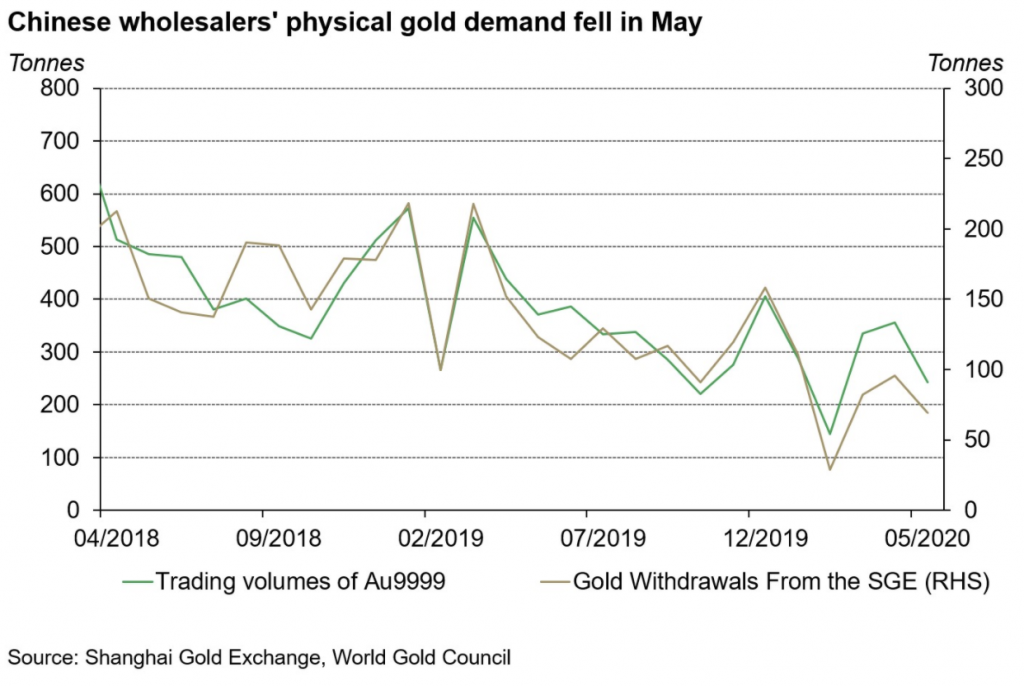

Despite gold prices reaching record levels amid the coronavirus pandemic, the demand for the precious metal by the one of the world’s biggest gold-consuming countries has remained relatively stagnant. According to the latest data depicting gold withdrawals from the Shanghai Gold Exchange, the first half of 2020 suggests that China’s demand for gold has largely been slow to recover, despite draconian coronavirus mitigation efforts that have for the most part eradicated the severity of the outbreak.

Given that China’s demand for gold is highly dependent on the income levels of the middle-class society, and since the coronavirus pandemic has caused the Chinese economy to experience diminished growth, gold withdrawals from the Shanghai Gold Exchange have also been impacted.

However, according to mining engineer Lawrence Williams, if demand continues to remain weaker this year, then there is a probable chance that the 2020 total will not exceed 1,000 tonnes – the lowest amount in over 10 years. Although a 500 tonne reduction in Chinese gold consumption is likely, the second half of 2020 may be more optimistic in the event that a resurgence of the virus does not occur and the economy can get back on track to pre-pandemic levels.

Information for this briefing was found via Sharps Pixley, Gold Hub, and the Shanghai Gold Exchange. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.