Two recent metallurgical coal transactions which carried high price tags could benefit Colonial Coal International Corp. (TSXV: CAD) – a small-cap, pure play, British Columbia-based met coal developer.

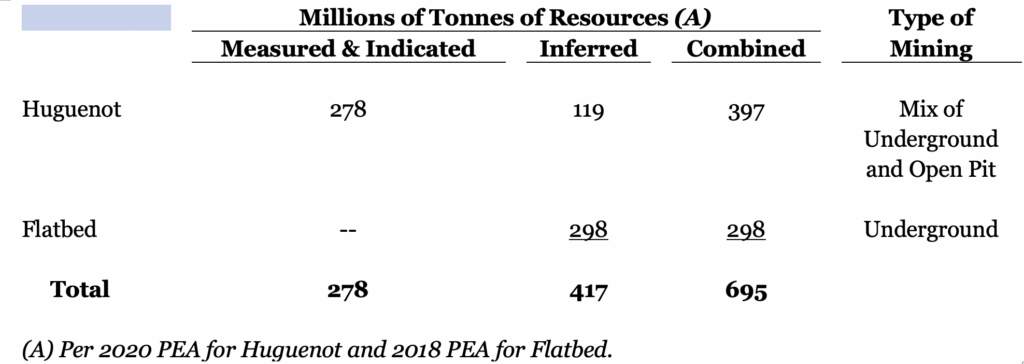

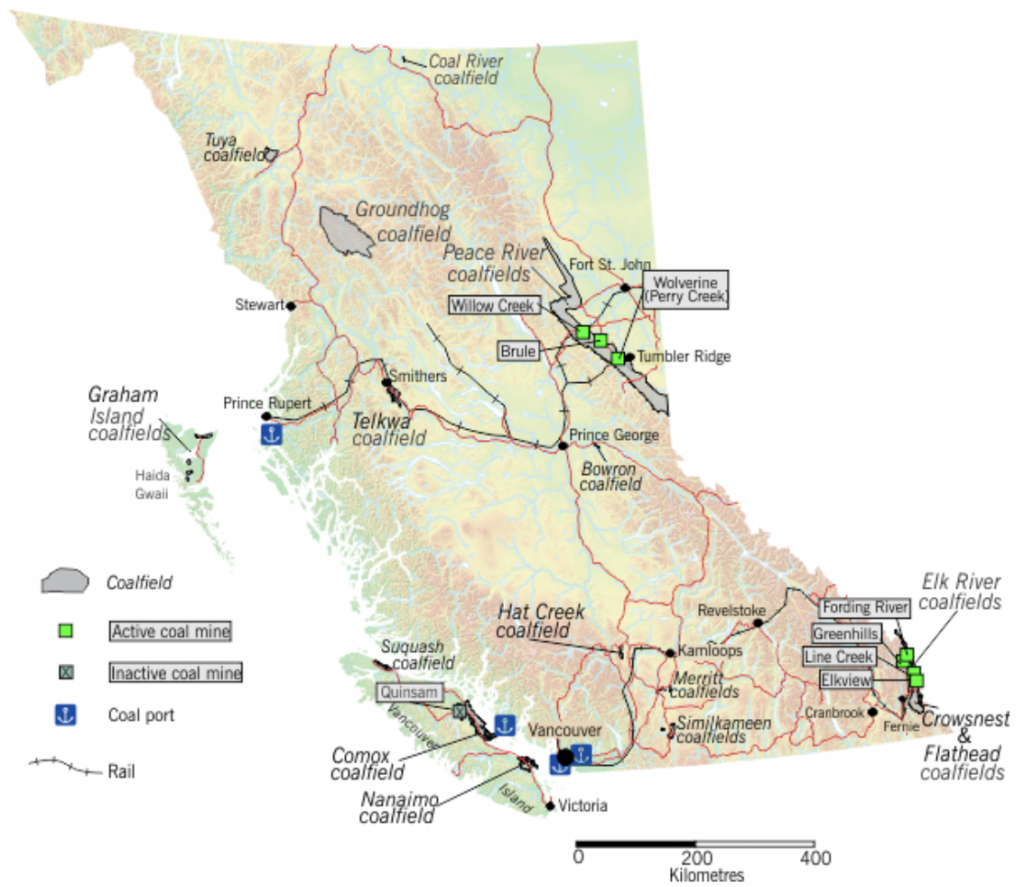

Colonial Coal owns two major coal projects in the Peace River Coalfield in northeastern BC, Huguenot and Flatbed, for which the company is actively seeking buyers. Huguenot and Flatbed have nearly 700 million tonnes of steelmaking coal resources.

First, in October BHP Group Limited (NYSE: BHP) and Mitsubishi, the giant Japanese trading house, announced the sale of two jointly owned Australian coking coal operations to Whitehaven Coal Limited (ASX: WHC), a lead coal producer in Australia. (Coking coal is another name for metallurgical coal.) Whitehaven agreed to pay US$3.2 billion in cash plus US$900 million in additional contingent payments for 100% of the Blackwater and Daunia metallurgical coal mines in Queensland, Australia.

The additional potential payments of up to US$900 million will be comprised of three outlays – three months after the first, second and third deal closing anniversaries. BHP/Mitsubishi will receive 35% of the realized revenue from Blackwater and Daunia coal that exceed US$159 per tonne in year one, and US$134 per tonne in both years two and three.

Blackwater has one of the largest coal reserves – 877 million tonnes – in both Australia and the world. Its annual production capacity is about 13 million tonnes. Daunia is smaller; it has resources of about 115 million tonnes and production capacity of around 4.5 million tonnes per year. Both Blackwater and Daunia are open pit mines.

For Colonial Coal, the key aspect of the BHP/Mitsubishi – Whitehaven transaction is that Whitehaven paid about US$4 per tonne (up to US$4.1 billion divided by total reserves and resources of around one billion tonnes) for coking coal assets “in the ground.” Furthermore, the quality of the Blackwater/Daunia met coal is considered to be lower quality met coal than Colonial Coal’s Huguenot and Flatbed resources.

Second, in mid-November, Teck Resources Limited (NYSE: TECK) reached an agreement to divest 100% of its steelmaking coal business, named Elk Valley Resources, for an implied overall price of US$9.0 billion through the sale of a majority stake (77%) to Glencore plc (LSE: GLEN). Per the accord, Japan’s Nippon Steel Corporation will acquire 20% of Elk Valley; and POSCO, a South Korean steelmaking company, will own the balance, or 3%.

Teck Resources’ operating met coal assets are in southeastern British Columbia, while Colonial Coal’s Peace River properties are in the northeastern part of the province. Teck Resources does own two development properties in Peace River which are adjacent to Colonial Coal’s Flatbed property.

The significance of the Teck Resources announced deal is that many observers believe that as many as ten major global steel or coal companies were bidding for the Elk Valley Resources assets. The parties which did not win the bidding war – but presumably still want to gain or increase exposure to Canadian met coal resources – may now turn their attention to Colonial Coal’s properties. Indeed, Colonial Coal’s CEO David Austin recently noted that Colonial is engaged in discussions with Chinese and Indian groups regarding the company’s Huguenot and Flatbed properties.

READ: Colonial Coal Reportedly Sees Strong Interest After Marketing Its Met Coal Properties

Colonial Coal’s ability to reach constructive deals for Huguenot and Flatbed will obviously be the key determinant of shareholder value, and whether the company can negotiate such accords is of course uncertain. However, if Colonial Coal were able to sell the properties at an average of US$2 per tonne of resources, it would receive proceeds of approximately US$1.4 billion (US$2 times 695 million tonnes of aggregate resources).

Since Colonial Coal has approximately 185 million fully diluted shares outstanding, the pretax proceeds from such a US$2 per tonne sale would equate to around US$7.50 per Colonial Coal share. Colonial Coal is currently valued at only about US$0.35 per tonne of resources.

Colonial Coal International Corp. last traded at $1.88 on TSX Venture Exchange.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Good article. Thank you.

US$1.4 billion equates to CA$1.92 billion.

Divide that sum by 185 million shares and you get to just over $10 share price.