China, from which the first coronavirus outbreak began, has now begun the recovery period by gradually easing lockdowns and restrictions, given that the Communist Party declared the virus under control. Reviving such a large economy like China’s is going to be far from easy: the country’s economy has not suffered such a downturn since the 1960’s.

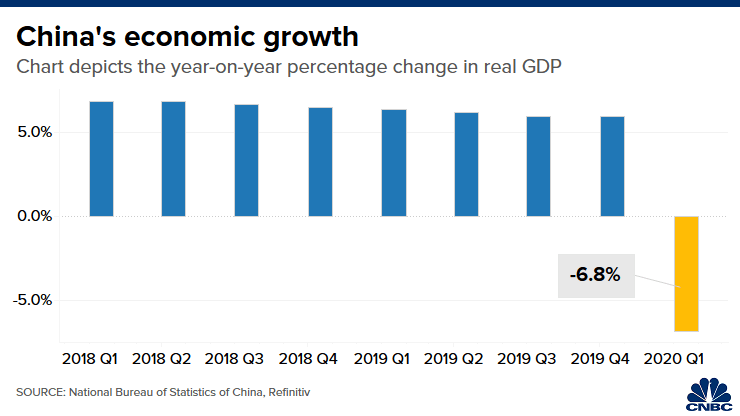

Since the onset of the pandemic in December, which resulted in a reported 82,367 cases and 4,632 deaths, the government had to shut down various factories, shopping malls, and offices that employed large amounts of people as a move to contain the spread of the virus. As a result, the Chinese economy suffered the largest contraction since the 1960’s, with a decrease of 6.8% since the end of March compared to the year prior. The Communist Party has since begun easing restrictions by reopening necessary factories last month, but the majority of businesses are still to remain closed, as well as travel restricted to domestic nationals only.

It was previously predicted that the Chinese economy would begin a positive rebound by April, but according to analysts from Oxford Economics, UBS, and Nomura, it’s now anticipated to be a drawn-out growth process with little to no growth for the remainder of the year. The ruling Communist Party is yet to announce the forthcoming growth targets, but it is highly unlikely they will be able to meet its previous target of increasing incomes two-fold from 2010 as was anticipated before the coronavirus crisis.

The Chinese economy has a long road ahead before it can get back to pre-virus levels, and the growth pattern is most likely not going to follow the V-shaped rebound as predicted earlier. Retail sales have dropped by 19% in March compared to the year prior, and have only rebounded by 3.7% since. Further end-of-the-quarter March data suggests auto sales fell by a staggering 48.4%, with exports decreasing by 6.6% when also compared to the previous year.

The projected slow growth can be largely attributed to a significant increase in unemployment numbers, with many consumers deferring consumption due to the increased uncertainty in job security. Although the Communist Party has urged companies and factories to continue paying their employees and abstain from layoffs during the nation-wide shutdowns, many have not been able to meet the government’s demand and ended up laying off workers anyways.

Information for this briefing was found via AP News and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

China’s numbers are a lot worse than this. The whole economy is built on mark-to-market accounting with housing prices.

They are smart enough to never let housing go down, but eventually those foreign reserves go bust and Houston we have a problem.

Is that Kyle Bass on our site?

Hard to believe these numbers are accurate with the numbers being thrown around by analysts for the US.

You shut down your economy and only lose 7%?

I guess I should return my tin foil hat!

Not too shocking. I suspect the real numbers are MUCH worse.