It appears that Donald Trump’s request to cease Chinese equity investing has not completely fallen on deaf ears: on Wednesday, the Senate voted in favour of new legislation which would prevent certain Chinese companies from listing on the stock exchanges in the US.

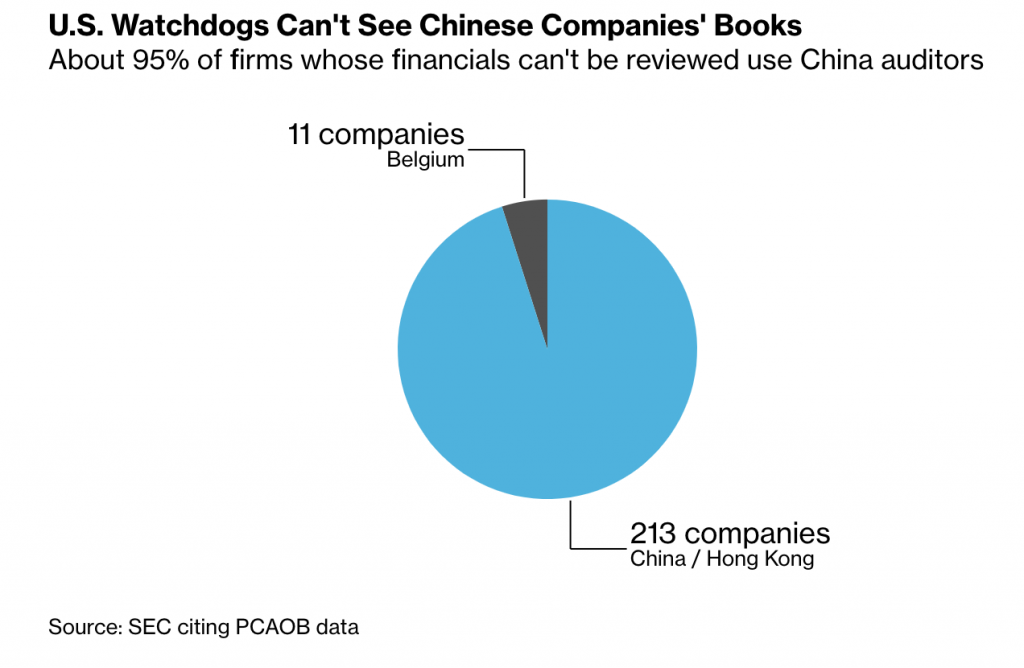

As tensions between the US and China continue to rise, several US senators penned up a bill to the Senate, which would ultimately force Chinese companies to comply with US accounting rules and prove they are not controlled by a foreign government. It appears that the US is finally fed up with China’s refusal to permit the Public Company Accounting Oversight Board (PCAOB) to review audits of their companies, many of which list on US security exchanges, including NASDAQ and NYSE.

A large portion of these Chinese companies receive investments from a variety of US pension funds and college endowments, given that the return tends to be above average. However, some of those companies are complicit in questionable audit practices, many of which are not overseen by US audit inspections. In addition, the US government is raising the alarm regarding the destination of American money once it is invested in Chinese companies, suggesting that the funds go towards outperforming the US technology developments, including AI, online data collection, and autonomous driving.

If the bill gets finalized, Chinese companies such as Alibaba and Baidu will have some new rules to comply by. The companies will have to prove they are not controlled by a foreign government, and if they can’t show that, then a US-based audit will need to be done for three consecutive years in order to determine the company’s transparency. Otherwise, the Chinese company will be barred from listing their securities on US exchanges.

Information for this briefing was found via Bloomberg and PCAOB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.