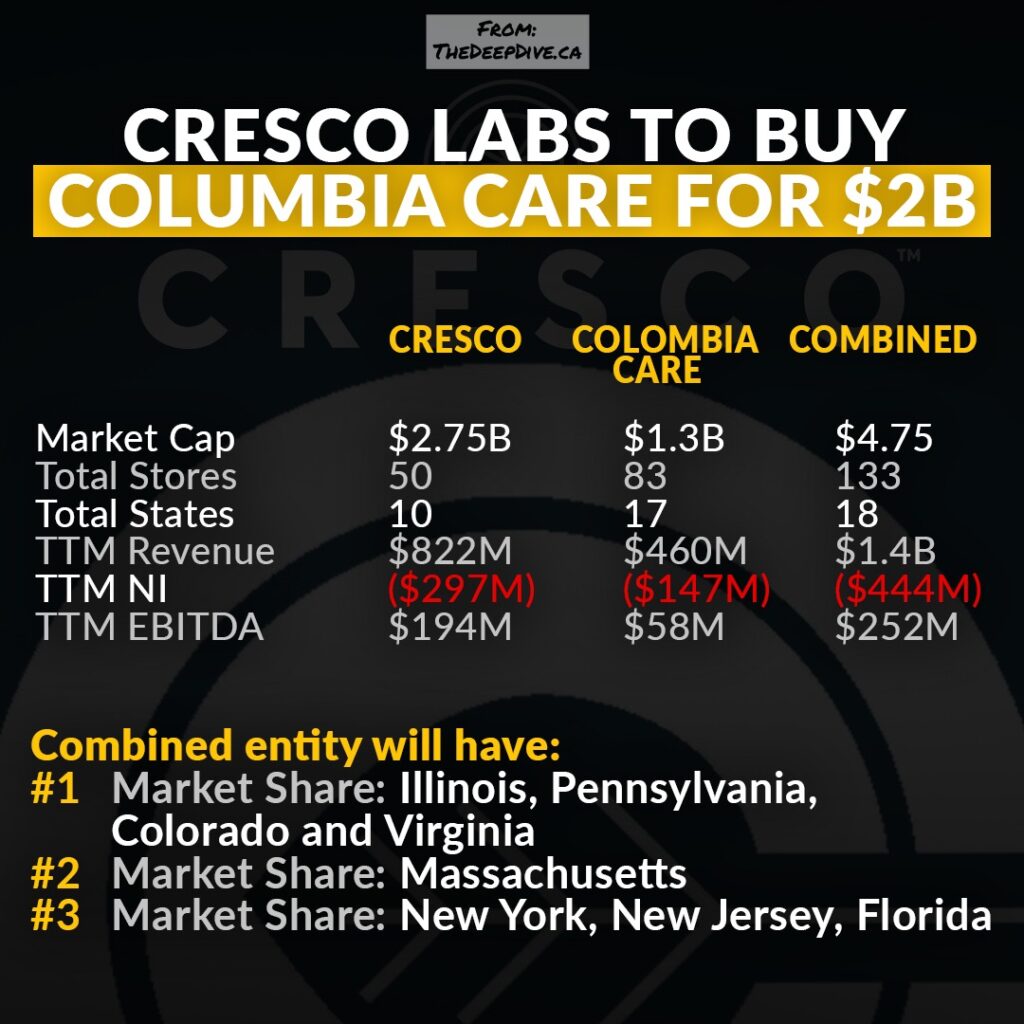

Columbia Care (NEO: CCHW) this morning reported its fourth quarter and full year financial results, a day after revealing it would be acquired by Cresco Labs (CSE: CL) in an all-stock transaction. The firm posted record quarterly revenue of $139 million for the period ended December 31, 2021.

The results released this morning are inline with preliminary data released ten days ago, when the company delayed its earnings reporting date. Revenue was up 5% on a quarter over quarter basis from $132.3 million to $139.3 million, with the quarter also marking the firms transition to US GAAP accounting.

““We are pleased to report record results for the full year and fourth quarter of 2021, in what was a truly transformational year for Columbia Care,” said CEO Nicholas Vita on the results.

Cost of sales for the quarter came in at $82.0 million, resulting in a gross profit of $57.3 million. Selling, general and administrative expenses however amounted to $69.8 million, demonstrating that the company has a ways to go before profitability. Goodwill impairment charges of $72.3 million pushed the quarter further into the red, with an overall loss from operations of $84.8 million being posted for the quarter.

After a $31.0 million boost from other income, the company posted a net loss of $54.7 million for the three month period, while adjusted EBITDA came in at $20.6 million.

For the full fiscal year, revenue amounted to $460.1 million, an improvement of 156% year over year from $179.5 million. Gross profits came in at $194.0 million, which was heavily offset by $232.1 million in SG&A, as well as that $72.3 million goodwill charge, leading to a loss from operations of $110.4 million for the year.

For the full fiscal year, the company posted a net loss of $146.9 million, while adjusted EBITDA amounted to $57.9 million.

Cash and cash equivalents meanwhile reportedly sits at $82.2 million, with total current assets at $226.4 million. Total current liabilities however presently is pegged at $244.0 million.

In terms of annual guidance, the firm had expected revenue between $470 million and $485 million under IFRS standards. Under such standards, the firm recorded $473 million in revenue. Adjusted gross margin however missed, coming in at 45% versus the 46%+ estimate, while adjusted EBITDA hit $85 million on an IFRS basis, just barely achieving guidance of $85 to $95 million.

Looking forward, the company expects to generate US GAAP revenue of $625 to $675 million for 2022, while adjusted EBITDA is expected to be between $120 and $135 million. The guidance is said to assume adult use sales beginning in the second quarter of 2022 in New Jersey.

Commenting on the recently announced merger, Vita stated, “In an evolving industry, the opportunities to better achieve our mission through consolidation led us to this historic moment. With Columbia Care’s strategic national footprint in the most attractive markets and Cresco’s success in execution and incredibly popular brands, we will together create the most important and investable company in cannabis. There is no better team in the industry to maximize the potential of this market defining combination.”

Columbia Care last traded at $3.85 on the Neo.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.