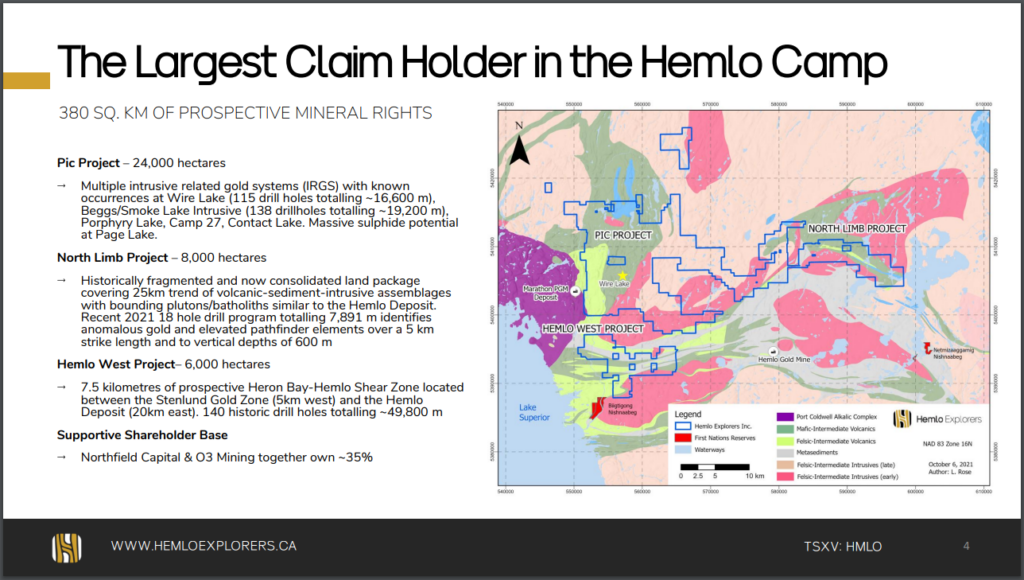

Hemlo Explorers Inc. (CSE: HMLO) is a junior resource exploration and development company with a number of mineral properties located in Canada. The company’s primary focus is in the Hemlo-Schreiber Greenstone Belt in the Hemlo, Ontario gold camp where it has assembled a large 380 square kilometre land package of prospective mineral rights, making it the largest claimholder in the area.

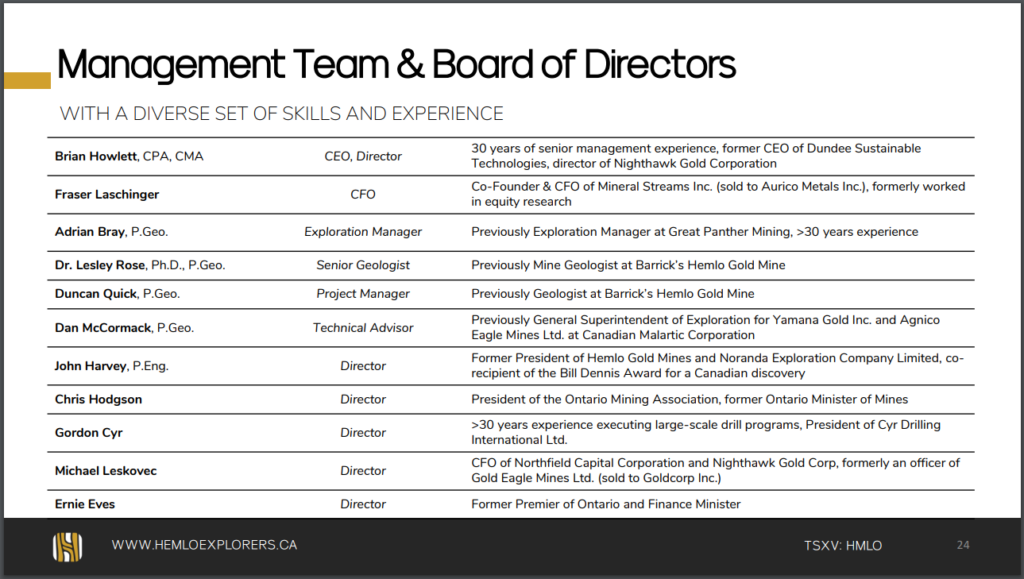

The company is headed by a diverse management team with years of extensive experience in mineral exploration, geology, and finance, particularly in the Hemlo area, with several members of the team having worked at the Hemlo Mine.

The Investment Thesis

We base our investment thesis on the following factors:

- HMLO identified sulfide targets on the Pic Project, approximately 3 kms east of Generation Mining’s Marathon deposit, whom secured a $240 Million streaming agreement with Wheaton Precious Metals

- HMLO’s Pic Project being adjacent to GENM’s Marathon deposit could potentially garner acquisition or joint-venture attention from other companies looking to participate in the Hemlo area.

- The Williams Mine in the Hemlo area has produced more than 21 million ounces of gold over its 30 years of operation.

- The Hemlo area has very well established infrastructure.to support exploration and mining.

- The company has entered into a binding term sheet with Barrick Gold related to the Pic Project, demonstrating the potential of the property.

The Deep Dive views Hemlo Explorers Inc. as an early-stage exploration company with upside potential and relatively modest risk. The Hemlo area is a prolific high-grade gold producer. With drilling planned to further investigate the newly discovered sulfides that are only 3 kms from Generation’s Marathon deposit, HMLO will continue to explore the property to further delineate the size and scope of the Pic Project.

The Regional Background

Gold was discovered at Hemlo in the mid-1980’s and led to the formation of the Golden Giant Mine which produced 6 million ounces from 1985 to 2005. Barrick Gold’s (TSX:ABX) Williams Mine at Hemlo has produced more than 23 million ounces of gold during its 30 years of continuous operation. Located about 350 kilometres east of Thunder Bay, Ontario, it consists of an underground and open pit operation. The mine has 3.3 million ounces of measured and indicated gold resources which includes proven and probable gold reserves of 1.5 million ounces, and inferred gold resources of 900,000 ounces.

A potentially significant development of the potential of the region occurred on December 22, 2021, when Generation Mining announced that it entered into a definitive precious metal purchase agreement (PMPA) with Wheaton Precious Metals Corp. (TSX: WPM) for production from its Marathon palladium copper project. Wheaton will pay $240 million to Generation Mining in upfront cash, $40 million which will be paid on an early deposit basis for development of the Marathon Project prior to construction. The balance will be payable in four staged installments during construction. The Marathon PMPA is subject to the closing of Generation Mining’s acquisition of the remaining 16.5% interest in the Marathon Project from Sibanye Stillwater Limited.

The Generation Mining streaming deal could have a significant impact on HMLO as it could likely draw renewed attention to the Hemlo area and Hemlo Explorers Pic Project in particular due to its proximity to GENM’s property.

The Projects

Hemlo Explorers has three main projects;

- The Pic Project – 24,000 hectares – multiple intrusive related gold systems

- North Limb Project – 8,000 hectares – covers a 25 km trend of volcanic-sediment-intrusive assemblages similar to the Hemlo Deposit.

- Hemlo West Project – 6,000 hectares – 7.5 kms of prospective Heron Bay-Hemlo Shear Zone located 20 kms west of the Hemlo Deposit.

The Pic Project

Hemlo Explorers’ flagship property is its 24,000 hectare Pic Project, which is located adjacent to Generation Mining’s (TSX:GENM) Marathon palladium-copper proposed open pit operation and consists of multiple intrusive related gold systems. Results from a previous drill hole had identified sulfide mineralization closely resembling surface gabbro intrusions that are similar to the intrusions on Generation Mining’s property, which prompted further exploration of the target area.

On December 9, 2021, Hemlo announced that it identified sulfide targets on the Pic Project, approximately 3 kilometres east of Generation Mining’s Marathon Palladium-Copper proposed open pit operation. HMLO’s targeting strategy is based on the magma conduit deposit model which explains sulfide mineralization and other contributing economics factors at the Marathon deposit.

The Pic Project also has a number of other previously identified intrusive related gold systems with known occurrences, including:

- Wire Lake – 115 drill holes totalling 16,600 metres

- Beggs/Smoke Lake – 138 drill holes totalling 19,200 metres

- Page Lake – massive sulfide potential

- Porphyry Lake

- Camp 27, Contact Lake

Hemlo is currently preparing to implement its 2022 exploration strategy for the Beggs/Smoke Lake and Page Lake targets. The company will use the winter to digitally capture, analyze and interpret all the existing data on the properties, as well as conducting a summer road access scoping study for Beggs/Smoke Lake. The team is planning summer programs at the two properties to prospect, map and sample the anomalous gold areas within intrusive boundaries, seeking evidence of faults and shears, dykes, veining, and mineralization. Hemlo is also considering whether it will conduct an airborne VTEM survey at Page Lake to identify areas of conductivity and resistivity for sulfide and gold sulfide deposits.

Perhaps the most significant aspect of the Pic Project however, is the interest from major producer Barrick Gold (TSX: ABX). In April, the duo announced a binding term sheet that if executed would see the producer obtain an earn-in right for a portion of the project. Under the terms of the arrangement, the company can earn up to an 80% stake in 910 claims by conducting a pre-feasibility study within the next six years.

The earn-in right is subject to the company spending $0.8 million on the property in the first year, and having at least $1.0 million in expenditures on each anniversary of the definitive agreement thereafter. The arrangement can be extended by up to two years with a $0.5 million payment to Hemlo for each year extended.

“Hemlo Explorers has moved its Pic Project to a point where it was ready to option to a major. We believe that we have the best possible partner to complete this program. We are excited to work with Barrick in bringing this project forward,” commented CEO Brian Howlett at the time.

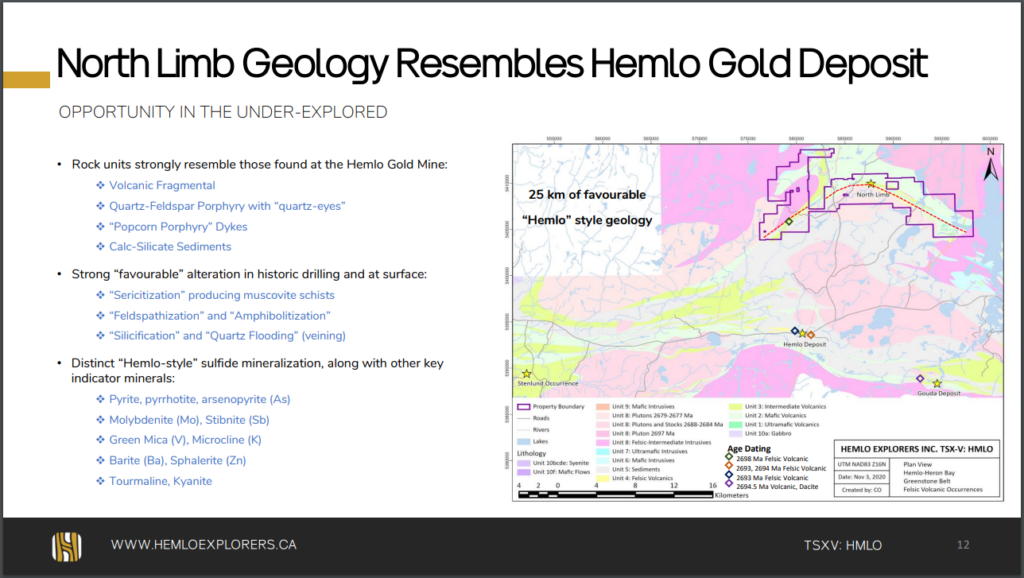

North Limb Project

The North Limb Project consists of 8,000 hectares of historically fragmented claims that has now been consolidated into a contiguous land package covering a 25 km trend of volcanic-sediment-intrusive assemblages whose geology resembles the Hemlo Deposit.

A 2021 18-hole, 7,891 metre drill program identified anomalous gold and elevated pathfinder elements over a 5 km strike length to a depth of 600 metres. The company is encouraged by the identification of distinct “Hemlo-style” sulfide mineralization, as well as other key indicator minerals.

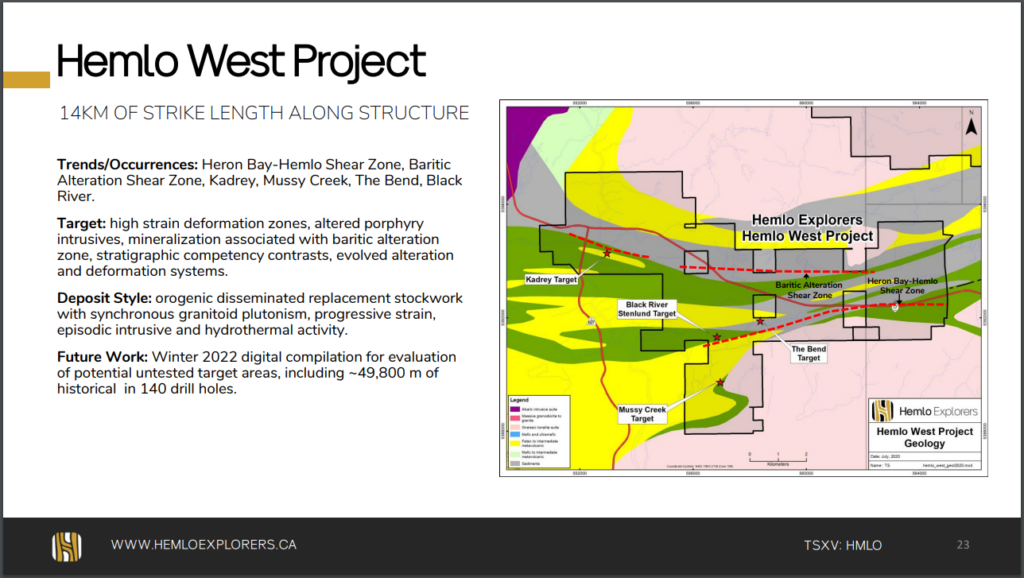

Hemlo West Project

The 6,000 hectare Hemlo West Project has 7.5 kms of prospective Heron Bay-Hemlo Shear Zone located between the Stenlund Gold Zone 5 kms to the west, and the Hemlo Deposit 20 kms to the east. What makes this property compelling is a 14 km strike length, and there is existing data from 140 historic drill holes totalling 49,800 metres.

HMLO will use the winter of 2022 to digitally compile all the existing data on the property and evaluate potential untested drill targets. There have previously identified potential deposit style structures containing high strain deformation zones, altered porphyry Intrusives and other indicators on the Heron Bay Hemlo Shear Zone, Baritic Alteration Shear Zone, Kadrey, Mussy Creek, The Bend, and the Black River targets that will warrant closer examination in future exploration programs.

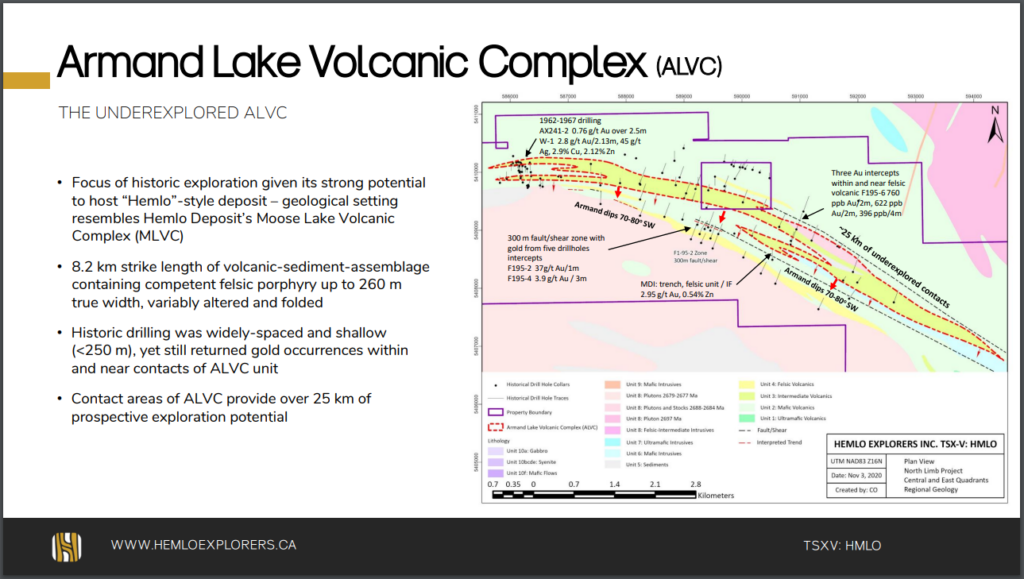

Armand Lake Volcanic Complex (ALVC)

Hemlo’s asset portfolio also contains the largely unexplored Armand Lake Volcanic Complex, a property containing 25 kms of prospective exploration potential, which did have some past exploration due to its geological setting being similar to the Hemlo Deposit’s Moose Lake Volcanic Complex, giving it the potential to host a Hemlo-style deposit. Previous data from a widely-spaced and shallow drill program shows a 8.2 km strike length of volcanic-sediment-assemblage containing competent felsic porphyry up to a 260 metre true width that returned enough gold occurrences to warrant more exploration.

The Management Team

Brian Howlett, CMA- CEO, President and Director

Mr. Howlett holds a B.Commerce in Finance from Concordia University and has served in a number of senior executive positions during his 30-year business career He is the former President and Chief Executive Officer of Dundee Sustainable Technologies Inc and remains on the Board.

Howlett also previously served as the President and Chief Financial Officer of Superior Copper Corporation after 12 years at ELI Eco Logic Inc., which included 6 years as Chief Financial Officer. Mr. Howlett currently serves as a Director of Nighthawk Gold Corp.

John D. Harvey – Interim Chairman

Mr. Harvey holds a Bachelor of Science degree in Geology from the University of New Brunswick. He He has served as President and Chief Executive Officer of Hemlo Gold Mines Inc. from 1989 to 1991, and he was also President of Noranda Exploration Company Limited from May 1982 to October 1994.

Mr. Harvey is currently a member of the Canadian Institute of Mining and Metallurgy and the Professional Engineers of Ontario, and serves as a consulting geologist for his firm, J.D. Harvey and Associates.

Fraser Laschinger – Chief Financial Officer

Mr. Laschinger holds an Honours in Business Administration from the Richard Ivey School of Business at the University of Western Ontario. Before joining Hemlo Explorers, he worked in equity research for a Canadian investment dealer and for a private resource company as Director of Corporate Development, where he oversaw corporate finance initiatives and led the due diligence on a number of potential acquisitions.

Mr. Laschinger was a co-founder of Mineral Streams Inc., a private mineral royalty company which he sold before joining Hemlo explorers in 2011 and was subsequently appointed Chief Financial Officer in 2013.

Adrian Bray, P.GEO., QMC, PMC – Exploration Manager

Mr. Bray holds a B.Sc.H. from Acadia University as well as Quality Management and Project Management certifications from the University of Saskatchewan and the UBC Sauder School of Business.

He has served as a Senior Executive and Director for several junior exploration companies, and over his 30 years in the exploration field, has worked for a number of major and junior companies on projects from grassroots and advanced mineral exploration to mining projects in Canada and internationally. Mr. Bray is a Member of the Association of Professional Engineers and Geoscientists of British Columbia.

Dr. Lesley Rose, M.SC., PH.D., P.GEO. – Senior Geologist

Dr. Rose has spent over 10 years working on a variety of projects focused on gold exploration in northwestern Ontario, including a role as a Mine Geologist at Barrick Gold Corporation’s Hemlo Gold Mine.

Before that she was Chief Geoscientist at Fladgate Exploration Consulting Corporation and ICP-MS Supervisor at Activation Laboratories in Thunder Bay. She has been involved in academia as a Postdoctoral Research Scientist at the Bavarian Research Institute of Experimental Geochemistry and Geophysics at the University of Bayreuth, Germany, as well as teaching university geology courses and publishing peer-reviewed journal articles on her research.

The Comparables

The prolific Barrick Gold Hemlo Mine has produced over 23 million ounces of gold over the past 30 years. Despite the highly prospective nature of the underlying geology of the Hemlo-Schreiber Greenstone Belt, we have only identified few other juniors currently exploring in the Hemlo area, aside from Hemlo.

Ready Set Gold Corp. (CSE: RDY) owns an interest in two separate claim blocks totaling 4,453 hectares called the Hemlo Eastern Flanks Project, which is located 7 kms southeast of Barrick Gold Corp’s Hemlo Mine. The company is also developing its Northshore Gold Project in the Schreiber-Hemlo Greenstone Belt, located 70 kms west of the Hemlo Mine.

MetalCorp Ltd. (TSXV: MTC) is developing its 100% owned 5,719 hectare Hemlo East property, which is located immediately east along the regional structural-stratigraphic trend of the Barrick Hemlo gold mine. The company recently announced that Barrick Gold declared force majeure on its option agreement to acquire up to an 80% interest in the Hemlo East property due to claims to the project lands by First Nations in the area, making it unable for Barrick to meet its obligations to MetalCorp under the option agreement in a timely fashion.

Trojan Gold inc. is a private junior exploration company that has acquired a 50% working interest in the 4,428 acre Hemlo South property from Tashota Resources Inc. Trojan is in the process of seeking a listing on the Canadian Stock Exchange.

The Risks

From our view the following potential risks are worth considering.

- Price of Gold. Just as the gold price can be a catalyst, a potential decline in price would have a negative impact on gold exploration stocks and other precious metals. We are of the mindset that if gold remains above $1800, there will likely be an influx of capital coming into the juniors. However, if it drops below, explorers could struggle.

- Jurisdictional Risk. While Ontario is a highly regarded mining friendly jurisdiction, any potential environmentally sensitive issues could prevent its projects from progressing. While the probability is very low, it cannot be completely discounted.

- Market Sentiment. Markets can fluctuate wildly as investor expectations can change rapidly depending on the two most common drivers; fear and greed.

The Catalysts

Some of the potential catalysts we see that could have a large impact on the share price include:

- The price of gold. The most obvious variable for any gold explorer, developer, or producer is the price of gold. As the price of gold rises so does the net asset value of projects, which increases shareholder value.

- Broad economic indicators. Given the current macroeconomic environment which is plagued by inflation, the theory goes that gold will be viewed as a safe haven for investors as a store of value.

- The results of any future drill programs. HMLO will be actively exploring their Pic Project property to better define the sulfide zones on the property next to Generation Mining’s Marathon Project, add to the database and potentially work towards an eventual resource calculation. Any meaningful discovery or confirmation of more promising mineralization could serve as an upside catalyst for the common shares.

- Close-ology. Hemlo’s properties are located near the prolific Hemlo Gold Mine and it is prudent for exploration companies to search for new deposits in close proximity to existing mines. The recently announced $240 million stream deal between GENM and WPM now signifies that HMLO could be next door to another mine.

- Potential future Merger and Acquisition activity. Any meaningful discovery on its property could lead to an opportunity for a take out or joint-venture by a larger entity looking to expand into the area.

In Conclusion

Hemlo Explorers Inc. is primarily focused in the Hemlo-Schreiber Greenstone Belt in the Hemlo, Ontario gold camp where it has assembled a large land package of prospective mineral rights, making it the largest claimholder in the area. The company’s management team has years of extensive experience in mineral exploration, geology, and finance, and their technical team is particularly familiar with the Hemlo area, with several members having worked at the Hemlo Gold Mine.

Hemlo Explorers Inc. appears to offer a reasonably low-to-moderate risk play in the prolific Hemlo District. The company will be building upon very encouraging sulfide mineralization findings that closely resemble the mineralization found at Generation Mining’s Marathon palladium-copper proposed open pit operation only 3 kms away. The recent $240 Million stream deal between GENM and WPM could potentially draw renewed mining industry attention to the Hemlo area, particularly due to the company’s massive land position, and the binding term sheet in place with Barrick suggests further opportunity may exist for the company and region as a whole.

FULL DISCLOSURE: Hemlo Explorers is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Hemlo Explorers on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.