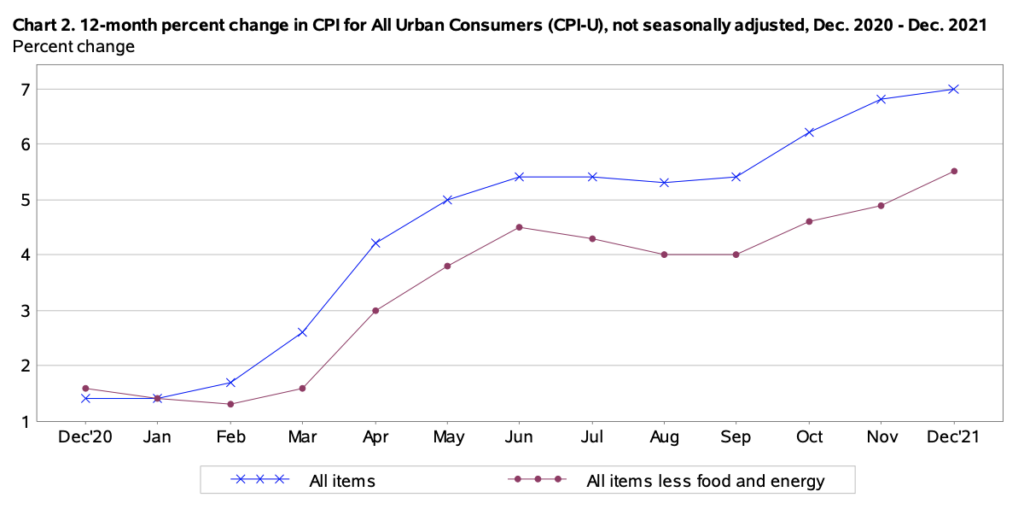

Wall Street darling Cathie Wood has once again gone rogue against the common consensus on rising price pressures, and reassuring the investment community that inflation is anything but a problem.

During her latest monthly market webinar which aired this week, Wood took aim at the financial market’s obsession with accelerating prices, instead insisting that inflation is not a growing threat. To illustrate her firmly-held conviction, the Ark Invest CEO pointed to the influence of labour productivity gains, citing a slight 0.3% increase in unit labour costs in the fourth quarter of last year.

Wood insisted that financial markets have a tendency to overlook the effect of productivity improvements on long-term inflation prospects. She took aim at recent US wage data showing that average hourly earnings rose 5% from the year before, instead contending that the figure is probably closer to 3% in real terms due to an increase in worker productivity. “I think not taking into account productivity is going to cause a serious miscalculation in terms of what’s going to happen to inflation,” she added.

Consumers are rebelling against soaring auto prices. Auto manufacturers enjoyed pricing power during the COVID-related supply shock but may regret moves that, along with soaring oil prices, have accelerated the shift to electric vehicles. This inflation is transitory. https://t.co/WqxOLmtddu

— Cathie Wood (@CathieDWood) February 7, 2022

The Ark Invest CEO also pointed to the oil market, which has recently been a substantial source of rising consumer inflation. According to her, the sudden appreciation in oil prices to above $90 per barrel will eventually correct itself, as an increase in supply will be attracted back into the oil market, ultimately equalizing the inflation equation. Wood cited 2019 oil production data, which showed that output peaked at 12.3 million barrels per day, making the US one of the largest producers of energy.

According to Wood, such levels will be reached once again, because “it appears in 2022 we will be going up to roughly 12 million barrels per day and in 2023 up 12.6M barrels per day.”

Remember when Cathie Wood said oil was going to $12 pic.twitter.com/EeNeqxgZJq

— Quoth the Raven (@QTRResearch) February 4, 2022

Information for this briefing was found via Ark Invest. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.