Canada’s housing authority has recently released a statement urging the country’s private mortgage lenders to refrain from issuing loans to what are now considered risky borrowers.

Back in June, the Canada Mortgage and Housing Corp (CMHC) announced that as of July 1, the eligibility criteria for potential mortgage borrowers will be tightened in response to the negative economic impacts stemming from the coronavirus pandemic. Now, in order to qualify for a mortgage, the borrower will need to have a higher minimum credit score, as well as a reduced debt burden. With the tightened measures, the CMHC aims to decrease taxpayer risk while shielding new home owners from a drop in house prices.

However, CMHC’s plan did not go as intended, as many private lenders such as Canada Guaranty Mortgage Insurance Co. and Genworth MI Canada Inc. took upon the opportunity to fill the demand gap. As a result, CMHC has lost a sizeable portion of the market share, and is now urging its private-sector competitors to observe the new rule changes.

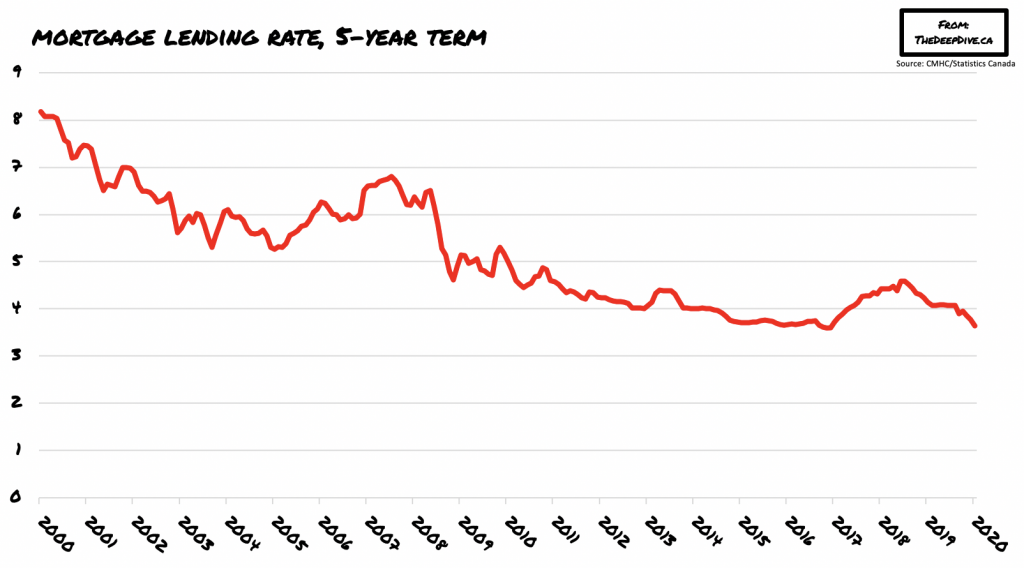

According to the CMHC chief executive officer Evan Siddall, the decision to tighten lending rules comes amid concerns rising from the increased volatility of Canada’s housing market. The record-low interest rates coupled with an increase in new listings is creating a risky trend among borrowers and private lenders that could potentially draw out the economic recovery even longer. Siddall urges the private mortgage issuers to take the long-term macroeconomic vulnerabilities into strong consideration, rather than short-term profitability.

Information for this briefing was found via CMHC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.