The global energy crisis seems to grow more acute each day, and the effects of energy shortages, including natural gas, coal, oil, and liquified natural gas (LNG), seem to ripple daily from country to country and worldwide region to worldwide region. Energy stocks have less than a 3% weighting in the S&P 500 Index, so many investors likely have only a small percentage of their portfolios allocated to energy stocks.

To put that small figure in some perspective, Apple Inc. (NASDAQ: AAPL) stock alone has a weighting in the benchmark index of just over 6%. Given the intractability of the worldwide supply problems, investors may want to consider boosting their allocations to the broad sector.

We point out three important developments supporting such a stance which occurred just over the weekend. First, China’s largest coal-producing region, the northern province of Shanxi, was hit by severe flooding in early October. As of October 8, about 60 coal mines in Shanxi had completely suspended operations and 372 had halted work, according to provincial authorities. In 2020, Shanxi produced 1.06 billion tons of coal, or more than 25% of China’s aggregate production.

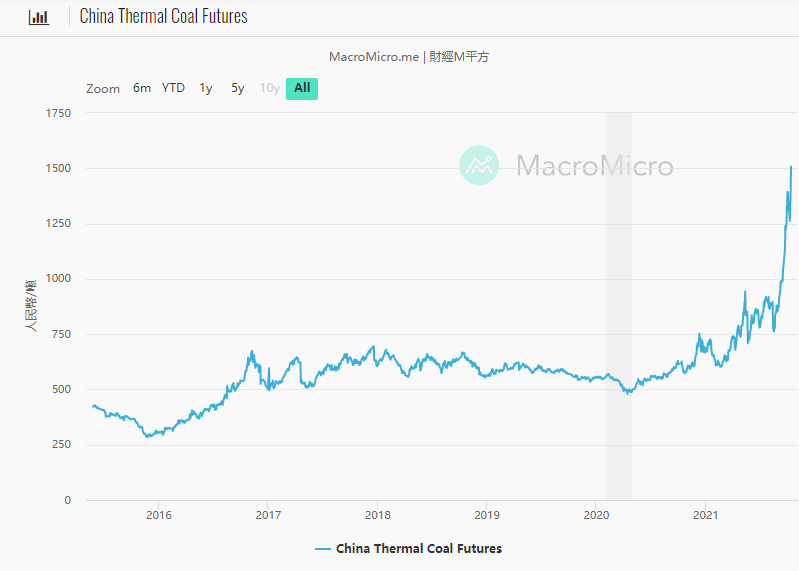

In turn, coal futures on the Zhengzhou Commodity Exchange jumped 12% to 1,408 RMB (around US$220) per tonne on October 11. China is already very short thermal coal, and the Shangxi development only exacerbates this situation.

Second, natural gas prices have risen so much and so quickly in the U.K. that the Chancellor of the Exchequer of U.K., Rishi Sunak, is considering a plan to provide loans or other assistance, in the “low hundreds of millions of pounds” sterling, to energy-intensive industries according to the Financial Times. Otherwise, steel, ceramics, glass, and paper manufacturing factories could be forced to close. (The Chancellor position in the U.K. equates to the Secretary of the Treasury in the U.S.) In addition, Bloomberg reported on October 11 that U.K. power producers are being forced to turn to high-priced coal because low wind levels are cutting power produced by windmills.

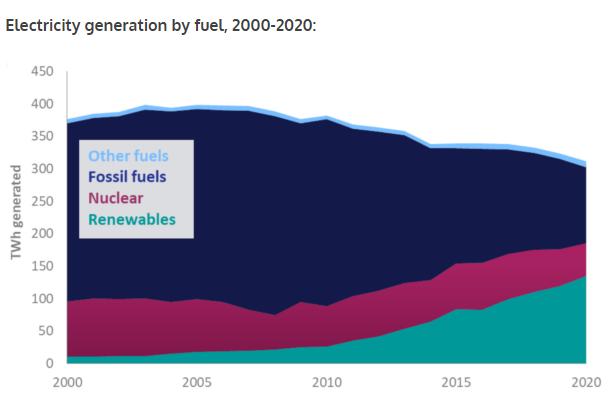

It is possible that the U.K.’s energy issues trace to that country’s aggressive embrace of renewable sources of energy. About 43% of its power generation comes from renewable energy sources versus around 20.5% and 26% in the U.S. and China, respectively. Only three coal-fired plants remain operational (not mothballed) in the U.K. When the wind does not blow or the sun does not shine as much as planned, the country’s fallback options are limited.

Finally, on October 11, Qatar, the world’s largest seller of LNG, told worldwide customers it is already producing at maximum capacity, and it has no ability to increase LNG output to fill the global gap in needed energy supplies. Asian spot LNG prices are at US$56 per million BTU. (One million BTU equates to 1,000 cubic feet, or 1 MCF, of natural gas.) Just two months ago, that spot price was around US$16 per million BTU.

The global energy crisis seems to “radiate” from one region to the next with great speed and increasing severity. Investors may consider boosting their exposure to energy commodity plays as the problems seem likely to continue to grow for some time. As an aside, many non-energy companies in a variety of industries are likely soon to feel the sting of rapidly rising energy prices. These effects may begin to be described as companies report their third quarter earnings and provide guidance for fourth quarter and full year results.

Information for this briefing was found via Bloomberg and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.