A major Chinese oil giant is pulling its operations out of several western regions over concerns that its assets could be restricted in the event western leaders impose sanctions against the communist country over Russian ties.

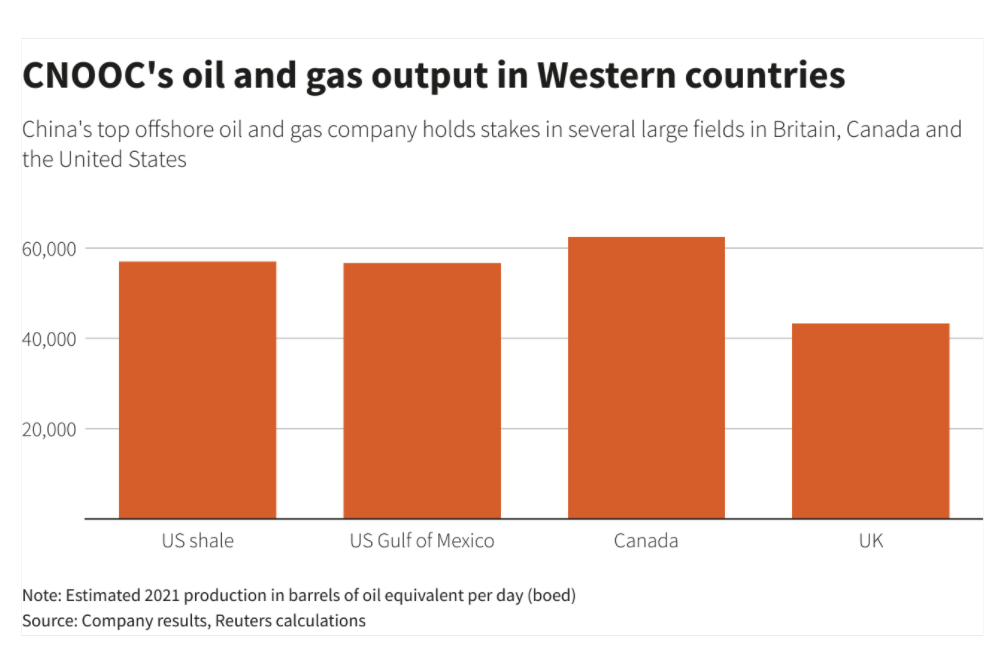

According to Reuters, which cited sources familiar with the matter, China’s oil and gas producer CNOOC Ltd is preparing to sell its “marginal and hard to manage” assets in Canada, the US, and the UK, amid increased obstacles to conduct business in western regions. The state-owned company made its debut into the three countries after purchasing Canadian-based Nexen for $15 billion nearly 10 years ago, which included assets in major Alberta oil sands projects, US shale basins, and offshore fields in the Gulf of Mexico. Combined, the projects heed about 220,000 barrels per day.

However, managing those assets has become a problem for CNOOC, given its strained relations with the west that only intensified following Russia’s military operation in Ukraine, which Beijing thus far refuses to condemn. “Assets like Gulf of Mexico deepwater are technologically challenging and CNOOC really needed to work with partners to learn, but company executives were not even allowed to visit the U.S. offices. It had been a pain all along these years and the Trump administration’s blacklisting of CNOOC made it worse,” said the source, as cited by Reuters.

The Chinese oil giant is in the midst of a global portfolio review ahead of planned public debut on the Shanghai stock exchange at the end of April. The company is looking to tap funding from alternative sources after its US shares were delisted last fall, which was part of former president Donald Trump’s quest against Chinese companies he alleged were controlled by the military. To make matters worse for Beijing, the Biden administration last week threatened consequences should China assist Moscow in evading sanctions.

With plans to abdicate its operations in the west, CNOOC is mulling asset purchases in less hostile and cheaper regions, such as Africa and Latin America, as well as focus on new project developments in Brazil, Guyana, and Uganda.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.