Last month’s home sales continued to be impacted by rising borrowing costs, as potential homebuyers took a break from the housing market in order to monitor the trajectory of real estate prices.

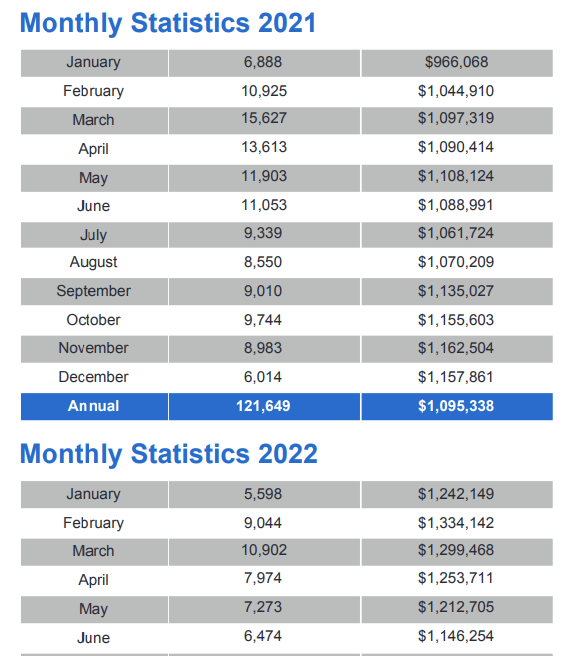

Latest data from the Toronto Regional Real Estate Board (TRREB) showed that a total of 6,474 homes traded hands in June, marking a 41% decline compared to the same month in 2021. Although the average home price trended 5.3% higher year-over-year to $1,146,254, the monthly change continued to dip lower. TRREB gave credit to the more inexpensive segments of the real estate market in being responsible for the annual increase in prices, primarily townhomes and condo apartments.

“Home sales have been impacted by both the affordability challenge presented by mortgage rate hikes and the psychological effect wherein home buyers who can afford higher borrowing costs have put their decision on hold to see where home prices end up,” said TRREB president Kevin Crigger. “Expect current market conditions to remain in place

during the slower summer months. Once home prices stabilize, some buyers will re-enter the market despite higher borrowing costs.”

Although the number of transactions slumped from June 2021, new listings remained little changed during that time. As such, TRREB suggests the trend in listings will serve as a strong indicator of the direction of Toronto’s housing market. “With the unemployment rate low, the majority of households aren’t in a position where they need to sell their home,” explained TRREB chief market analyst Jason Mercer. “This could cause market conditions to tighten somewhat, providing some support for home prices.”

Information for this briefing was found via TRREB. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.