Despite the agreement between OPEC and affiliates to cut oil production to record levels, oil prices still dropped to $20 per barrel, due to the inescapable drastic decline in global demand for fossil fuels. Given the grim outlook on mitigation efforts in containing the deadly coronavirus, there still could be more damage on the way for the oil industry.

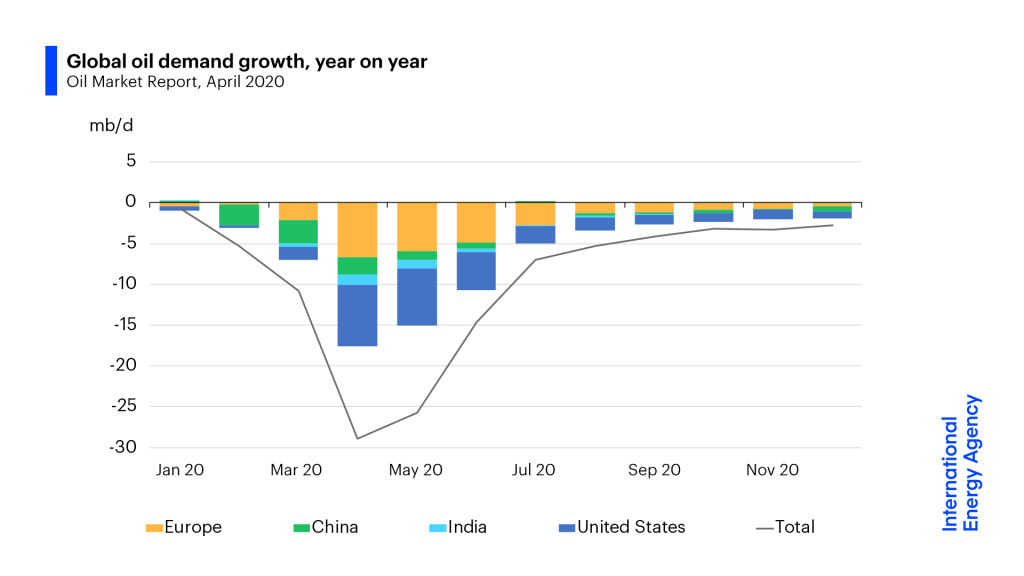

As a result of the OPEC+ agreement, there will be a reduction of 10 million barrels per day (b/d) , but that is still not enough to get the oil industry output back to equilibrium. According to the International Energy Agency (IEA), which is an organization that creates sustainable policies within the OECD framework, is forecasting oil demand to drop by 29 million b/d for the month of April. However, optimism shouldn’t be welcomed just yet: in its April Oil Market Report, the IEA is forecasting that, “even assuming that travel restrictions are eased in the second half of the year, we expect that global oil demand in 2020 will fall by 9.3 million barrels a day (mb/d) versus 2019, erasing almost a decade of growth.”

Given the slow recovery for the oil market, the IEA is forecasting a slow, V-shaped improvement, but figures will still remain in the negatives. Even if the market begins to make a rebound, oil prices are not going to increase in the near term. Currently, oil prices have been drastically low, with West Texas Intermediate around $19 per barrel, and Western Canada Select below $5 per barrel – which would suggest there may be more supply cuts looming on the horizon, whether government-mandated or not.

With such low oil prices and lack of demand, there are going to be heavily indebted oil companies ceasing production entirely. According to the IEA, if West Texas Intermediate continues at $20 per barrel, a lot of companies will be operating at a loss with oil supply at 2.2 million b/d.

West Texas Intermediate last traded at $18.55 per barrel.

Information for this briefing was found via OilPrice and IEA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Down goes Alberta!