The Commodity Futures Trading Commission (CFTC), which is a US commodities regulator, recently issued a unique warning to clearing houses, brokers, and exchanges, regarding the the upcoming potential of a yet another negative oil price risk.

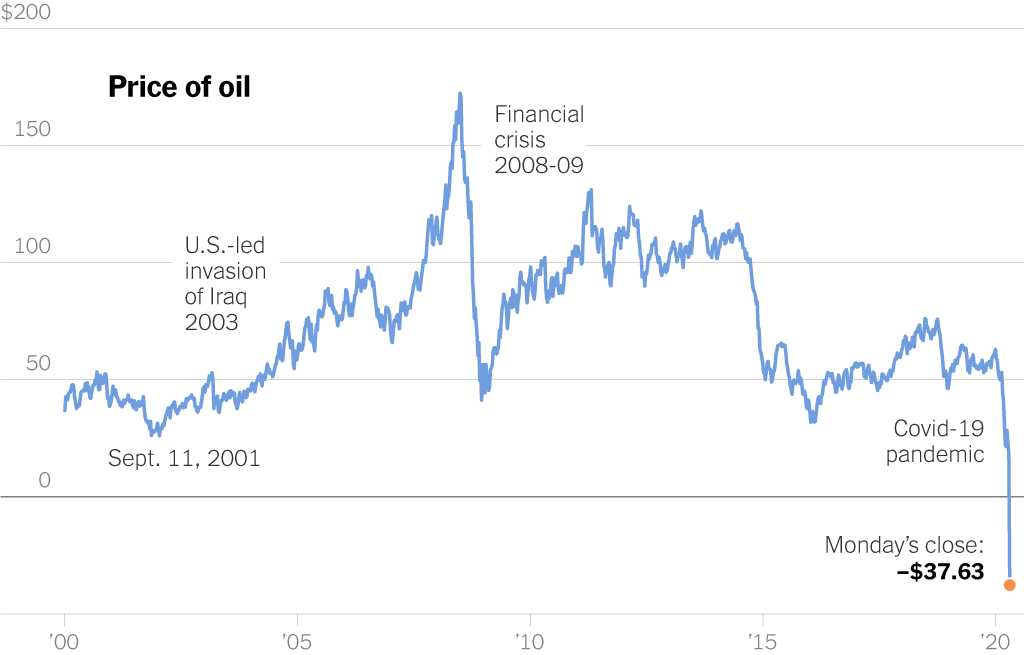

The CFTC is cautioning exchanges to keep a close eye on their markets, as the West Texas Intermediate (WTI) June delivery contract is set to expire next week – opening up the potential for another repeat of May oil contracts which chaotically ended up settling at -$37.63 per barrel. Although the commission is not making an outright prediction regarding the upcoming futures contracts, but rather is suggesting that exchanges should put rules in place such as the suspension or reduction of trading in the event that emergency authority needs to be exercised.

Amid the coronavirus pandemic, the oil market has been hit with an unprecedented drop in demand, resulting in significantly high trading volatility. As a result, oil futures contracts dipped below negative pricing, as buyers were grappling with a shortage of storage facilities to store the amassing supply of oil. In turn, the negative oil prices led to losses for traders and futures brokers, which gave rise to widespread criticism – even though CME Group, which is largest exchange company in the world, warned of such an event back in April.

Information for this briefing was found via Financial Times, CME Group, and New York Times. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.