Reports of rapid increases in COVID cases in Beijing, China, coupled with that country’s insistence on a zero tolerance COVID policy, has increased fears that China will impose a strict lockdown on Beijing, just as it did in Shenzhen and the key port city of Shanghai. If strict lockdowns are imposed in Beijing, China’s economic growth and corporate profits will face even further curtailment.

On April 25, West Texas Intermediate (WTI) oil fell below US$100 per barrel for the first time in recent weeks on fears of reduced economic activity in China. Global stock markets initially fell on the concerns but rallied midway through the day on news of Elon Musk’s buyout of Twitter.

The (likely) unintended consequences of China’s strict COVID containment policies are a step change, even from the high current level, in supply chain congestion and further inflationary pressures. As China’s factories, particularly in Shanghai, receive approval to resume production, manufacturing will likely commence in a synchronized fashion — and at a breakneck speed to compensate for the time off. In turn, ships carrying goods will set off to ports on the west coast of North America like Los Angeles and Long Beach as quickly as possible. Imports from China represent nearly 20% of all U.S. imported goods. For computers and electronics, that percentage is around 35%.

However, those and many other ports are already heavily congested, and finding port space for the new container ships will take time. It follows that owners of the container ships, which could face long stretches of idling, will demand higher freight rates. These costs will in turn be passed on to end customers, exacerbating inflationary pressures. For example, the quoted freight cost to bring one container to the U.S. from China is nearly US$16,000, up from US$5,900 a year ago, according to the Keelvar consulting firm.

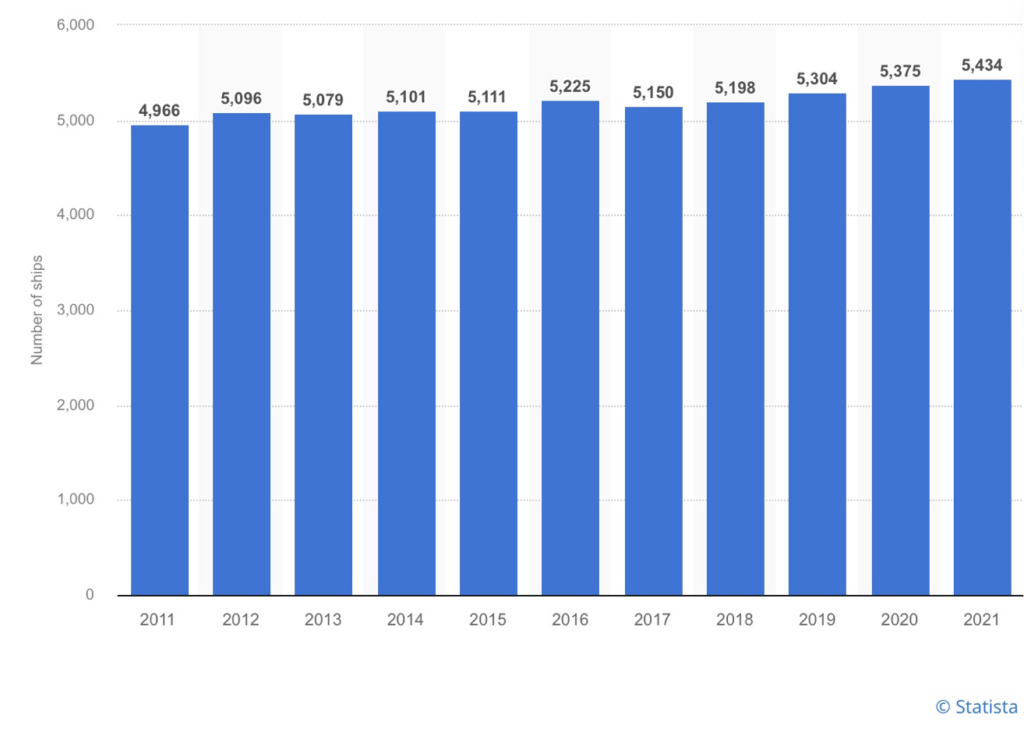

Per Winward AI Insights, approximately 506 container ships were waiting outside China’s ports between April 12 and 13, nearly double the 260 vessels that were waiting in February 2022 before the forced COVID lockdowns were implemented.

Looking at this from a worldwide perspective, about 1,826 container vessels were idling outside ports in mid-April, nearly double from 975 in February. Remarkably, the number of idling ships currently represents around one-third of all global container vessels. In more regular times (such as February 2022), that percentage was only about 18%.

The effects on the West’s supply chain and inflation from China’s strict COVID-19 control measures should begin to be felt in North America soon. Neither will be welcomed as central banks are beginning a program of raising short-term rates to combat persistent price increases.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.