On April 20, 2023, President Gabriel Boric of Chile introduced a new framework for Chile’s lithium industry, the National Lithium Policy (NLP). This was quite significant, as Chile holds one of the world’s largest lithium reserves with 9.3 million metric tonnes (MT), and was the world’s second largest lithium producer in 2022 with 39,000 MT produced.

Australia was the largest lithium producer in 2022 with 61,000 MT, but it only has reserves of 3.8 million MT. Between them, Australia and Chile accounted for 77% of the world’s 2022 production.

Australia produces lithium primarily from lithium-bearing hard rock, whereas lithium in Chile is found within the lithium-rich brines extracted from the salars (salt lakes) high up in the Andes Mountains. This is a region where the borders of Chile, Bolivia and Argentina intersect, and is best known globally as the “Lithium Triangle.” It is estimated that the prolific Salar de Atacama contains approximately 37 percent of the world’s economically viable lithium reserves.

Mining is an Enormous Percentage of Chilean Exports

Mining is a very important segment of Chile’s economy, with the sector accounting for over 62% of Chile’s total exports and contributing $317 billion or 15% of Chile’s GDP in 2021. Chile is also the world’s largest copper producer.

President Boric, who assumed power in March 2022, made reforming the country’s mining industry a key part of his election platform. He promised to shake up the mining industry through initiatives that would create more wealth for the country, establishing a balance of public and private interests for a more equitable sharing of mining profits. This in turn would enable investments in better education, healthcare, and provide other sustainable socio-economic benefits for the Chilean population.

The problem, though, is that the threat of the government nationalizing the Chilean mining industry created significant uncertainty and fear within the industry, and with foreign investors.

A Palatable National Lithium Policy?

Recognizing that the lithium industry is the key to Chile’s economic future, the National Lithium Policy outlines a strategy that appears to be more palatable for the industry. The goal of the NLP is to involve the state through the entire production cycle, from exploration to operations and manufacturing. The policy would see the state involved via public-private partnerships.

The cornerstone of the NLP strategy is the creation of a national lithium company and the establishment of Chile as a vertically-integrated leader in EV lithium battery production – instead of being merely a raw materials exporter. The NLP also calls for the creation of a Public Technological and Research Institute of Lithium and Salt Flats to facilitate broader local development of new skills, job opportunities, and more sustainable economic growth by transforming the lithium industry into a stronger, more competitive industry.

A secondary goal of the NLP is to promote the use of new extraction technologies, methods, and mining practices that will be integrated into strict environmental standards for sustainable lithium extraction and production. At the same time it will serve to protect the environmental interests of indigenous groups and local communities and to foster greater economic engagement. The Government’s expectation is that these measures will enable new investment opportunities for lithium, and support sustainable economic growth for Chile as a whole.

Until the National Lithium Company is established and assumes its role as the state’s partner overseeing all lithium projects in the Country, Chile’s two state-owned copper mining companies, CODELCO and/or ENAMI, will act as the state partner in a 51/49% ownership structure of public/private partnerships for lithium project development.

Some key aspects of the NLP:

- The State will retain a majority interest in projects that are deemed strategic for the country.

- Any future lithium projects will be required to implement some form of Direct Lithium Extraction (DLE) technology for water and environmental concerns.

- Use of traditional solar evaporation recovery methods will be banned.

- Government will provide guidance regarding indigenous and local community engagement in all stages of lithium project development in the country.

- Creation of a network of protected salt flats, with a goal of protecting 30% of these areas by 2030.

- Creating the Public Institute of Lithium and New Technologies.

- Attract more exploration companies to develop other salars and salt flats to broaden lithium production.

Implementation

Mining giants SQM (NYSE: SQM), and Albemarle Corp. (NYSE: ALB) are the two main lithium producers in the Salar de Atacama and dominate Chile’s lithium industry. In Chile all mines are considered to belong to the state, and in order to explore and/or mine for minerals, a private company must first obtain a concession to do so. Concessions apply to any mineral unless they are exempted by law.

In 1979, Chile deemed lithium to be a strategic critical mineral. It was removed from the concession process and subsequently made subject to specific rules. The Corporación de Fomento (CORFO) is the state owned company that owns and administers Chile’s pre-1979 concessions, which are leased to SQM and Albermarle.

The government recognizes that both will need a gradual transition to conform with the new NLP requirements, leading to the requirement to negotiate new operating contracts when their current contracts with Chile’s state development company CORFO expire; 2030 for SQM and 2043 for Albemarle.

SQM is already moving towards using more DLE and less evaporation ponds in Chile, and is said to be currently evaluating a variety of DLE technologies. These include solvent extraction, adsorption, ion exchange, and membranes, for what the company says will be the world’s largest DLE plant at their Atacama JV in Chile. SQM is planning to spend USD$1.5 billion on DLE and has committed to a 50% reduction in the brine it pumps to mine lithium.

SQM will modernize its process of evaporation and brine extraction, improve operating yields and adopt the use of seawater via a desalination plant. The company will continue to use the existing passive evaporation process alongside DLE, in combination with new equipment that uses energy to actively concentrate brine in the initial transition stage.

Current Exploration In Chile

A 2013 study by The National Geology and Mining Service, the state agency which regulates Chile’s mining industry and provides geological data, identified 45 salt flats and 18 salt lakes located in the Antofagasta and Atacama regions that may be prospective for future lithium mining projects. The Government wants to attract exploration companies to help develop these additional salars and salt flats to increase and broaden the country’s production.

Not surprisingly, the lithium rush has brought a number of exploration companies to the region, but uncertainty over the government’s intentions for the industry has prevented any meaningful progress.

Several Canadian publicly-traded exploration companies have been advancing their projects in Chile. Progress had recently been guarded as a result of the uncertainty regarding the government’s intentions for the mining industry and fears of nationalization. Now that there is some clarity, it is reasonable to expect that exploration activities will begin to accelerate.

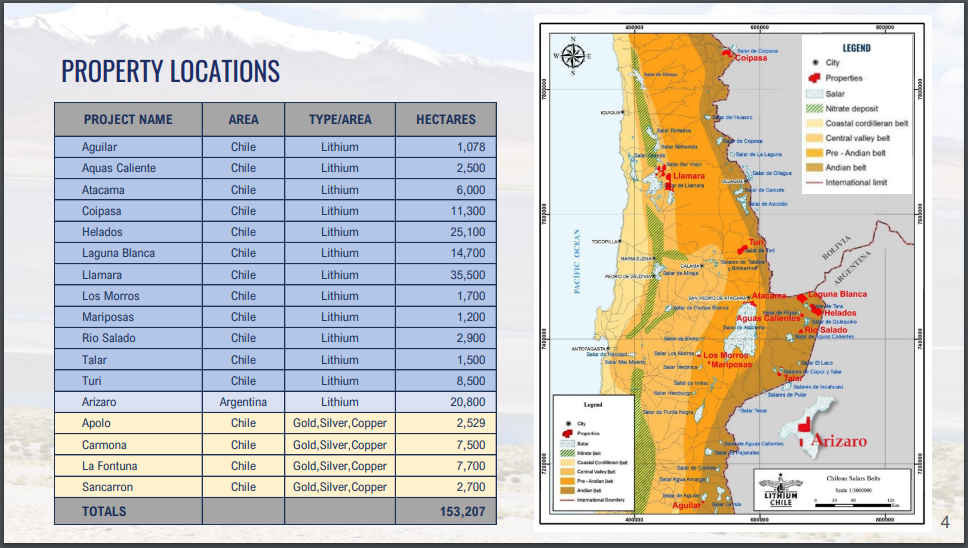

Lithium Chile Inc. (TSXV: LITH) has amassed one of the largest land portfolios in the region, with properties on 13 lithium-rich salars comprising 111,978 hectares in northern Chile and 20,800 hectares in Argentina. The company has a number of projects in Chile in various stages of exploration and development.

Lithium Chile recently commenced a 4-hole exploration program in July 2023 at the 35,500-hectare Molle Verde property on the Salar de LLamara, while its Argentina asset recently saw a PEA completed that features a pre-tax NPV of US$1.8 billion.

Wealth Minerals Ltd. (TSXV: WML) along with its joint-venture partner thyssenkrupp Mining Technologies are advancing the 8,000 hectare Ollagüe Salar Lithium Project from the exploration stage to the production of high-purity lithium products.

The goal is to establish the project as a leading benchmark of “green” lithium brine resource development. The company also holds the Atacama Project, which covers 46,200 hectares and is said to be the firms main focus over the next two years.

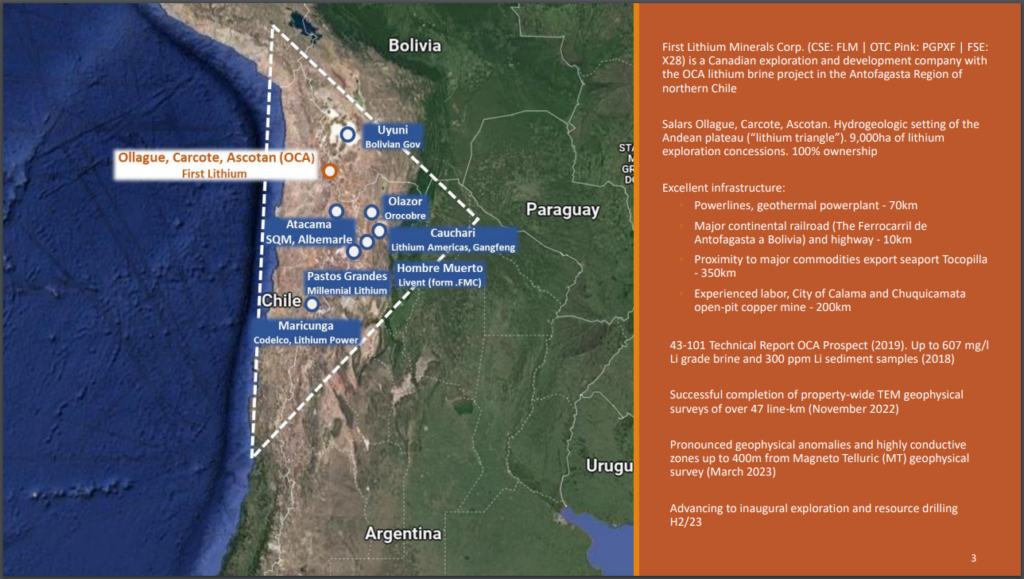

First Lithium Minerals Inc. (CSE: FLM) has been assembling its land position in Chile since 2017. The company is focused on developing its flagship OCA Project, which comprises 40 mining exploration concessions covering 8,900 hectares on the edges of the Ollague, Carcote, and Ascotan Salars in the eastern part of the Atacama desert in the Antofagasta Region.

The company currently has an ongoing surface brine geochemical sampling program, while focusing on community engagement and social licensing in the region as well. First Lithium intends to conduct a shallow drill program to test brine depth and continuity of chemical composition as part of a phase two exploration program outlined for 2023.

As it currently stands, the Government is effectively welcoming new investment into developing its under-explored salars and salt flats. Exploration companies will likely not need to be concerned with the public-private ownership of their assets until they are ready for production.

Many junior explorers tend to build value for their shareholders by developing their assets to the economic feasibility stage, with the end goal of attracting larger mining companies to acquire the assets for production. Chile’s mining regime has always been one of state control over operating mines. The major unknown variable today is what will the private-public requirements be like when the economic feasibility of a project has been established and ready for acquisition.

The Politics of the NLP are in Doubt

One thing to be considered, is that it is entirely possible that the NLP might not be implemented if there is severe political backlash or if the current government loses power. Since his election in 2021, President Boric has faced considerable political pressure from all sides of the political spectrum. While he is considered to be a somewhat far to the left progressive, many of his campaign promises connected with Chileans.

In 2020, 80% of Chileans voted to revamp Chile’s Pinochet-era Constitution. However, the first draft proposal put forth by Boric’s government was rejected in September 2022. The May 7, 2023, Constitution Council elections were held to determine who would write the next draft of the Constitution. The right wing was victorious, with the Republican party winning 22 of the 50 council seats, and another right-wing coalition securing 11 seats. The left, meanwhile, was reduced to only 17 seats on the council. By controlling more than three-fifths of the council votes, the right wing can now freely control how the new Constitution will be drafted. This was seen as a major blow to President Boric’s agenda.

Even with the political winds shifting to the right, most of the proposed elements of the National Lithium Policy do not require legal ratification – i.e. in practical terms from the mining industry’s perspective, they are now in effect. However, the formation of the National Lithium Company requires approval by four out of seven members of Congress, votes which the Government does not currently have. It remains to be seen if other aspects of the NLP will meet political resistance.

The National Lithium Policy appears to be an all-encompassing strategy to capitalize on Chile’s massive lithium reserves. The idea is to create a fully-integrated ground-to-market lithium industry – the engine of the country’s long-term sustainable economic growth and a source of wealth creation for all Chileans for generations to come.

For junior exploration investors, introduction of the NLP reduces concerns about nationalization and is a signal that business will return to normal. The government has identified where the underexplored salars and salt flats are located and must now attract new players to develop these potential economically viable lithium deposits. All in all, this provides a compelling opportunity for junior lithium exploration investors.

FULL DISCLOSURE: Lithium Chile is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Lithium Chile. The author has been compensated to cover Lithium Chile on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.

FULL DISCLOSURE: First Lithium Minerals is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of First Lithium Minerals. The author has been compensated to cover First Lithium Minerals on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.