Canopy Growth (TSX: WEED) has evidently seen little interest from noteholders to convert their debt to equity in the company as of late. The firm this morning revealed that it has entered into arrangements with noteholders to convert just a small portion of notes to equity.

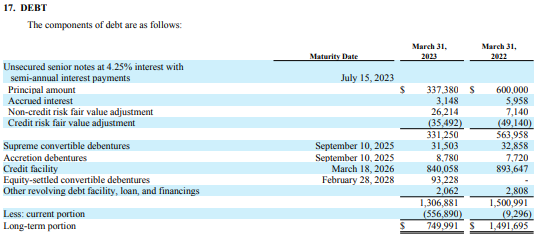

The company has managed to convince holders of just $12.5 million worth of notes to convert that debt into equity. The notes, which are senior unsecured notes with 4.25% interest, come due on July 15, 2023. As of March 31, the company had $337.4 million in principal amount outstanding of the notes, with an additional $3.1 million in unpaid interest owing.

The notes were originally issued in 2018, with $600.0 million in principal initially issued under the debt offering. In June 2022 however, $262.6 million of the debt was converted to equity, much of which was owned by Greenstar. That debt was collectively converted into 76.8 million shares.

Comparatively, the $12.5 million that recently agreed to convert to equity will see the issuance of 24.3 million shares, demonstrating the fall in valuation experienced by the company.

READ: Canopy Growth Sells Off Five Facilities In Q1 2023

“We are pleased to have reached an agreement to equitize these notes and remain focused on further strengthening Canopy’s financial position. This announcement builds on other already completed actions to preserve cash and provide additional financial flexibility,” commented Canopy Growth CFO Judy Hong.

As of March 31, Canopy had $677.0 million in cash and a further $105.6 million in short term investments.

Canopy Growth last traded at $0.58 on the TSX.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.