Cineplex Inc (TSX: CGX) reported their third quarter results on Friday, reporting revenues of $61 million, a significant decline from the $418.4 million reported in the year ago period. In terms of loss per share, the company incurred a loss of $1.91 for each share outstanding. Naturally, the loss is largely a function of the ongoing pandemic, with the company announcing Friday that they had managed to secure financial covenant suspensions on their outstanding credit facilities, which currently total $460 million, with the suspensions being extended until the second quarter of 2021.

This morning, Canaccord Genuity reiterated their 12-month price target of C$7.00 and upgraded the stock to hold from sell. Aravinda Galappatthige, Canaccord’s analyst, expects Cineplex not to meet its financial covenants that were extended to the second quarter of 2021. She says, “it is reasonable to believe that the banking syndicate will offer a further extension on the back of the aforementioned mitigating initiatives. Factoring in the above, we upgrade the stock to HOLD from Sell.”

Galappatthige makes a note of the recent uptick in COVID cases in Canada and expects that this will cause further delays in a recovery. She comments, “we felt that management formulated a formidable combination of developments to strengthen its balance sheet and financial picture.”

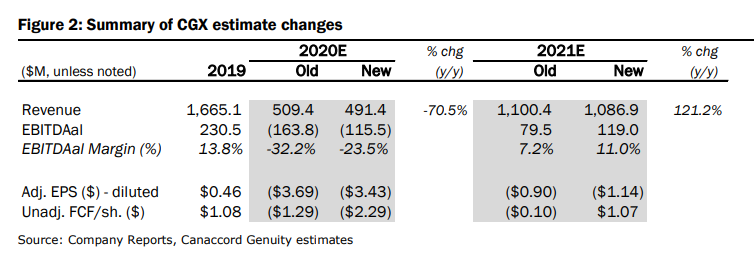

Galappatthige has made slight adjustments to their 2020 and 2021 estimates, decreasing expected revenues from $509.4 million and $1,100.4 million to $491.4 million and $1,086.9 million, respectively. EBITDA meanwhile is expected to improve from -$163.8 million to -$115.5 million in 2020, and increase from $79.5 million to $119.0 million in 2021 based on the revised estimates.

She then says, “There is still a fair bit of uncertainty around central factors like film slates, and the eventual shape of the box office recovery.” Galappatthige turns to China and Japan, saying that their data suggests a quick return as conditions ease but then presents a different point of view citing, “extended periods of closures can have an impact on consumer behavior patterns, and potentially trigger increased direct releases.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.