In response to a struggling economy amid the coronavirus pandemic, the Bank of America has decided to defer a total of $7.7 billion in loans for its commercial clients.

As of July 23, nearly 2% of the bank’s commercial clients have had their loans modified in some way, such as payment deferrals for durations up to 90 days or waivers on loan covenants. In the meantime, Bank of America’s consumer and small-business division had to defer a total of $28.5 billion in loans, with over of 1.4 million consumers requesting a delay on their credit card payments. Of those that were granted deferrals, approximately 61% have so far made some form of payment, while another 33% have been making timely payments each month.

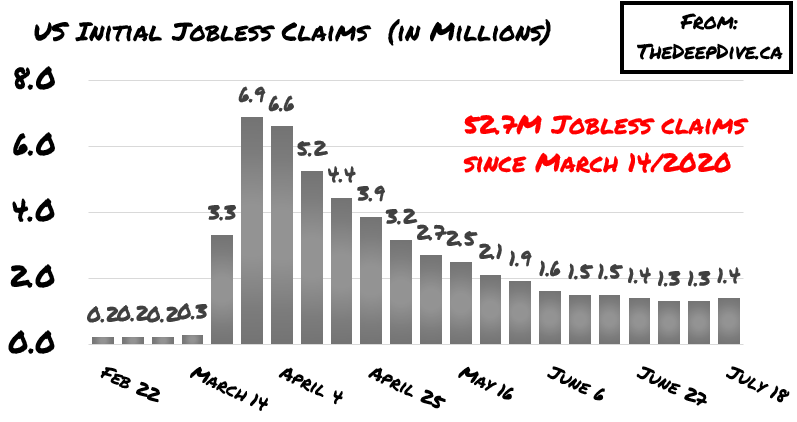

The Bank of America anticipates the current economic uncertainty to continue for the time being, as coronavirus cases continue to mount and initial job claims fail to show signs of a significant improvement. As a result, the negative macroeconomic environment will most likely contribute to a deterioration of the bank’s businesses.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.