Despite JPMorgan issuing a relatively optimistic outlook earlier regarding the current and near future state of the US economy, much of that positive sentiment has since been reduced. According to the bank’s chief equity strategist Mislav Matejka, the second half of 2020 will now come affixed with a profoundly unattractive risk-reward, with stocks stocks continuing to suffer from diminishing cash and bonds, much like what was witnessed in the first half of the year.

The sudden bearish outlook for US stocks can be attributed to several very evident reasons. Given the current soaring pace of coronavirus infection rates across the US, it is very unlikely that a 2003 template of the SARS virus can be replicated. Although various economic projections are based on the virus tapering off following the first wave of infections, which in turn would cause consumer behaviour to resume in mirror of a V-shaped economic recovery, the reality of the situation is taking a much different pace. The US has now entered a significantly larger second wave of the deadly virus – or depending on how one looks at it, the US hasn’t even overcome the first wave.

The second reasoning behind the sudden downgrade in JPMorgan’s optimism can be associated with the development of the US-China relationship. Despite the Phase 1 trade deal remaining intact, there continues to be an increased risk of escalating tensions between the two countries, causing trade to relapse into uncertain territory once again. This thus puts further pressure on the international trade, and ultimately US manufacturing output during a time when US firms are attempting to resume production following the lifting of economic restrictions.

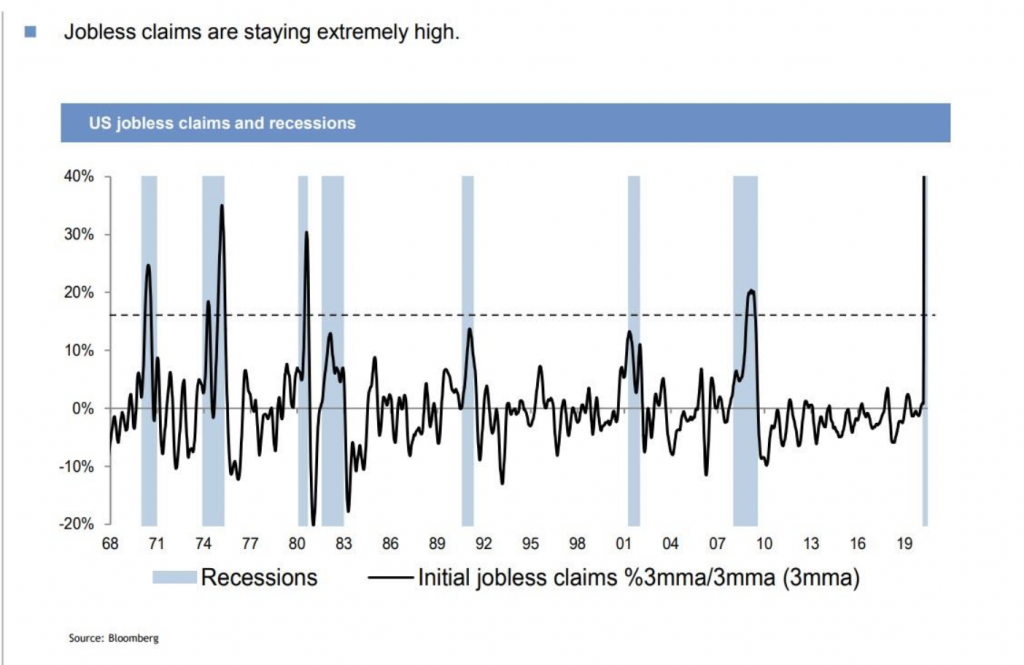

Lastly, the deflationary spiral that typically follows a recession causes a reduction in demand, a drop in wages, decreased production, and an even further decline in prices. Even after the initial economic shock subsides, the negative spiral continues to linger for some time. As hopes of a V-shaped economic recovery slowly slip away, forthcoming 2021 GDP projections are becoming more and more bleak – especially with the continued soaring unemployment rate. Nonetheless, as the window for mitigating the coronavirus pandemic in the US continues to close and slip away, there is a good chance that other economic projections will begin retracting their previous optimistic outlooks much like JPMorgan.

Information for this briefing was found via JPMorgan and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.