Carlyle Commodities Corp. (CSE: CCC) is a Vancouver-based junior exploration company that is advancing its 24,000 hectare 100%-owned Newton Gold Project, located 100 kilometres west of the town of Williams Lake in central British Columbia.

The company made a timely purchase of the Newton Gold property in 2020, during the pandemic-driven lull in the precious metals market. The property is located in the vicinity of a number of operating mines and advanced-stage projects, including the Blackwater Gold Project, which currently has a large resource estimate of 11.9 million ounces of gold and 128 million ounces of silver.

The Investment Thesis

We base our investment thesis on the following factors:

- Carlyle’s Newton Gold Project shares similar geological characteristics with Artemis Gold’s Blackwater Gold Project that is preparing for production.

- The Newton Gold project has a current resource estimate of 861,400 ounces of gold and 4,678,000 ounces of silver.

- Carlyle is aggressively exploring the property to increase the size and scope of the deposit and to increase the resource calculation.

- If Carlyle is able to expand its current resource estimate it could become a potential takeover target.

- The price of gold has been rallying as of late, maintaining a price over $2,000 gold.

The Deep Dive views Carlyle Commodities’ Newton Gold Project as a prospective opportunity for junior exploration investors. The blue-sky potential is notable due to the sheer size of the property, with current geology suggesting that the deposit is an epithermal system, which often tend to host massive deposits. With close to a million ounces of gold already estimated, the company is in an excellent position to quickly advance the project to a stage where it could potentially attract a buyout from a larger mining entity.

The Newton Gold Project

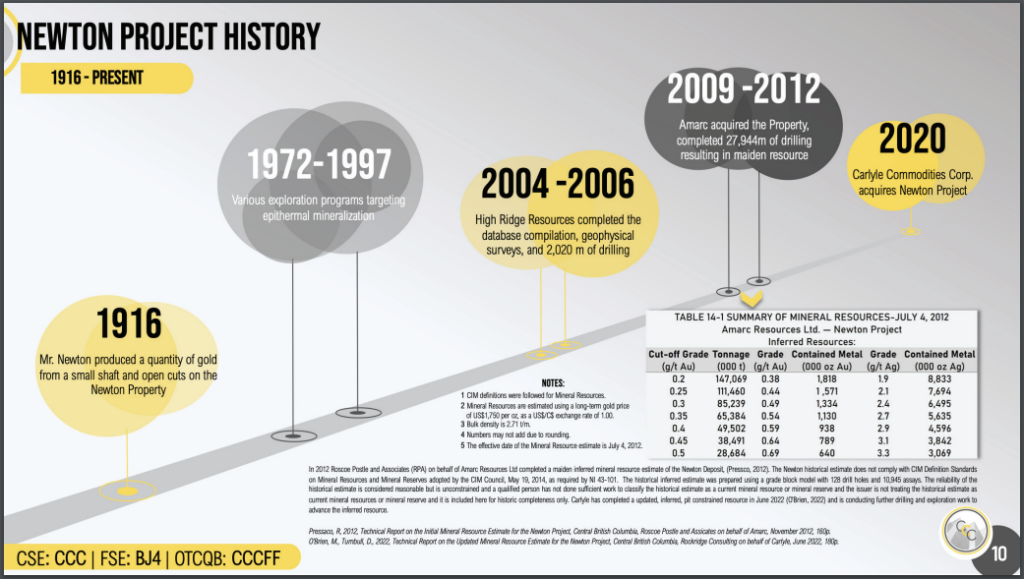

The Newton property has a long history that dates back to 1916 when its owner, Mr. Newton mined it from a small shaft and some open cuts. The property received some periodic exploration interest between 1972 and 1997 by various companies, such as Cyprus Exploration Ltd., and others that were targeting epithermal mineralization. From 2004 to 2006, High Ridge Resources compiled a database, executed geophysical surveys, and conducted 2000 metres of drilling on the property.

From 2009 to 2012, Amarc Resources Ltd. (TSXV: AHR) conducted 27,944 metres of drilling and produced a resource calculation. A NI 43-101 Technical Report was produced in December 2012, which stated that the Newton Project contained a historical non-pit constrained inferred mineral estimate of 1.6 million ounces of gold and 7.7 million ounces of silver based on a cut-off of 0.25 g/t gold.

After Carlyle purchased Newton from Amarc in 2020, it completed an updated NI 43-101 technical report in June 2022, which utilized optimized pit shell constraints to fulfill the requirement for “reasonable prospects for eventual economic extraction” – in order to conform to new NI 43-101 resource calculation guidelines.

The updated resource calculation shows 861,400 ounces of gold, with an average grade of 0.63 g/t, and 4,678,000 ounces of silver with an average grade of 3.43 g/t.

The Newton property contains a low-sulphide epithermal system that is open in multiple directions and at depth. Mineralization is hosted within Late Cretaceous felsic volcanic and intrusive rocks, but also occurs in mafic volcanic and clastic sedimentary rocks and along fault and fracture zones. Gold and related base metal mineralization occurs in extensive zones of strong quartz-sericite alteration.

Epithermal deposits are found throughout the world, and while they are often seen as large tonnage, low-grade, open-pit operations, they tend to be massive in size and therefore attractive for exploration. The alteration types and metal associations at the Newton property are nearly identical to other epithermal gold deposits found in British Columbia, such as the Blackwater, New Prosperity, Brucejack and Snowfields deposits. There are a number of existing mines and advanced-stage projects in the vicinity of the Newton Project, most notably Artemis Gold Inc.’s (TSXV: ARTG) Blackwater Gold Project 180 kilometres to the north.

What makes Carlyle compelling is that the Newton Gold Project shares similar geological characteristics with the Blackwater Gold Project, which is expected to commence production on in 2024. This is considered to be one of the world’s largest open pit development projects. Both properties are considered to be low-to-intermediate sulphide epithermal gold-silver deposits hosted in felsic volcanics, with silica-sericite alteration. The Blackwater Gold Project has resources of 11.9 million ounces of gold at a grade of 0.63 g/t and 128 million ounces of silver, with mineral grades largely in-line with newton.

Artemis currently has a market capitalization of $888 million – i.e. it greatly exceeds Carlyle’s current market capitalization of only $3.8 million. Of course, much exploration work needs to be conducted on the property to add additional resources to the property’s resource calculation. To date only a small portion of the Newton Property has been drilled.

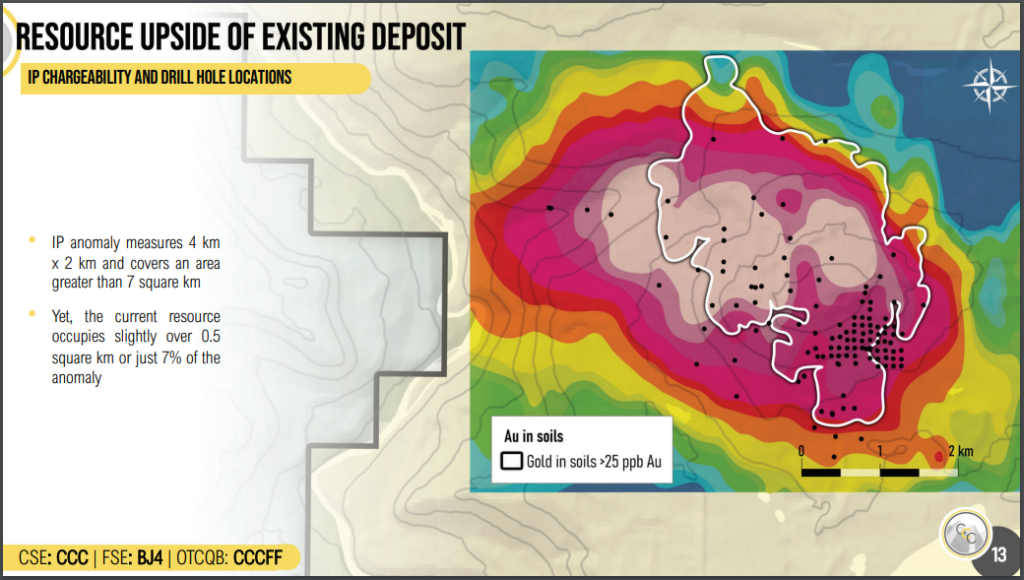

Geophysics and ground exploration shows that there are multiple unexplored mineralization zones located in various parts of the property. Further to this, the current resource estimate occupies just 7% an IP anomaly that exists on the property, and measures 4 kilometres by 2 kilometres in size.

Just last month, Carlyle announced it had completed a three hole phase one drill program. This program was formulated to increase tonnage and gold ounces for the pit-constrained inferred mineral resource estimate, with drilling testing the continuity of mineralization at depth, as well as the southern boundary of the deposit.

Highlights from the results released so far under the program include:

- N23-089: 689 metres of 0.51 g/t gold, 1.48 g/t silver from 18.0 metres depth

- Including 548 metres of 0.60 g/t gold, 1.75 g/t silver from 18.0 metres

- Including 448 metres of 0.67 g/t gold, 2.03 g/t silver from 18 metres

- Including 30 metres of 1.24 g/t gold, 1.61 g/t silver from 413 metres

- N23-090: 0.41 g/t gold, 2.86 g/t silver over 231 metres from 20 metres

- Including 0.46 g/t gold, 3.25 g/t silver over 198 metres from 20 metres

- Including 0.52 g/t gold, 3.71 g/t silver over 168 metres from 20 metres

Results so far are said to have confirmed continuity of the mineralized main felsic volcanic domain, and extended known mineralization by 345 metres beyond the current limits of the inferred resource. A higher grade zone was also discovered below the current resource.

Once all of the assay results from the phase one drill program are returned, evaluated, and added to the Newton Property’s database, the technical team will formulate its 2023 exploration strategy. The company plans to drill areas that have a high probability of hosting mineralization along the periphery or near existing drilling. They will employ a combination of near-surface and deep drilling.

The Management Team

Morgan Good – Chief Executive Officer and Director

Good is a venture capitalist with nearly 20 years of capital markets experience, focusing in areas of finance, M&A, corporate restructuring, business development and marketing. He has served on various boards across several sectors, and outside of Carlyle, is CEO and director of Alset Capital Inc. Good has been directly and indirectly responsible for raising in excess of $100 million over his career relating to many private and publicly-traded companies.

Jeremy Hanson VP of Exploration, Director

Hanson holds a B.Sc. Hons with distinction from Simon Fraser University and has over 10 years experience as a professional geoscientist in mineral exploration throughout Canada. He is the founder of Hardline Exploration Corp, a geological consulting firm focused out of Western Canada. Hanson also serves as a Director and VP Exploration for Garibaldi Resources Corp. where he found and was responsible for their Nickel Mountain discovery in the golden triangle. Hanson is also Technical Advisor for Nickel Rock Resources Inc., as well as a director of the Smithers Exploration Group.

Leighton Bocking – Director

Bocking has over 18 years of capital markets experience and has been focused on financing and structuring companies. He has held various corporate development roles at Gold Standard Ventures Corp. and Timmins Gold Corp. He has served as a director for a number of Canadian publicly-traded companies.

Inar Kamaletdinov – Chief Financial Officer

Mr. Kamaletdinov holds a BBA Accounting from Simon Fraser University’s Beede School of Business and obtained his CPA designation articling with Ernst & Young Canada managing assurance engagements for publicly traded companies in the natural resource, technology, and manufacturing industries. He has over 9 years of experience in financial reporting under International Financial Reporting Standard, providing financial reporting for Canadian junior mining companies, as well as for a publicly-traded asset management solutions organization.

The Risks

From our view the following risks are worth considering.

- Price of Gold and Silver. Just as the gold price can be a catalyst, a potential decline in price would have a negative impact on gold exploration stocks and other precious metals. We are of the mindset that if gold remains above $1800, there will likely be an influx of capital coming into the juniors. However, if it drops below, explorers could likely struggle.

- Drill Results. Poor drill results could negatively affect price performance of the stock.

- Jurisdictional Risk. While British Columbia is a highly regarded mining friendly jurisdiction, the Province and local indigenous communities are environmentally sensitive and have the potential to block mining projects due to environmental concerns.

- Market Sentiment. Markets can fluctuate wildly as investor expectations can change rapidly depending on the two most common drivers; fear and greed.

The Potential Catalysts

Some of the potential catalysts we see that could have a large impact on the share price include:

- The price of gold and silver. The most obvious variable for any gold explorer, developer, or producer is the price of gold. As the price of gold rises so does the net asset value of projects rise, which increases shareholder value.

- The results of any future Newton Gold Project drill programs. Carlyle will continue exploring and drilling the massive Newton property with the objective of expanding the resource at depth and getting a better understanding of the underlying geology. Any meaningful discovery or confirmation of more promising gold mineralization could serve as an upside catalyst for the common shares.

- Potential future Merger and Acquisition activity. The Deep Dive believes we are in the early stages of a secular bull market for gold, which has seen the early stages of M&A activity. Due to Carlyle’s continuing efforts increase the resource estimate for the Newton project, any meaningful additional discoveries on the property could potentially present an opportunity for a take out or joint-venture by a larger entity looking to expand into the area.

- Valuation. Carlyle currently has a very small market capitalization which appears to be undervalued when compared to Artemis Gold’s Blackwater Gold Project that is expected to enter production in 2024. Newton and Blackwater share similar geology and metal grades. Newton is at the stage that Blackwater was several years ago, and if Carlyle can advance the project’s resources significantly to justify a Preliminary Economic Assessment (PEA) of the project, it would be reasonable that at some point the success could be reflected in the market capitalization.

In Conclusion

Carlyle Commodities Corp currently has a unique opportunity to develop a project that has strong similarities to one of the largest in-development projects in Canada. While that project, the Blackwater project, is several years ahead in terms of development, it provides investors a glimpse of the potential of the Newton project, should the company be able to expand the current resource of the property to something similar in size.

The Newton property is massive and recent drilling supports management’s view that the felsic units hosting the mineralized gold zones are open at depth. Undoubtedly, much work still needs to be done to advance the Newton Gold Project to the same level as the Blackwater Gold Project. However, if the firm were able to expand the current resource significantly and put the project through a preliminary economic assessment, it could quickly become a potential takeover target, given the proximity of Blackwater.

FULL DISCLOSURE: Carlyle Commodities is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Carlyle Commodities on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.