Monday was a very big day for companies who are in the business to help patients who suffer from Alzheimer’s, and it was an even bigger day for those patients. On Monday, the long-awaited FDA decision on Biogen’s Aduhelm drug was announced. The FDA approved the treatment, which costs the patient $56,000 per year.

This has sent the shares of companies who are in the field soaring, with Eli Lilly touching all-time highs, gaining about $32 billion on the day. That is more than the roughly $21 billion Biogen gained in market capitalization on the news. Cognetivity Neurosciences also jumped 19% before opening at an all-time high.

Off the back of this news, Echelon Capital Markets almost doubled their 12-month price target on Cognetivity Neurosciences (CSE: CGN) to C$1.50, up from C$0.85 prior, and reiterated their speculative buy rating on the company. Their analyst Stefan Quenneville says that the approval is a major catalyst for Cognetivity. He acknowledges that the FDA’s decision was a controversial outcome but nonetheless says, “it is clearly a major positive catalyst for Cognetivity as we anticipate that potential demand for its Integrated Cognitive Assessment (ICA) platform will likely increase meaningfully as millions of patients will need to be triaged for their suitability for aducanumab.”

The thesis is quite simple and Quenneville explains it perfectly by saying, “Currently, many patients are not properly screened due to limitations with legacy pen and paper-based or computerized tests.” With Biogen’s drug, it is specifically to help people who are affected by early-onset Alzheimer’s, while Cognetivity’s ICA is “a very elegant solution that provides initial diagnosis and ongoing monitoring of a patient’s cognitive ability quickly and accurately.”

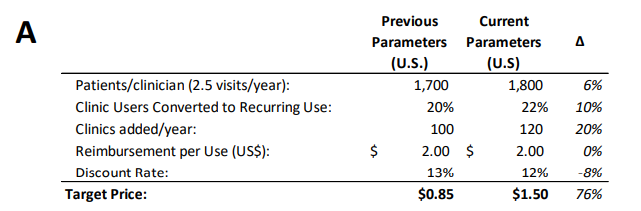

Quenneville believes that Cognetivity’s ICA will be approved for use in the U.S by the end of the year, it is currently approved in the UK and EU. Much of the price target increase can be attributed to their increase in the adoption rate of ICA by 20% which you can find below.

FULL DISCLOSURE: Cognetivity Neurosciences Ltd is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Cognetivity Neurosciences Ltd on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.