Canuc Resources Corporation (TSXV: CDA) is an interesting junior resource company. It is engaged in mining exploration in Mexico, while also generating cash flow from 8 producing natural gas wells in West Texas. The Company’s flagship San Javier Silver-Gold Project is in Sonora State, Mexico, located within the prolific Sierra Madre Silver Belt. Most of the silver that makes Mexico the world’s second largest silver producer comes from the Sierra Madre Silver Belt.

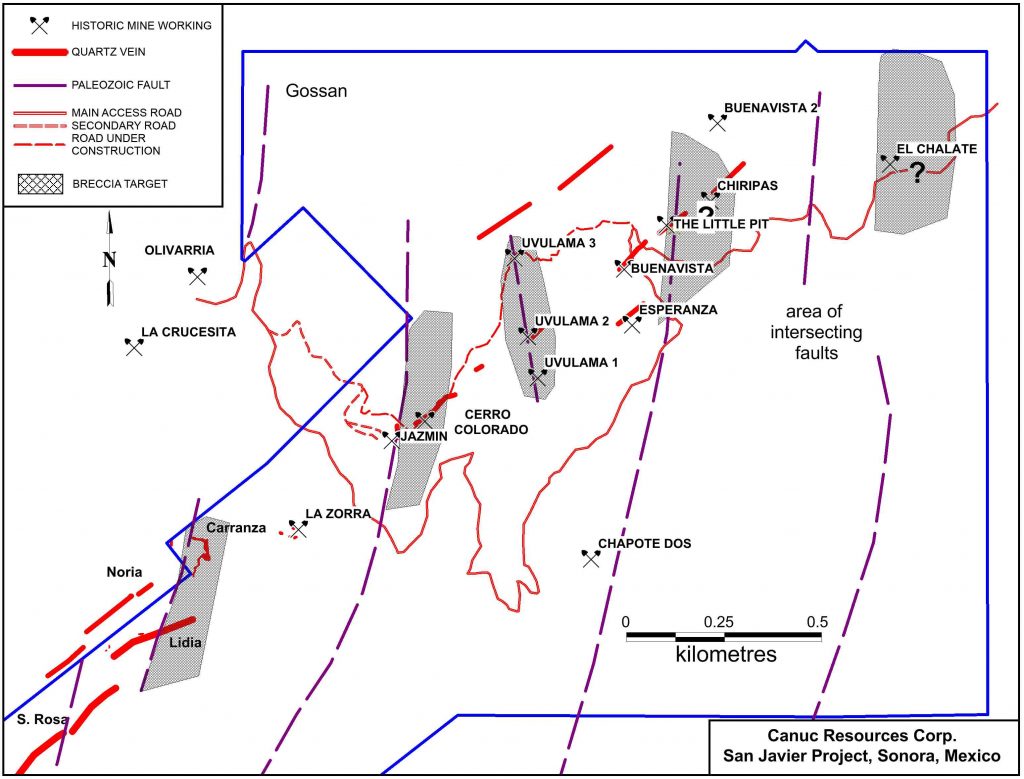

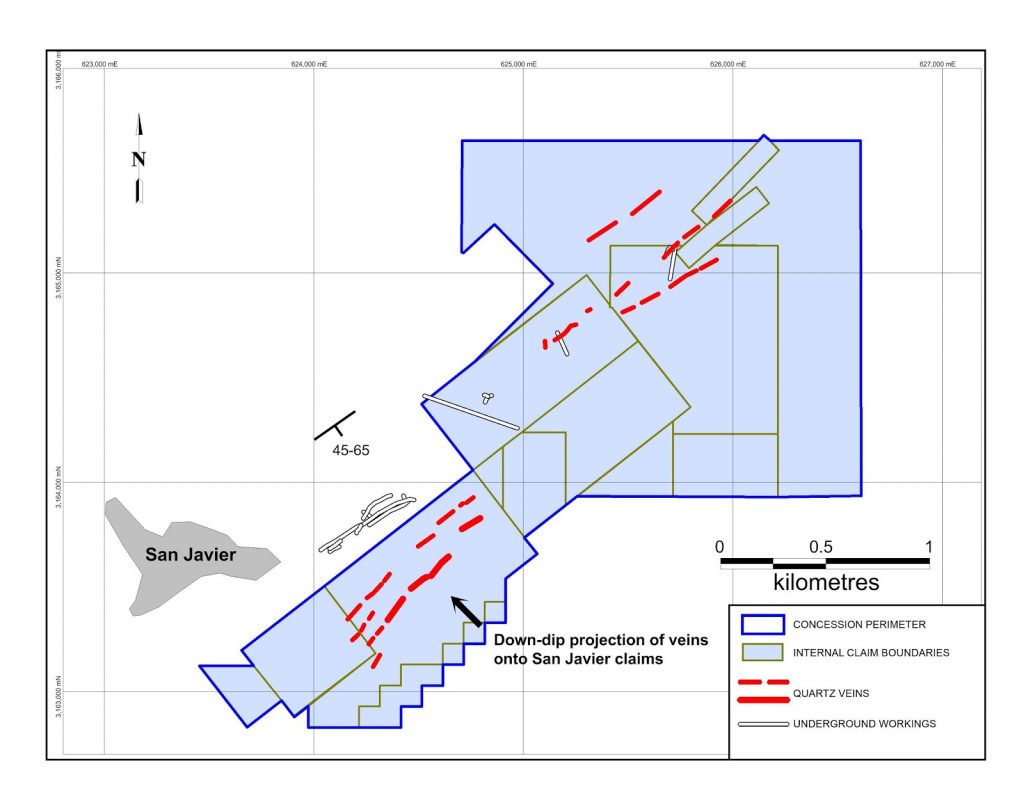

Canuc caught our eye with a July 28, 2020 announcement that it had commenced a geological mapping and systematic sampling program along the 3 km structural corridor of the San Javier Silver-Gold Project. The San Javier area has also been the subject of recent activity by another junior exploration company, Barksdale Resources (TSX-V:BRO). Barksdale has some noteworthy shareholders such as Eric Sprott, US Global Investors and Teck Corporation.

Barksdale announced on August 6th that they were acquiring ground at San Javier and raising $4M for exploration. On September 1st Barksdale announced that the financing had been increased to $6.35M and that Teck Resources would be exercising its full rights to equity participation. We thought it prudent to investigate further, as especially with these industry hitters being involved any significant discoveries could quickly lead to a wave of investment in the San Javier Mining Camp.

The goal of the Canuc work program is to uncover more silver-gold bearing breccias on the Company’s property, furthering earlier discoveries from work undertaken in 2017 and 2018. This will help delineate the size and scope of the mineralized zones and will build upon the discovery of three silver-gold bearing breccia bodies made in the earlier exploration program.

The San Javier mineral deposits are Iron-Oxide-Copper-Gold (IOCG) deposit type. These deposits are known to contain high grades of copper, gold and silver and to have substantial metal inventories. They are very valuable deposits and create very profitable, long life mines. IOCG discoveries are considered ‘company makers’ for explorers who are lucky enough to find them. Examples of IOCG deposits include the Olympic Dam Deposit, the Ernest Henry deposit and Candelaria each of which contains more than $20 billion USD of recoverable metal and has resulted in multi-year mine lives for the companies that own and operate them.

Canuc is hoping to find magnetite, an indicator mineral common to all major IOCG deposits. A magnetic geophysical survey will be part of the Company’s exploration program and would confirm the location of any magnetite on the property.

According to a 2006 report written by world renown IOCG expert Dr. Murray Hitzman, San Javier displays all the hallmarks found in IOCG deposits. Dr. Hitzman suggests that whatever their origin, IOCG deposits are invariably associated with very large volumes of hydrothermally altered rocks created during formation of the geological structures.

Dr. Hitzman noted that he saw little evidence of magnetite mineralization in the nearby deposits. This suggested to him that the known prospects near to Canuc’s property represent very high levels of an IOCG system – and that what had been found nearby may have been structurally detached, or faulted away, from the lower sections of the hydrothermal systems that Canuc now seeks to identify. Therefore discovery of magnetite by Canuc could provide evidence that San Javier hosts a major IOCG deposit. Canuc is hoping to find magnetite which would suggest it is close to the core and concentrated silver, copper and gold metal chambers of the IOCG system.

We expect that Canuc will report exploration results very soon. If the current exploration program shows continued promise, this will confirm the validity of Canuc’s optimism regarding the San Javier Project. It should also help to enhance the value of the project and to attract further investor interest.

Canc Resources last traded at 19 cents and has a market cap of $16.1M.

FULL DISCLOSURE: Canuc Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Canuc Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.