China’s banking sector is not faring too well amid the broader global economic slump, with investor pessimism surging to the same level US banks traded at during the height of the 2008 financial crash.

Some of China’s biggest lenders, including Chanson & Co., and Industrial & Commercial Bank of China Ltd., are now trading at around 0.4 of their book value— the lowest on record and roughly on par with investors’ pricing of major US banks such as JPMorgan Chase & Co. and Bank of America Corp. during the financial crisis. Global investors have grown wary of the growing pile of bad debt plaguing Chinese banks, simultaneously as the country’s economy is set to dramatically slow thanks to the government’s ongoing Covid Zero policy.

“While we haven’t yet witnessed any signs of a structural deterioration in the domestic economy, it’s likely to remain under pressure in the next few years amid a global recession,” explained investment bank Chanson & Co director Shen Meng. “Banks would be more stressed if they can’t recover the loans by then.” The Chinese economy is projected to expand by a paltry 3.3% this year, substantially below government forecasts calling for growth of 5.5%.

However, making matters worse, though, is the economy’s heavy dependence on the real estate industry to boost GDP growth. China’s property sector accounts for about 28% of the country’s output, but with a bleak outlook due to the worsening slump in prices and sales, banks could soon face grave loan losses. “That makes Chinese banks prone to any increase in risks associated with the GDP growth,” said Moody’s Investors Service vice president Nicholas Zhu, as cited by Bloomberg. “Their net margins could further narrow as banks plan bigger provisions for bad debt and continue to cut loan rates to support the economy.”

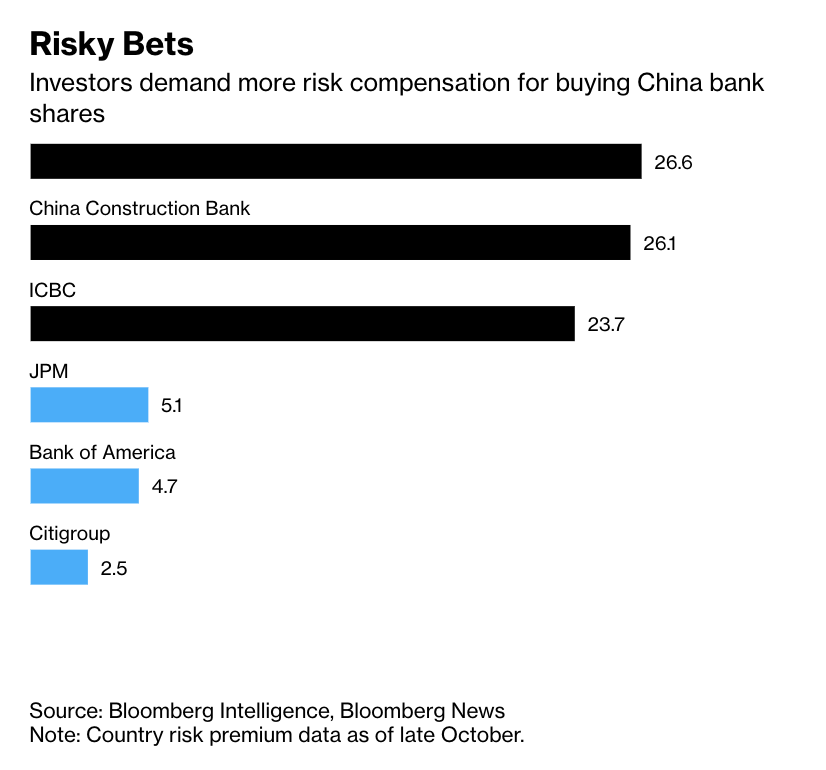

Although some Chinese bank stocks benefited from a modest rally in the beginning of November amid rumours that the government might relax its stringent pandemic policies, the speculation was quickly put to rest after an official asserted the country will “unswervingly” adhere to Covid Zero. As a result, Chinese banks are paying the price for the government’s relentless policies. Data compiled by Bloomberg shows the top five state-owned lenders faced a country risk premium of about 26% last month, while US counterparts had readings in the single digits.

“What matters more is not how much of a risk there might be for banks today, but rather where the property market is going in the long run,” Fitch senior director for financial institutions Grace Wu told Bloomberg via telephone. “If the property market remains sluggish for much longer it will certainly impact demand and quality of other loans.”

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.