CME Group is set to launch a new lumber futures contract on August 8. The new derivative is said to feature a more precise hedging acumen and is designed to be more accessible to producers.

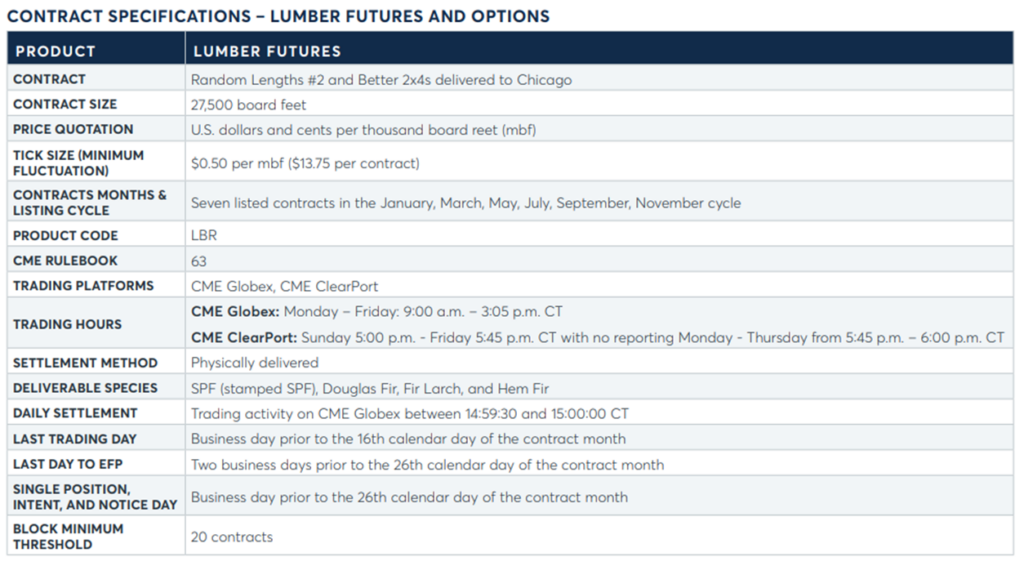

The new futures are now sized at 27,500 board feet, characterized by the derivative exchange as “a single truckload to enable more tailored risk management strategies.”

The delivery point has also been set to Chicago Switching District where the futures will be physically delivered “allowing for a wider breadth of market participation from both western and eastern producing mills.”

The deliverable species have also been extended to include SPF (stamped SPF), Douglas Fir, Fir Larch, and Hem Fir, which is expected to make the pricing more precise and inclusive.

Options on the new lumber futures will also be launched on the same day. Minimum price fluctuation is set at US$0.10 per mbf (US$2.75 per contract).

The futures are set to trade on CME ClearPort and CME Globex, under the code “LBR”.

Biggest changes:

— Stinson Dean🌲 (@LumberTrading) July 5, 2022

-Smaller contract size, truckload (1/4 of current carload contract size)

-Delivered Chicago (roughly $90 adder over current contract delivery point of WCanada)

-ESPF &WSPF written into the contract so producers in both sides of Canada can deliver (long overdue!)

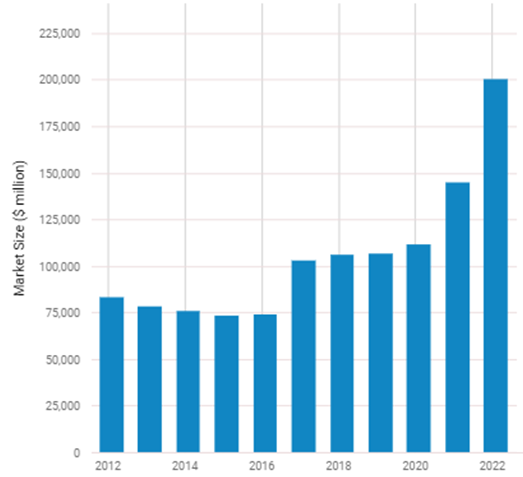

Research firm IBISWorld estimates the lumber wholesaling industry at around US$200.8 billion for the year, sporting a 14.2% annualized market size growth from 2017 to 2022.

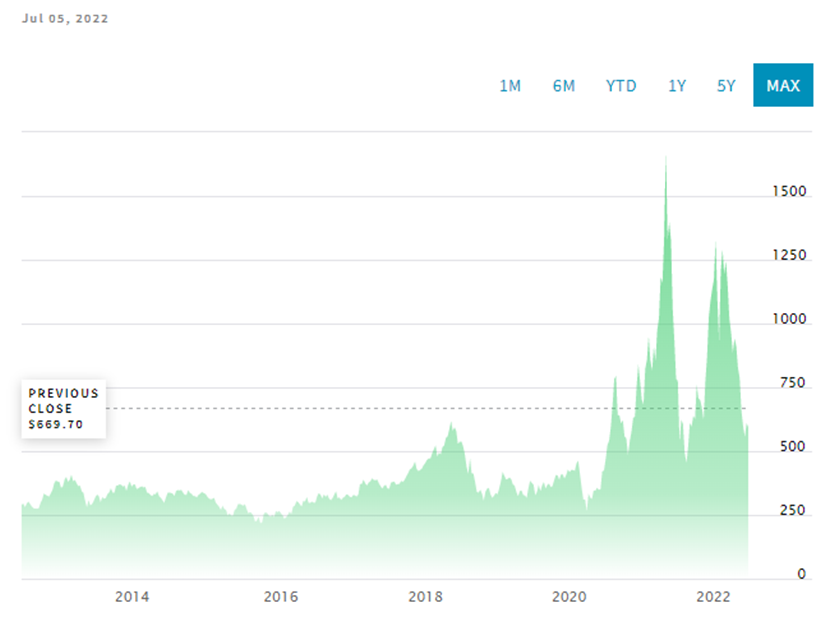

Lumber prices have seen its all-time high May 2021–breaching the US$1,500-mark–before immediately climbing back down. It once again rallied during Q1 2022, reaching beyond the US$1,400-mark, before slumping back down for the rest of the first half of the year.

Lumber’s last price was at US$648.40.

Information for this briefing was found via CME Group. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.