Although many of the world’s central banks have foregone gold purchases in 2020 during the pandemic crisis, that trend is likely to reverse come next year, according to several research firms and banks.

In 2018 and 2019, gold purchases by central banks reached record levels, with totals of 656 tons and 667 tons respectively. However according to Citigroup, when 2020 rolled around the demand for gold by central banks fell to 375 tons, the lowest the demand has been in nearly a decade. Given the economic turmoil that resulted from the coronavirus pandemic though, the bank forecasts that the demand for gold will regain momentum to approximately 450 tons in 2021.

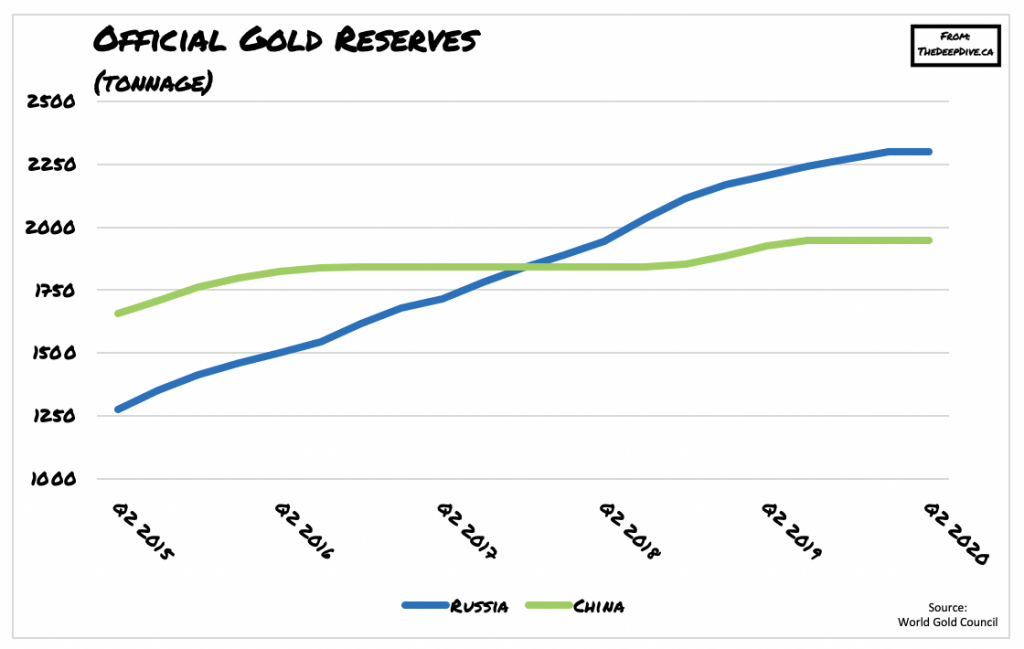

Citigroup head of commodities Aakash Doshi notes that the trend in gold buying will escalate due to a long run de-dollarization trend which is pushing central banks towards reserve diversification. Russia and China, which have not made any significant gold purchases in 2020, will most likely revamp their demand once the outcome of the upcoming US election is known.

CPM Group managing partner Jeff Christian noted that the oil price war that erupted between Russia and Saudi Arabia in April and the resulting drop in oil prices was the dominating factor behind the decline in central bank purchases. Although China is not subject to the same economic restrictions as Russia, it too clawed back on its gold purchases in 2020 after it spent the previous years diversifying its portfolio.

In the meantime, HSBC Securities anticipates the gold-buying recovery to reach 400 tons in 2021, which although a little lower than Citigroup’s forecast, it is nonetheless pointing to the same trend. HSBC’s chief precious metals analyst James Steel acknowledged that the previous two years were certainly robust with respect to gold demand, but 2020 is not weak relative to historic trends. Nonetheless, the World Gold Council pointed out that net gold purchases fell by 39% in the first two quarters of 2020 compared to the same time a year ago.

Information for this briefing was found via Kitco News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.