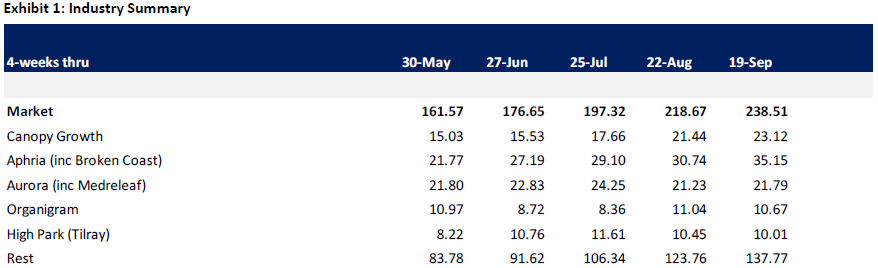

Recently, Cantor Fitzgerald released their monthly review of Hifyre data for the four weeks ending September 19th. In the summary, analyst Pablo Zuanic states, “we note ACB and WEED remain rather flower dependent (about two thirds), with their respective value brands 69% and 49% of their flower sales.”

Zaunic reiterates Aphria as their top pick and says Aphria is making a push into the value category, where they have eight 28g SKU’s which is the highest in the industry. They also comment that Tilray is more focused on 2.0 vs. 1.0, and results have been mixed.

In the note, Pablo Zuanic reiterates his ratings and price targets on the following companies:

- Aurora (TSX: ACB) (NYSE: ACB), Overweight, C$17.50

- Aphria (TSX: APHA) (NASDAQ: APHA), Overweight C$12.50

- Hexo (TSX: HEXO) (NYSE: HEXO), Neutral, C$1.25

- Organigram (TSX: OGI) (NASDAQ: OGI), Overweight, C$5.35

- Tilray (NASDAQ: TLRY), Neutral, $7.90

- Canopy Growth (TSX: CGC) (NYSE: WEED), Neutral, C$27.50

In Zuanic’s first point, he goes through the outperformers and the laggards. In the last several four week periods, with the most recent ending September 19th, the entire cannabis market grew roughly 10% on average. Out of the five LPs that Cantor covers, Aphria and Canopy grew +13% and +12%, respectively, which outperformed the +10% market increase. Meanwhile Tilray and Organigram grew below the market increase at +6%, and +1%, respectively, and Aurora was flat at 0%.

The next point Zuanic goes into is how the trends vary, and there is no pattern or correlation between the five LP’s covered by Cantor. Commenting on the most recent four week period, he states, “APHA grew 14%, WEED +8%, ACB +3%, OGI -3%, and TLRY -4%.” He then goes onto to explain that there are wild swings in the trailing data, with no consistent results period to period. For example, Tilray went from +20% average growth in the first eight weeks to -7% in the last eight weeks. Organigram went from -12% to +14%, Aurora went from +5% to -4%, Aphria from +16% to +10% and Canopy was +8% to +14%.

Now we move onto the individual LPs and see how their categories are doing. First is Aphria, which had Flower sales increase +16%, Pre-rolls +25%, Oils +7%, and Vapes +6% in the last four weeks. Zaunic says Aphria is the clear leader in the vape business and holds a 24% market share for that category. Aphria has 14%, 15%, 20% market share for flowers, pre-rolls, and oils, respectively.

Onto Canopy, which had a product mix that consisted of 65% flower, 15% pre-rolls, 8% oils, 7% beverages, 3% vapes, and 2% edibles for the last four weeks. Their flower category grew the most at +15% while edibles and vapes were hit the hardest with a -9% and -33% decrease, respectively. Zuanic says that Canopy has ten different brands, which is the most out of any LP but outside of Canopy’s beverage category, the company has not made any inroads yet to the other 2.0 categories.

Aurora had a product mix of 67% edibles, 16% pre-rolls, 6% vapes, and 2% oils for the last four weeks. Edibles, vapes, and oils grew 38%, 20%, and 16% respectively for the period. While flowers, pre-rolls fell 2% and 16%. ACB market share 12% flower, 36% edibles, 5% pre-rolls, 5% oils, and 3% vapes

Tilray’s four-week product mix was flower 31%, vapes 28%, pre-rolls 26%, edibles 8%, beverages 5%, and oils 3%. The most notable sales mix changes are that pre-rolls and oils fell 19% and 21%, respectively. Tilray has a strong market share of 18% in the beverage category, mainly attributable to their tea.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

I see conflicting price estimates for aphria

8.25 and 12.50 Canadian both

Does this include medical sales