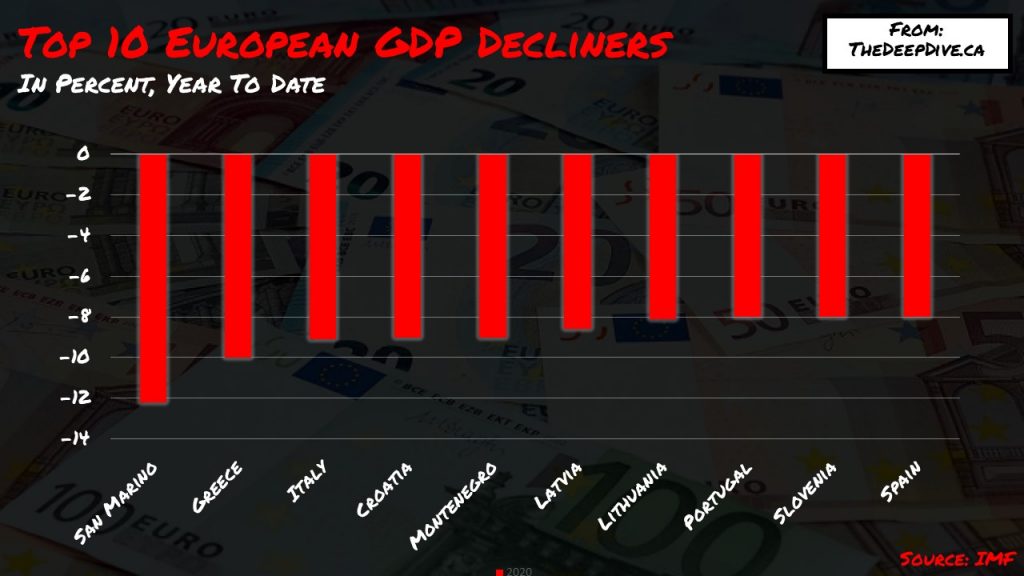

During the height of the coronavirus pandemic in Europe, all 19 countries of the euro-area suffered the largest economic contraction in history. The eurozone economy declined by 12.1%, while GDP in the EU economy fell by 11.9%.

Since records first began being compiling in 1995 at the region’s Eurostat statistics office, the second quarter of 2020 data is by far the most alarming ever compiled. The European Union’s largest economy, Germany, suffered a contraction of 10.1% in the second quarter, which is a stark comparison to a decline of 5.7% following the 2009 financial crisis. Spain, which was hit the hardest, suffered a GDP drop of 18.5%, followed by Portugal’s economy, which recorded a contraction of 14.1%.

France in the meantime, suffered its largest economic collapse in history due to the pandemic. The country’s GDP fell by 13.8% according to data released by its national statistics agency. The cost of the coronavirus lockdowns caused a further blow to an already-deteriorating economic situation which became evident back in 2019. France’s economy was already shrinking in the fourth quarter of last year, but once the full force of the deadly coronavirus pandemic emerged, the downward spiral was too strong to prop up.

One of France’s main economic contributors, domestic consumption, fell even further after the first quarter as many individuals who were reliant on government funding had no choice but to further reduce their spending. This caused household consumption to fall by 11% in the second quarter, following a 6% decline between January and March. As a result, the French government has warned that the worst economic shock in the post-war era will soon erupt, while Villeroy de Galhau, who is the head of the Bank of France, foresees the country’s economy falling by 10% in 2020 with no return to pre-crisis levels until at least 2022.

Information for this briefing was found via Business Insider and RT News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.