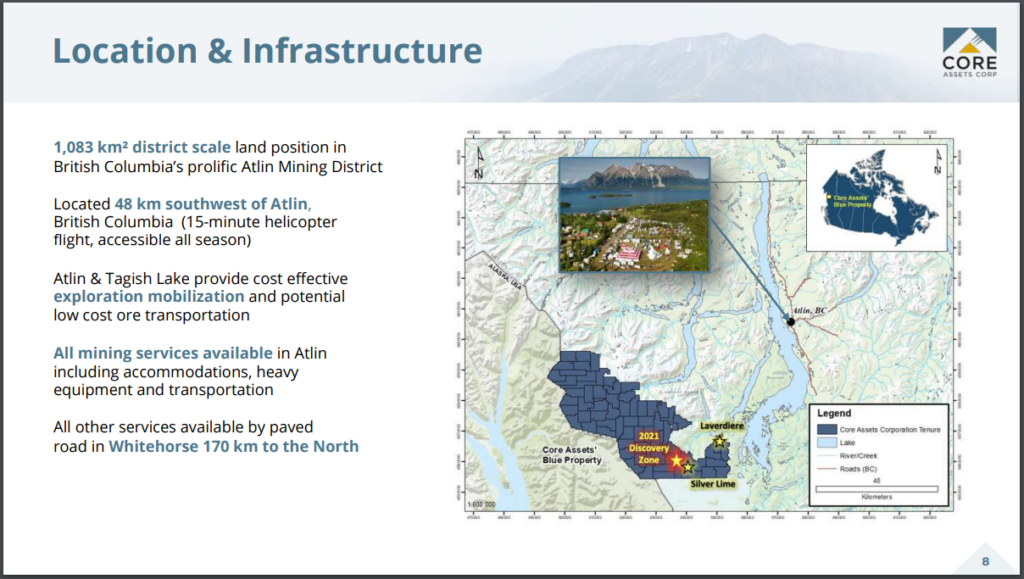

Core Assets Corp. (CSE: CC) is a Vancouver-based junior mineral exploration company focused on exploring and developing its CRD Porphyry polymetallic copper project in the Atlin Mining District in Northwestern British Columbia. Referred to as the Blue Property, the project comprises a 1,083 km² district scale land position within the last unexplored area of the prolific Stikine Terrane, with Core Assets essentially owning the whole district. The Atlin gold camp was established during the Klondike Gold Rush and produced in excess of 600,000 ounces of gold between 1898 and 1945, making it British Columbia’s second largest gold producing region.

The Blue Property is located 48 km southwest of Atlin, and the area has an excellent road and power infrastructure, readily available mining support services, and equipment can be transported to the property during the winter months over the nearby Atlin and Tagish Lakes once they freeze over. The Blue Property contains one of the world’s largest and highest grade documented surface expressions of mineralization of any known early stage CRD project, with indications of a large porphyry feeder stock nearby that hosts the requisite geological elements to produce a world class CRD-porphyry skarn deposit. The sheer size of the Blue Property provides the opportunity for many potential discoveries.

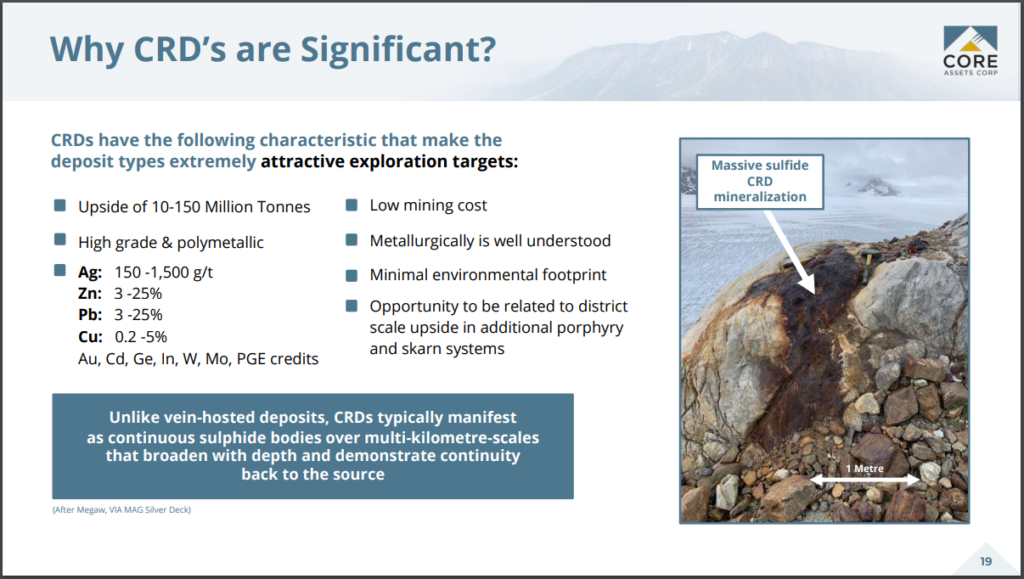

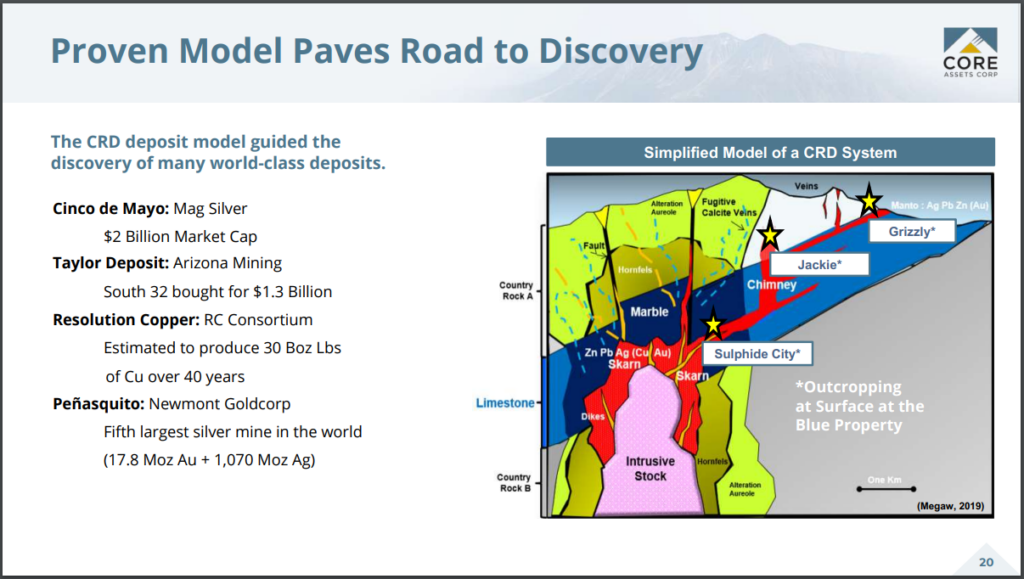

Carbonate replacement deposits (CRDs) are carbonate-hosted polymetallic deposits that were formed at very high temperatures, replacing sedimentary carbonate rocks. When the molten metallic solutions cooled, they formed into vertically-oriented polymetallic igneous intrusions, which Core Assets refers to as “Chimneys” and Mantos, which are horizontal structures that were formed around the rock like a blanket. The Blue Property contains numerous chimneys intersected by mantos.

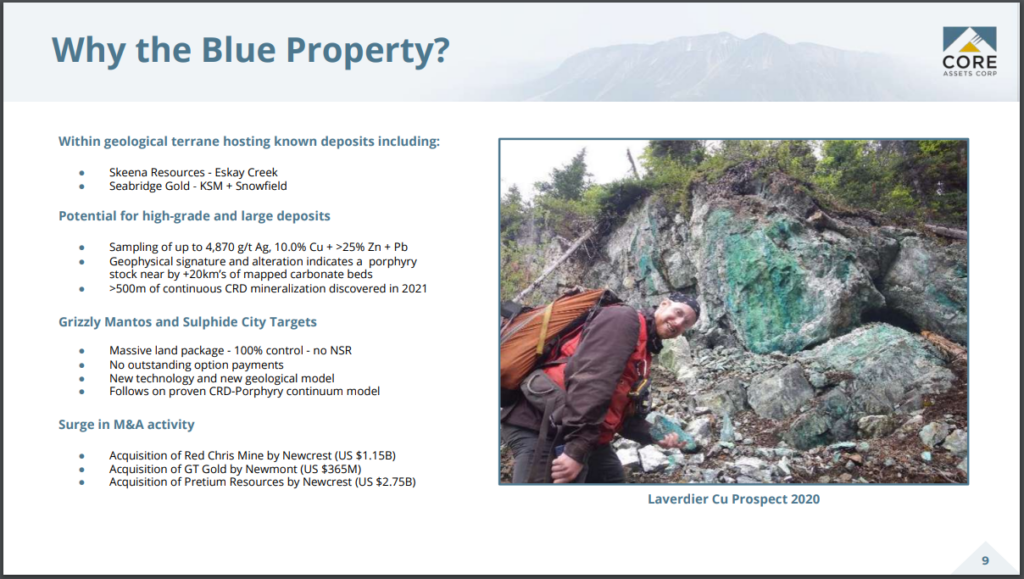

Core Assets targeted the Atlin region because it is a continuation of the same geological terrane that is host to several major deposits within the better known “Golden Triangle” region of BC just south of Atlin. Skeena Resources Ltd. (TSX: SKE) is working towards putting the Eskay Creek open-pit mine back into production. It has proven and probable reserves of 3.9 million ounces of gold at a grade of 4.57 g/t AU/Eq. Seabridge Gold Inc. (TSX: SEA) meanwhile is developing its KSM deposit, which is the world’s largest undeveloped gold project, with proven and probable reserves of 47.3 million ounces of gold and 19.4 billion pounds of permitted, measured and indicated copper resources.

Another exploration company that is very similar to Core Assets is Western Alaska Minerals Corp. (TSXV: WAM), which is developing its Waterpump Creek lead-zinc-silver CRD deposit located in southeastern Alaska near the BC/Yukon border and appears to be hosted by the same underlying geology as Core Assets’ Blue Property CRD project. It has a historical non-43-101 resources estimate of 166,000 tons at 9.5 o/t silver, 16.1% lead, and 5.5% zinc. WAM will compile an updated resource estimate once it completes its current drilling programs.

CRD deposits tend to occur near the Earth’s surface and can be massive in size, with sulfide bodies often extending for many kilometres, and can open up at depth. The metallurgy is well understood, and they can be cost-effective and easy to mine as open-pits with a lesser environmental impact than underground mines. Some CRD deposits can be found near or interspersed with additional porphyry and skarn systems. The Blue Property has over 20 kms of mapped carbonate beds, including the 2021 discovery of over 500 metres of continuous CRD mineralization. The geophysical signature and alteration is indicative of a porphyry stock in the vicinity. Extensive sampling on the property returned values of up to 4,870 g/t silver, 10.0% copper and over 25% lead and zinc.

The Blue Property has identified a number of key mineralized zones that the company is focusing on that are effectively projects within the overall project. On August 12, 2022, Core Assets announced very encouraging drill results from the Sulphide City target within the Silver Lime zone, intersecting multiple chimney-style CRD feeders. This includes intersecting a molybdenum-copper-bearing porphyry that the firm believes could be the source feeding the more than 250 high-grade CRD occurrences that have been observed at surface throughout the Silver Lime porphyry CRD deposit. To date, the company has intersected significant CRD mineralization in every drill hole that has been completed.

Core Assets CEO Nick Rodway commented, “The second hole ever drilled at the Sulphide City target is what we consider to be a potential company maker — SLM22-006 intersected extensive copper-molybdenum-zinc-mineralized intercepts of altered porphyry and endoskarn, and semi-massive to massive zinc-copper-lead/silver contact skarn and carbonate replacement mineralization. We have now tapped into the Silver Lime porphyry CRD system at both the Sulphide City and Jackie targets, located 2.4 kilometres apart. Multiple skarn and/or carbonate replacement occurrences have been intersected in every drill hole completed at the Silver Lime project to date. Tapping into a well-mineralized porphyry source at Sulphide City with CRM mapped for 6.6 kilometres at surface indicates that this system is large with room to grow and is comparable to other district-scale porphyry CRD systems globally.“

The CRD exploration model has led to the discovery of some of the world’s largest deposits. The Peñasquito Mine in Mexico, which is owned by Newmont, is the world’s 5th largest silver mine, with reserves of 17.8 million ounces of gold and 1.07 billion ounces of silver. The Resolution Copper Project in Arizona, which is co-owned by Rio Tinto and BHP, is considered to be one of the largest untapped copper deposits, with estimated reserves of 1.787 billion metric tonnes at an average grade of 1.5% copper. The deposit sits 6800 metres below the earth’s surface and is projected to produce 30 billion pounds of copper over a 40 year period.

Core Assets appears to represent an opportunity for junior exploration investors, with large sized CRD deposits potentially leading to strong valuations and the potential for lucrative acquisitions. The polymetallic Taylor CRD deposit in Arizona, which has an estimated mineral resource of 138 million tonnes averaging 3.82% zinc, 4.25% lead and 81 g/t silver, was acquired in 2018 by Australian miner, South 32, from Arizona Mining for $1.3 billion, a premium of 50% over the price of Arizona Mining’s share price. If Core Assets can build upon the early indications of the size and scope of its Blue Property into one of the world’s largest CRD deposits, one can only guess what kind of valuation it may fetch as a potential acquisition. It will likely take the next three years of exploration just to delineate the size of the deposit.

FULL DISCLOSURE: Core Assets Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Core Assets Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.