China is reportedly working on a fresh package of measures to assist the property market after existing policies failed to sustain a recovery in the ailing sector.

Under the guidance of the State Council, regulators are considering lowering the down payment in some non-core neighborhoods of major cities, lowering agent commissions on transactions, and further relaxing restrictions for residential purchases, according to people who are familiar with the matter.

Sources who spoke with Bloomberg said the administration may also improve and extend some of the policies outlined in the comprehensive 16-point rescue package it unveiled last year. However, the plans have not been finalized yet and may be altered.

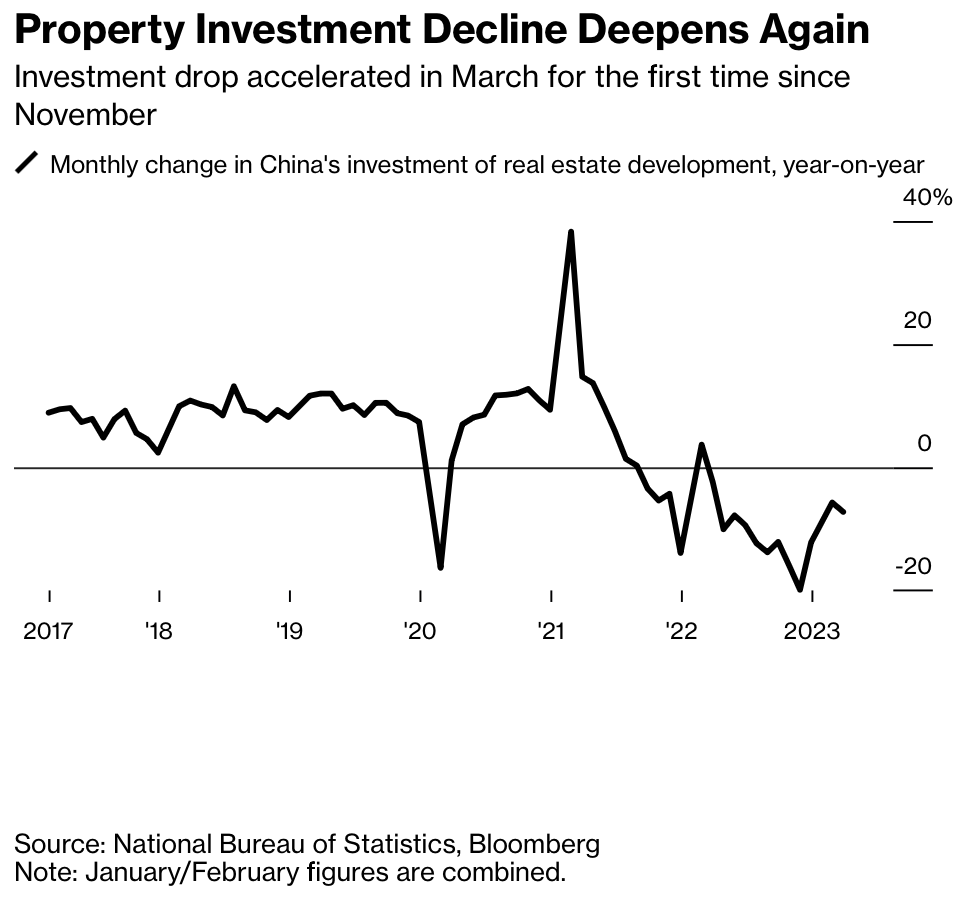

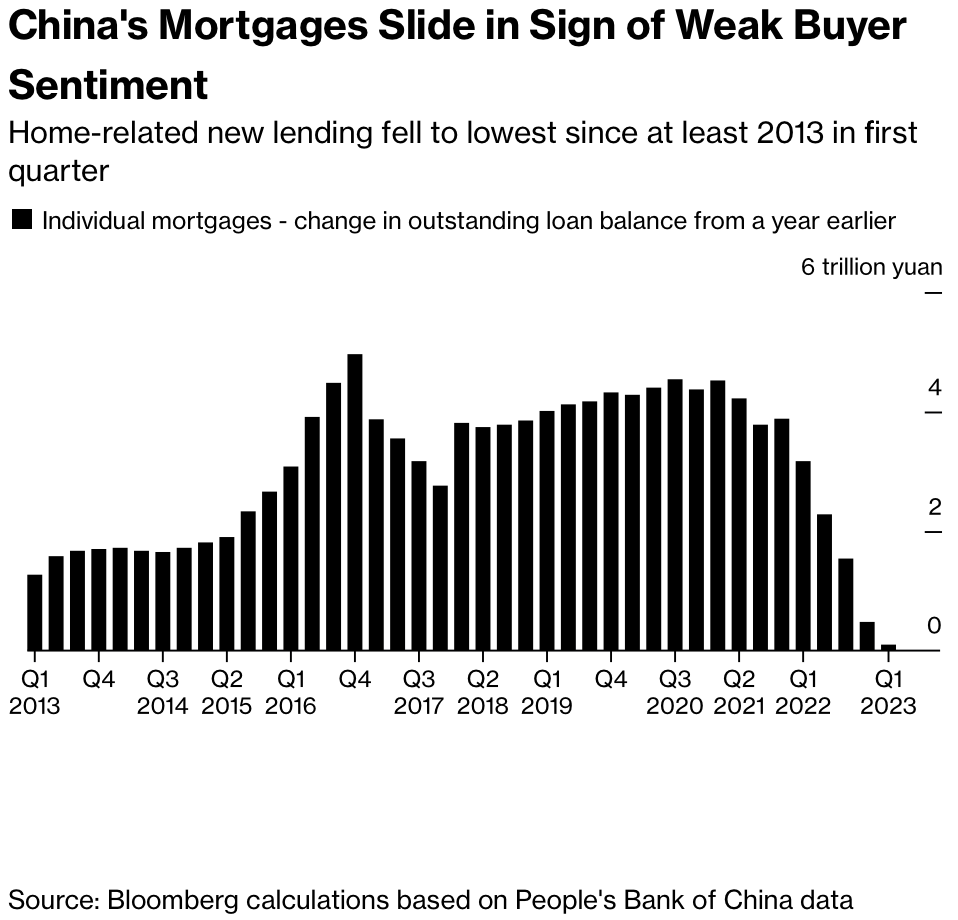

Although China’s property sector has escaped disaster, it remains a significant drag on the world’s second-largest economy. The residential market is showing signs of increased weakness, with a 6.7% increase in home sales in May, down from more than 29% in the preceding two months.

After an initial burst of consumer activity, China’s rebound stalled in April. Bloomberg economists polled predict gross domestic product to grow 5.5% this year over last, down from a previous forecast of 5.6%.

According to Bloomberg Economics, despite a wide range of restrictions implemented last year, a mountain of developer debt — equivalent to nearly 12% of China’s GDP — is at risk of default and poses a threat to financial stability.

Existing measures in place are said to include:

- Lower mortgage rates for first-time home purchasers if newly constructed house prices fall for three months in a row

- A countrywide real estate commission cap to increase demand

- Allowing private equity funds to raise capital for residential development

- Pledging 200 billion yuan ($28 billion) in special loans to enable the completion of stalled housing projects

- In November, the government published a 16-point plan that included everything from tackling the liquidity problem to lowering down-payment requirements for homebuyers

Local news reported that the government in the seaside city of Qingdao this week reduced the down payment ratio for first- and second-time house purchasers in regions not subject to purchase restrictions.

After China’s real estate sector defaulted on more than $100 billion in bonds, a number of developers are battling to secure creditor approval for their restructuring plans.

Dalian Wanda Group Co. and China Evergrande Group, two of the country’s most prominent developers, are showing increasing symptoms of difficulty.

Dalian Wanda is selling assets to generate extra liquidity while looking for a loan relief plan that may allow it to prolong principal repayments on some Chinese bank borrowings, according to people familiar with the situation in May.

Evergrande announced last week that it is facing over a thousand lawsuits totaling 350 billion yuan. The bankrupt property developer has been unable to gain enough creditor support for its international debt restructuring proposal.

Speculation about expected support measures aided a more than 6% surge in a Chinese property developer index on Friday, the highest since December.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.