So far, the year 2022 in the investment world may be best described as an extraordinarily upside-down period. To that end, coal, a heretofore long-time hated commodity, has been a top performer year to date and may continue to perform well for some time to come. Over the last few days, governments of Germany, the Netherlands and Austria all announced that power generated by coal-fired plants would be used in their respective countries to compensate for cuts in Russian gas supplies.

Germany’s decision to embrace coal is particularly noteworthy. The world’s fourth largest economy (behind only the U.S., China and Japan) as recently as late November 2021 announced plans to move forward the date for a complete coal phase-out to 2030 from 2038. Prior to the Russia-Ukraine war, Russia had supplied about 35% of Germany’s natural gas.

On June 18, Germany’s Economy Minister Robert Habeck was forced to announce a return to “coal-fired power plants for a transition period.” Despite its reluctant move in the short and intermediate term toward coal, Germany still hopes to achieve a coal exit in 2030.

A restrictive gas storage law passed in March 2022 seems to be a key impetus for Germany’s actions. By October 1 of each year, the country’s gas storage tanks must be 80% full, 90% by November 1, and still 40% by February 1, which is well into the winter heating season. The tanks are currently 56% filled.

Another major factor was Gazprom’s June 14-15 actions to cut a cumulative 60% of gas supplies delivered to Germany via the company’s Nord Stream 1 gas pipeline. Gazprom, Russia’s state-owned gas producer, cut deliveries from 5.9 billion cubic feet per day (Bcf/d) to 2.4 Bcf/d with little explanation.

The Netherlands lifted all restrictions through 2024 on the proportion of coal in its fuel mix. Until now, coal-fired electricity was permitted to fulfill only about a third of the country’s needs. The Dutch energy minister said his country had “prepared this decision with our European colleagues over the past few days.”

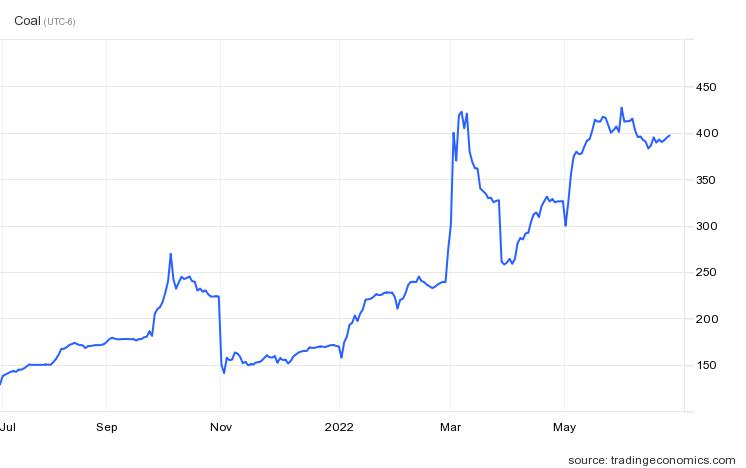

The actions by these European countries seem likely to maintain upward pressure on coal prices. After peaking at about US$430 per tonne when Russia invaded Ukraine, thermal coal briefly fell to around US$260 but has moved back to the US$400 per tonne range. From a longer-term perspective, the commodity is up around 700% in only 18 months.

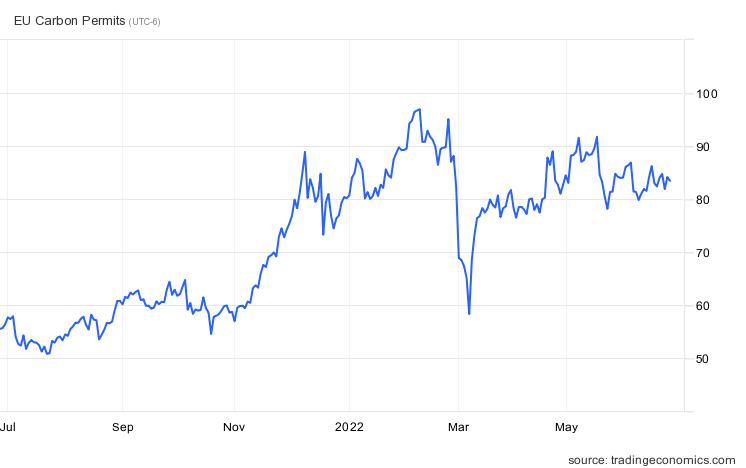

Another market which seems likely to be lifted by an increasing embrace of coal by European countries is carbon permits in the European Union (EU). The EU launched a greenhouse gas emission trading scheme in 2005 under which a maximum or cap is set on the amount of greenhouse gases (primarily CO2 but also methane and nitrous oxide) that can be emitted by participating installations.

EU allowances which permit emissions are auctioned off and can be traded. Presumably, utilities in Germany, the Netherlands and Austria will now be required to bid for extra allowances.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.