A number of analysts changed their recommendations and price targets on Canadian National Railway (TSX: CNR) over the last week after the company presented a strategic plan to improve operating income and operating ratio for 2022. Most notably, National Bank raised their 12-month price target to C$151 from C$144 and BMO Capital Markets relaunched coverage on the name with a C$155 price target and market perform rating.

Canadian National Railway currently has 19 analysts covering the stock with an average 12-month price target of C$154.64, or a 6% upside. Out of the 19 analysts, 3 have strong buys, 6 have buys and the other 10 have hold ratings. The street high sits at C$160 from Raymond James, while the lowest comes in at C$136.

Over the weekend, BMO Capital Markets relaunched their coverage of Canadian National Railway, raising their previous C$150 price target to C$155, but downgrading them from outperform to market perform. They say that the current activist campaign is underway, which is “tapping into investors’ negative sentiment following several years of share price underperformance.”

This a potential positive catalyst as it’s forcing management to show their hand at “some very meaningful and encouraging steps to improve operational efficiency.” BMO call’s the new strategic plan a positive step forward, but they believe it comes short of “Tapping into CNR’s full potential.”

BMO Capital Markets lays out the key takeaways from the strategic plan:

- Targeting $700 million of additional operating income for 2022 with cost reduction contributing $550 million and higher pricing contributing $150 million.

- Targeting an operating ratio of 57% for 2022

- Resuming share repurchase agreement.

- Conducting a review of the capital structure and financial leverage

- Reducing capital expenditures to 17% of total revenue in 2022

- Grow earnings per share by approximately 20% by 2022

- Boost ROIC to 15% by 2022

Commenting on the strategy and the future of Canadian National Railway, BMO comments, “We believe that realizing CNR’s full profitability and shareholder value creation potential hinges not only on improving the operating cost but also ensuring that the commercial strategy targets the right type of freight.” Additionally, CN Rail’s target of 57% operating ratio is lower than the 61.7% 2021 estimate BMO has for the company.

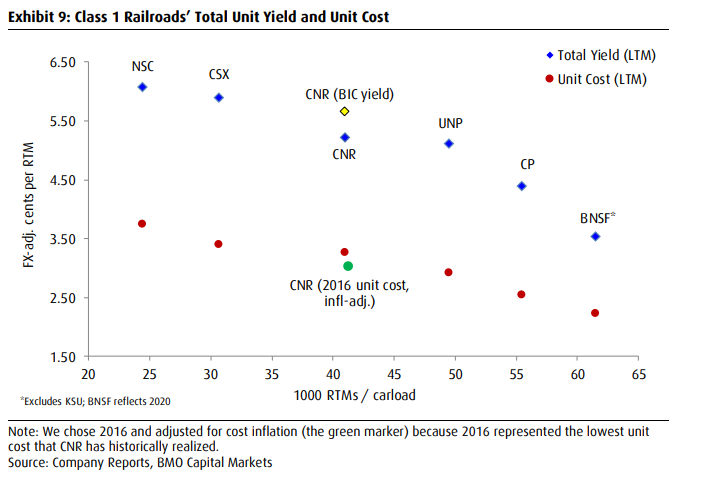

BMO believes that Canadian National Railway remains one of the lowest unit cost operations in the industry throughout most of the cost categories, although it has slipped in market share to CP due to their acquisition of PSR in 2016. BMO conducted a comprehensive analysis on Canadian National Railway’s unit cost and unit revenue performance over the past 5 years. They believe the trend can be bucked and through their analysis, they believe that a mid-to-low 50% operating ratio can achieve a high teens ROIC.

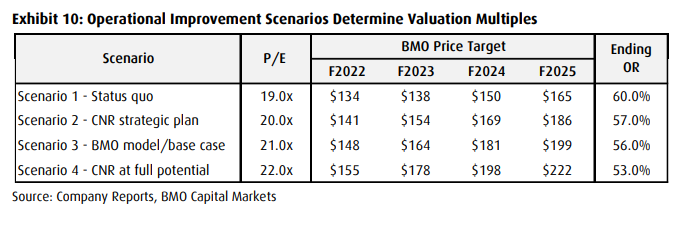

BMO has produced a scenario matrix with different scenarios based on what they are seeing from other investors and from the company, where the 2025 price target goes from $165 to $222. They say in the first scenario, or “status quo”, this scenario is where operating ratio remains in the low 60% range, causing the stock to experience a multiple contraction and CN Railway to continue to underperform.

In the “CNR strategic plan” scenario, they forecast operating ratio heading and staying towards the announced 57%, while the company executes on its other promises. The two other scenarios are lumped together in BMO’s explanation, for which they write, “The other two scenarios see the operating ratio drifting to the low 50% range based on our analysis with ROIC expanding to the high teens.”

Information for this briefing was found via mining.com and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.