After shooting a warning that the new set of US export control regulations will hamper the global supply chain, Chinese chip manufacturers have reportedly been summoned by the Ministry of Industry and Information Technology (MIIT).

The country’s top technology regulator convened executives from firms including Yangtze Memory Technologies Co. and supercomputer specialist Dawning Information Industry Co. into closed-door meetings following Washington’s latest export regulations.

MIIT officials were hesitant about the path forward, with as many questions as answers for the chipmakers, according to persons familiar with the conversations. While officials avoided elaborating on potential counter-measures, they emphasized that the local IT industry would supply enough demand for affected enterprises to continue operations.

The US Department of Commerce recently passed a new set of export control regulations intended to slow down China’s growing dominance in technology and military advancements. The new measures are an expansion of Washington’s foreign direct product rule, which was initially used to broaden the US government’s control of semiconductor exports to Huawei Technologies, and later to stem the flow of chips to Russia following Moscow’s military operation in Ukraine.

The US also added 31 firms, including Yangtze Memory and Naura, to its unverified list, significantly limiting their ability to purchase hardware from abroad.

Many representatives stated that aggregate US regulations mean disaster for their industry, as well as China’s efforts to decouple its economy from American technology.

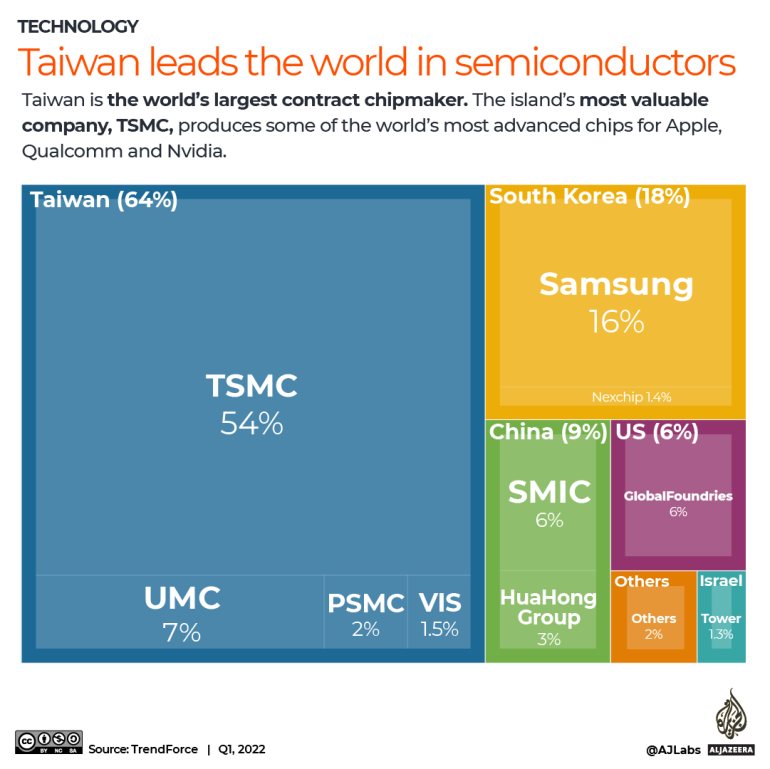

Taiwan still leads the world in producing semiconductors but China is aiming to be a key player in the industry. Chinese President Xi Jinping pledged digital self-reliance to prevail in a struggle with the US for technological supremacy in a major talk over the weekend, which many interpreted as Beijing redoubling policy and financial backing for areas such as AI and chips.

However, the global chip industry, which depends on China as the world’s largest single purchaser of semiconductors, has been preparing for some form of response from Beijing.

“When Beijing is caught flat-footed, its initial reaction is always slow,” according to a note from Fathom China. “Ministers are not authorized to make decisions on their own, they need the big bosses to decide. And right now, the big bosses are busy with the Party Congress.”

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.