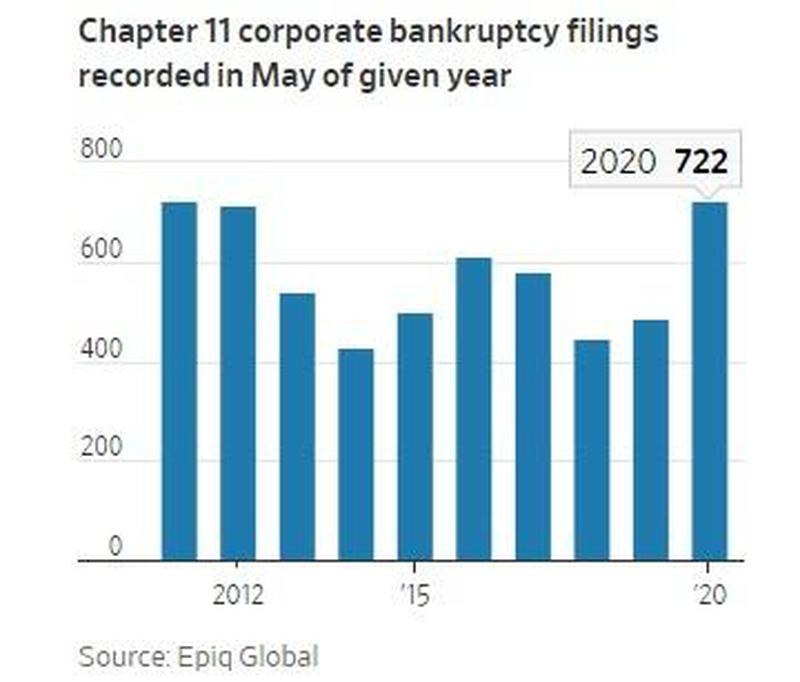

The coronavirus pandemic shocked the US economy, causing mandatory stay-at-home orders and businesses to temporarily close their doors to comply with social distancing measures. Many businesses were ill-prepared for the magnitude of financial ruin, and as a result had no choice but to file for bankruptcy.

According to data compiled by Epiq Systems Inc, the total number of chapter 11 commercial bankruptcy filings have increased from 487 in May 2019, to 722 as of May 2020, which corresponds to a 48% rise. However, total bankruptcy filings declined from 69,860 in May 2019, to only 39,969 in May of 2020 – thus accounting for a 42% decrease. In the meantime, total consumer filings fell by 43%, from 68,869 filings in May 2019 to 39,969 filings the following year.

Compared to April 2020, there was an increase of 29% of chapter 11 commercial filings in May. With regards to total bankruptcy filings, the number increased by 4% in May compared to the month prior. Then, total non-commercial filings for May increased by 3% from April. According to the data, the country-wide average per capita bankruptcy filing rate was at 1.98 (which corresponds to total filings per population of 1,000) for the month of May, which fell from a rate of 2.09 observed in the first four months of the year.

Information for this briefing was found via InBusiness. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.