Coeur Mining (NYSE: CDE) on Monday announced that they have agreed to sell their Crown and Sterling holdings to AngloGold Ashanti Limited for total consideration of $200 million, comprised of $150 million of cash upfront and $50 million upon Crown Sterling attaining a total resource of at least 3.5 million gold ounces. Coeur expects the transaction to close during the fourth quarter of 2022.

The Crown and Sterling assets include 35,500 net acres and are located adjacent to AngloGold’s existing gold projects in Beatty County, Nevada.

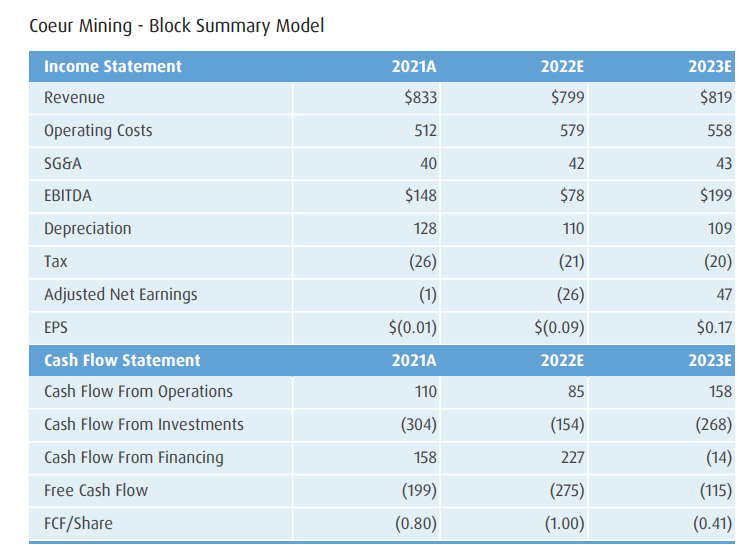

Coeur Mining currently has eight analysts covering the stock with an average 12-month price target of $4.61, or an upside of 38%. Out of the eight analysts, two have buy ratings, and the other six analysts have hold ratings on the stock. The street high price target sits at $6.25, which represents an upside of 87%.

In BMO Capital Markets’ note on the news, they reiterated their market perform rating and raised their 12-month price target to $4.00 from $3.75, saying that Coeur Mining is divesting the asset at a good price.

They add that the upfront payment of $150 million is higher than the $53 million in carrying value BMO had for the asset and is also higher than the $90 million original purchase price. With this, BMO has updated its net asset value from $2.59 to $3.00.

Lastly, they say that the money will allow Coeur to shore up its balance sheet; this is on top of the $100 million at-the-market offering the company just completed and the C$54 million sale of Victoria shares in June.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.