight Capital’s analyst Ty Collin joined the party with his own $0.00 price target and sell rating on Canopy Growth, aptly titling the note “Last Puffs of the Roach – Cutting our Target to Zero.”

Collin says that it’s no longer reasonable to value Canopy as an operating business due to,

- a) less than 12 months of cash runway,

- b) a lack of viable financing alternatives, and

- c) large ongoing losses without a clear path to profitability

As a result of this view, they have tried to put a value on the different assets Canopy has on their books. This results in a liquidation value of around $21.5 million, adding that they believe investors need to “be awake to the fact that no Canadian cannabis company is too big to fail in this environment.”

This comes after many notable and previously prominent cannabis companies have either had to file for bankruptcy or have had to sell themselves to competition in a fight to survive.

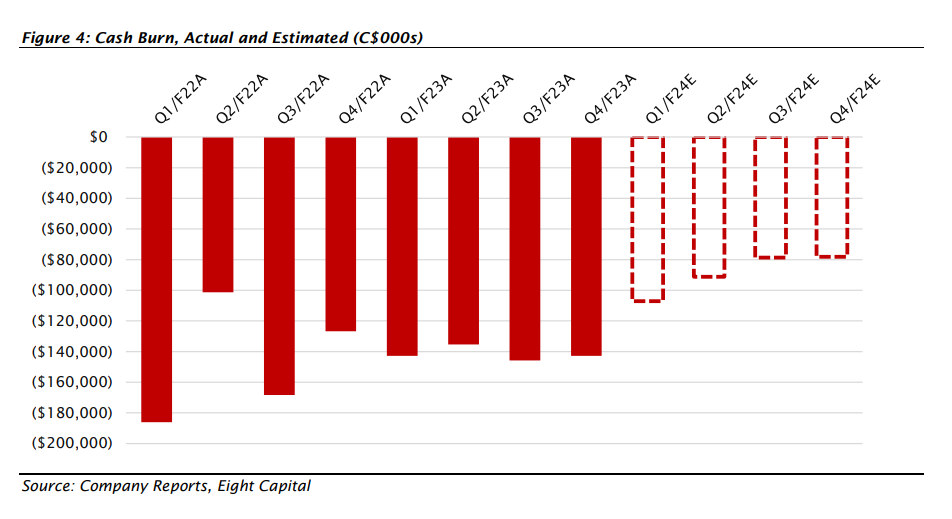

Collin estimates that Canopy burned roughly $143 million during their fiscal fourth quarter, which has been around the same amount of cash burn it’s seen for the last six quarters, which ultimately looks like management’s inability to stem the cash bleeding.

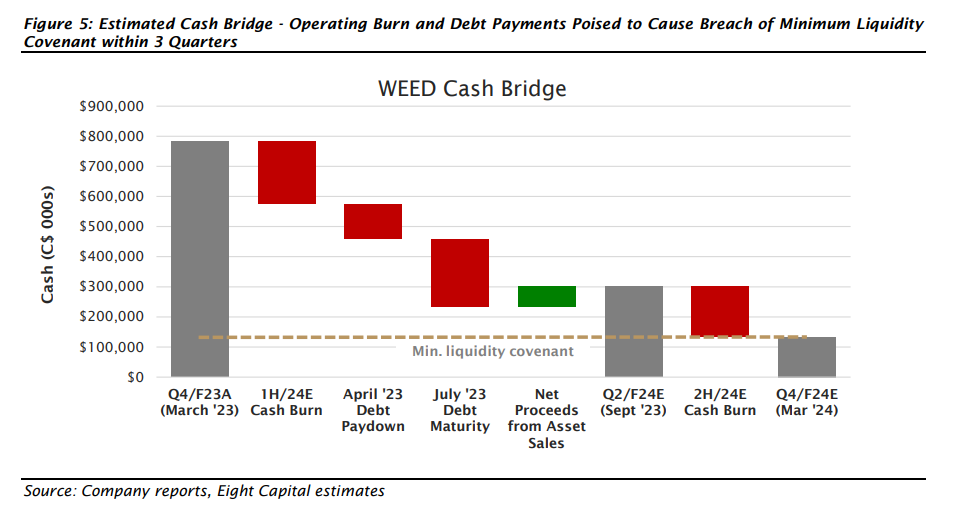

He estimates that Canopy ended its fiscal first quarter with only $637 million and likely only has three-quarters of cash left.

Though Collin believes that management still has some strings to pull, with their plan to sell non-core assets and hopefully negotiations with lenders, it is likely “too little, too late.” And the $115 to $118 million in cost savings expected to come in the second half of the year will not be able to plug the burn rate.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.