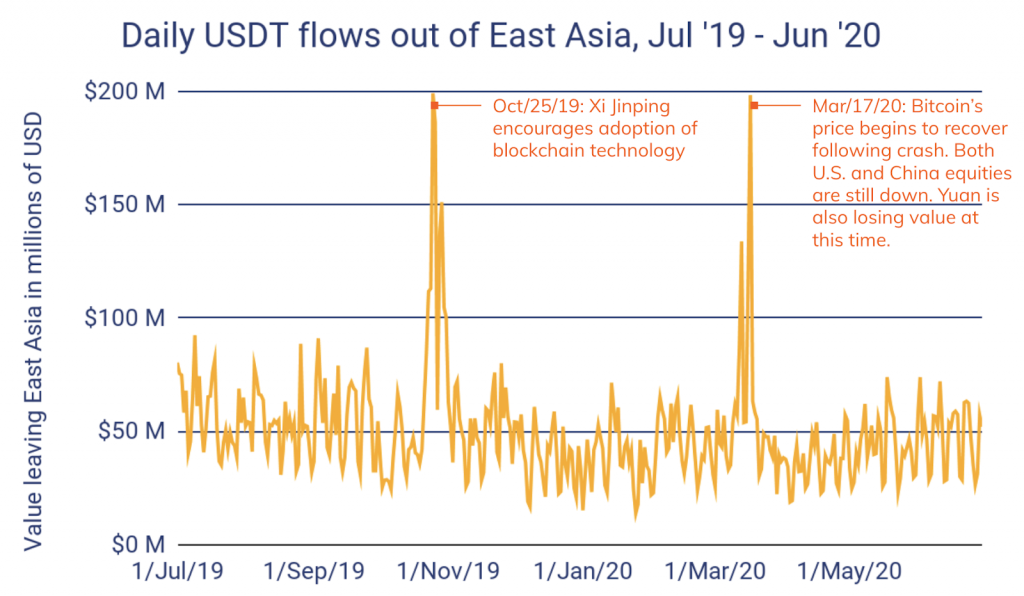

A recent report published by Chainalysis this week has proposed that China and other Southeast Asian investors have begun utilizing cryptocurrencies to enable capital flight to occur to other global jurisdiction. The report suggests that over $50 billion in capital outflows has occurred via Tether, a stablecoin that is said to be roughly pegged to the US dollar.

The rise of cryptocurrencies has enabled savvy investors within the region to be able to find a means of getting their capital out of the country. Currently, citizens of China are only permitted to purchase up to $50,000 worth of foreign currency a year at financial institutions. While in the past international real estate has been utilized as a loophole for this regulation, it’s now believed that tether and other cryptocurrencies are becoming a more popular option instead.

The report does note however that not all capital outflows from East Asia would be related to capital flight. Currently, the region accounts for 31% of all cryptocurrency transacted, making it the largest market in the world. Much of this however is due to the fact that a majority of the worlds crypto miners are located within China, with the region accounting for 65% of bitcoin’s total hashrate. A portion of cashflows as a result would be related to normal business operations.

“Over the last twelve months, with China’s economy suffering due to trade wars and devaluation of the yuan at different points, we’ve seen over $50 billion worth of cryptocurrency move from China-based addresses to overseas addresses. Obviously, not all of this is capital flight, but we can think of $50 billion as the absolute ceiling for capital flight via cryptocurrency from East Asia to other regions. … However, stablecoins are particularly useful for capital flight, as their fiat currency-pegged value means users selling off large amounts in exchange for their fiat currency of choice can rest assured that it’s unlikely to lose its value as they seek a buyer.”

However, large capital outflows were noted as being associated with notable events that happened in country, such as the nations leader, Xi Jinping endorsing the adoption of the technology. Other examples include the sell off in March of global equities following the spread of the coronavirus.

Information for this briefing was found via Chainalysis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.