The size of Celsius Network’s deficit stands at US$1.19 billion, according to the documents it filed related to its Chapter 11 bankruptcy application. But reading into the balance sheet items, the hole the crypto exchange finds itself in might be bigger than what it appears.

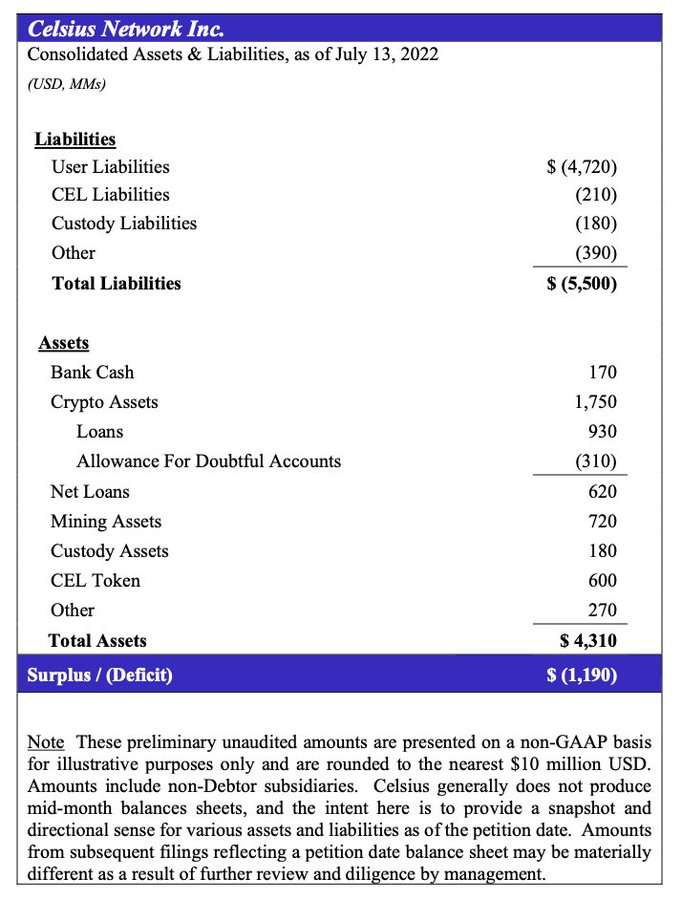

According to the filed balance sheet as of July 13, the company has a total of US$5.50 billion in liabilities against US$4.31 billion in assets.

But many are putting into question the value of the asset items, particularly the firm’s CEL token holdings, mining assets, and crypto assets – given the company’s stature since putting all withdrawals on hold and the “crypto winter” the industry is facing.

Furthermore, “other” items in both assets and liabilities are raising doubts about the true valuation given their unidentified nature.

I think they're overvaluing their assets pic.twitter.com/LJBRwYY30Q

— Bennett Tomlin (@BennettTomlin) July 15, 2022

It is likely bigger by the way, since they count CEL as an asset on their balance sheets at an inflated valuation. But still, they have "most" of it.

— Lark Davis (@TheCryptoLark) July 14, 2022

CEL, the firm’s digital coin, currently trades around US$0.8, putting the company’s current market cap at around US$550.0 million, just a few millions away from the book value recorded at US$600 million.

Understanding in a (crypto) crash

In its Chapter 11 bankruptcy filing, CEO Alex Mashinsky admitted that the amount of digital assets on the platform “grew faster than the company was prepared to deploy.”

“[The] company made what, in hindsight, proved to be certain poor asset deployment decisions. Some of these deployment activities took time to unwind, and left the Company with disproportional liabilities when measured against the unprecedented market declines,” Mashinsky wrote in the bankruptcy declaration.

But the crypto exchange also pointed to the fall of Terra’s LUNA token and TerraUSD stablecoin, as well the “crypto winter”, as contributors on why there is “growing industry-wide reluctance to do business with companies such as Celsius.”

“This reluctance was exacerbated by a series of negative media and social media comments about Celsius, a number of which were unsupported and misleading. As a result of all of these factors, users began withdrawing crypto from Celsius’ platform in large amounts and at a rapid pace,” the company reasoned.

Arguing that some of the companies’ assets are tied to long-term, illiquid investments, third-party lending, or pledged to acquire bitcoin miners and GK8 storage, Mashinsky highlighted that these became problematic for the firm when the crypto prices came down and withdrawals went up. This left the company to deal with an “unexpected and rapid ‘run on the bank’.”

That’s why, the company said, it had to pause withdrawals.

Filing for bankruptcy, the chief executive wrote, will provide a “breathing spell” for the company to implement a financial restructuring plan and “generate meaningful recoveries to [its] stakeholders as quickly as possible.”

Information for this briefing was found via Twitter and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.