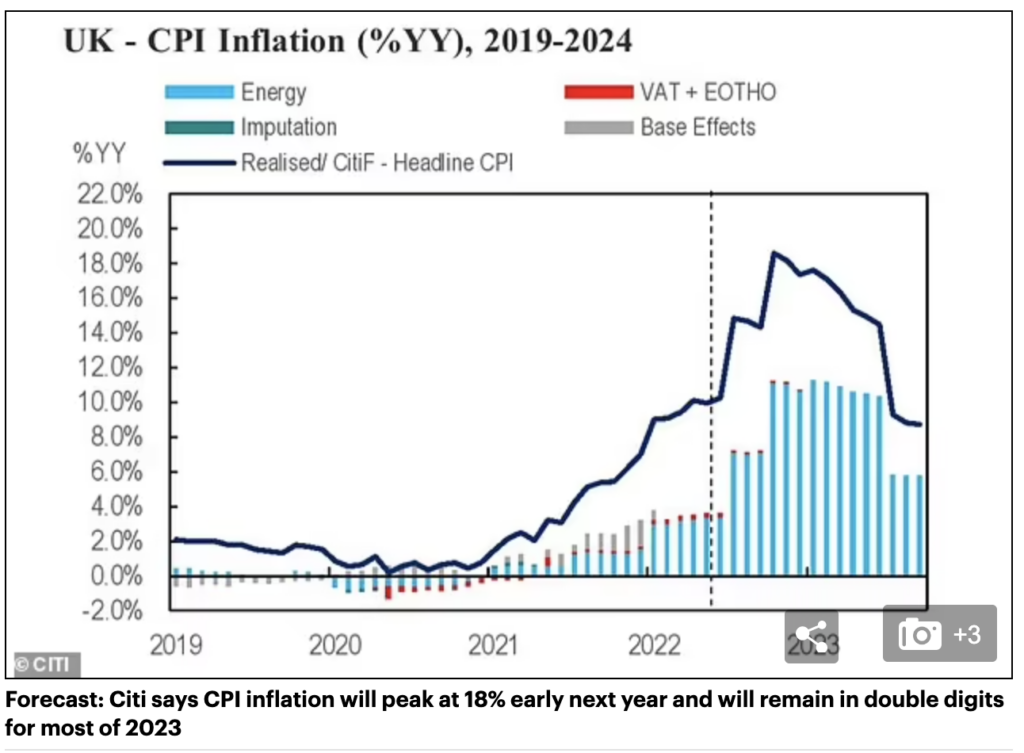

The outlook for the UK’s economy is becoming increasingly more bleak. A recent study conducted by Citi Bank suggests that the country’s consumers will face inflation rates upwards of 18.6% come early 2023, as energy prices skyrocket to astronomical levels and the central bank’s interest rate hikes will do little to help.

UK households faced an annualized 10.1% increase in consumer prices in July, largely driven by record-high energy prices amid the Ukraine conflict. Citi economist Benjamin Nabarro warns that the retail energy price cap will hit £4,567 per year by January, up from a current level of £1,971, likely prompting the Bank of England to raise borrowing costs to as much as 7% in an effort to prevent inflation from spiralling out of control even further.

However, in his note which was cited by the Daily Mail, Nabarro questions the effect that such a hawkish shift in monetary policy would actually have on reducing inflation while ensuring the real economy doesn’t slump into a catastrophic recession. “Should signs of more embedded inflation emerge, we think Bank Rate of 6 to 7 per cent will be required to bring inflation dynamics under control,” he wrote. “For now though, we continue to think evidence for such effects are limited with increases in unemployment still more likely to allow the MPC to pause around the turn of the year.”

Markets are currently expecting the central bank to raise rates to 3.75% by March of next year, after already increasing borrowing costs by 50 basis points to 1.75%. But, given that the current bout of inflationary pressures are stemming from a supply-side nature, the rate hikes will not have such a dampening effect on headline inflation, and will likely only hinder economic growth.

The Bank of England now predicts the economy will slump into five straight quarters of negative GDP growth starting in October. “It looks like a recession is almost an inevitability at this stage— with record low consumer confidence, the latest GDP figures pointing to a contraction, and now these fresh eye-watering inflation forecasts,” said Handelsbanken UK chief economist James Sproule.

Information for this briefing was found via the Daily Mail. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.