Borrowing costs for Chinese property developers were sent soaring over the past month, as international concerns over missed bond payments ripple across markets.

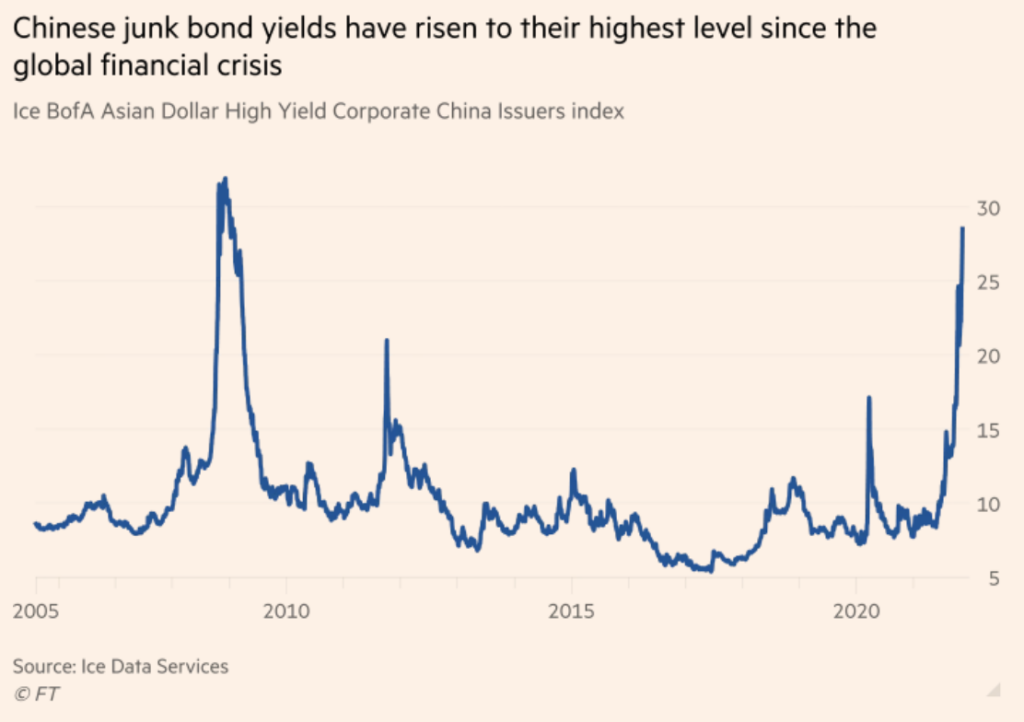

Investors offloaded their junk bond holdings of speculative-grade Chinese developers this week, sending borrowing costs to the highest in over a decade and further impeding the ability for cash-strapped companies to access dire liquidity. According to data from Ice Data Services and cited by the Financial Times, the average rate on Chinese high-yield dollar bonds surged from 14% in September to nearly 30% this week, bringing borrowing costs for China’s real estate sector to the highest since the 2008 financial crisis.

The demand for dollar-denominated debt from Chinese companies affixed with a speculative-grade credit rating has plummeted as of recent, after a string of missed bond payments from a number of major real estate developers left both domestic and foreign investors wary. The sharp increase in borrowing costs, coupled with regulatory pressure to cut back on debt, has made it even more difficult for companies such as Evergrande, Sinic, and Fantasia to access cash and avoid defaults.

Evergrande, which has been at the centre of China’s property crisis, once again narrowly avoided default after it made a $148.1 million interest payment on three dollar-denominated coupons literally minutes before the 30-day grace period was set to expire on Wednesday. Evergrande is far from the only company bouncing from one grace period to the next, though, with Kaisa— one China’s largest borrowers in the real estate sector— this week begged bondholders for “more time” to shore up liquidity after missing interest payments on two offshore bonds.

“I think probably we’re going to see more defaults down the road, and more contagion to other developers,” explained Macquarie chief China economist Larry Hu. “I don’t think they can issue bonds anywhere right now.” According to data from Dealogic, Chinese developers have raised total of $320 million from foreign bond sales since the beginning of the fourth quarter, which is significantly less than the billions of dollars that are typically raised during the period.

In a further testament of the severity of economic implications stemming from the collapse of China’s real estate sector, Beijing has decided to loosen recently-imposed restrictions on borrowing. As reported by the Securities Times on Wednesday, some property developers may soon be able to tap into interbank markets for cash in an effort to alleviate pressures from the bond selloff in offshore markets.

Information for this briefing was found via the Financial Times and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.