The Nasdaq has halted the preparations for at least four small Chinese companies’ initial public offerings (IPOs) while it probes short-lived stock rallies of such firms following their debuts.

According to attorneys and bankers that work on such stock launches, the big board decided to stay the pending IPOs amid a boom in the shares of Chinese companies that raise tiny amounts, often $50 million or less, in their IPO. These companies will then see stocks rise up to 2,000% in their IPOs, only to plummet in the days that follow, punishing investors who are brave enough to wager on penny stocks.

In mid-September, Nasdaq began questioning the advisers of tiny Chinese IPO hopefuls. According to one of the bankers, Dan McClory, head of equity capital markets at Boustead Securities, the queries covered the identities of their existing shareholders, where they reside, how much they are investing, and if they were offered interest-free debt so they could join.

Reuters spoke with seven persons who work on small Chinese company IPOs on the condition that neither they nor their clients be identified. According to these sources, the fleeting stock surges were created by a few offshore investors who masked their names and purchased the majority of the shares in the offerings, giving the impression that the launches were in high demand.

As a standard, the laws require that a firm going public have at least 300 investors, each owning at least 100 shares worth at least $2,500. These regulations, however, have not been enough to prevent trading manipulation in some penny stocks. Small Chinese firms have been drawn to Nasdaq’s exchange rather than the New York Stock Exchange because the former has traditionally been the site for red-hot technology startups – an image these firms frequently aim to create.

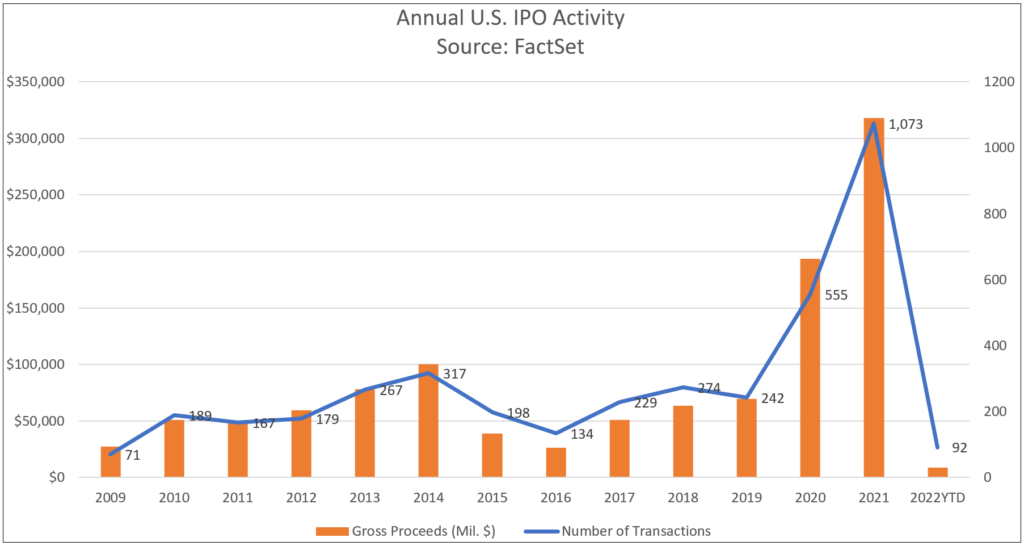

So far this year, nine such listings have occurred, despite the fact that the US IPO market is experiencing its worst drought in almost two decades due to market instability caused by the Federal Reserve boosting interest rates to combat inflation.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.