The pace of major corporate bankruptcy filings in the United States has accelerated to levels not seen since the tail end of the Great Recession in 2009. This week alone has seen nine large companies initiate Chapter 11 restructuring cases, including firms from the telecommunications and pharmaceutical industries.

According to data compiled by Bloomberg, the current three-day period is tied for the busiest stretch for big corporate bankruptcies on record. If the filings continue at this rate through Saturday, it will surpass the peak seen in late April 2009 when 16 major companies went bankrupt as the country was emerging from the financial crisis.

Lots of bankruptcies (small and large) to start April – I keep hearing TV economists talk about economic recovery? Recovery from what? Apparently 6% GDP growth you all were parading around warrants usage of ‘recovery’.

— Don Johnson (@DonMiami3) April 2, 2024

The risks for the economy remain entrenched the longer… pic.twitter.com/lOiidLd2Yp

Experts point to rising interest rates and softening consumer spending as key drivers behind the surge in insolvencies across businesses of all sizes. Michael Hunter, a vice president at legal services firm Epiq, noted that total bankruptcy filings have been climbing steadily for nearly two years, reflecting the broader economic conditions.

It’s truly insane. The vitriol with every disinflationary data point is toxic. NINE big bankruptcies in THREE days. Some yahoo is bound to declare that’s inflationary too. https://t.co/YZ9YChTG1n

— Danielle DiMartino Booth (@DiMartinoBooth) April 4, 2024

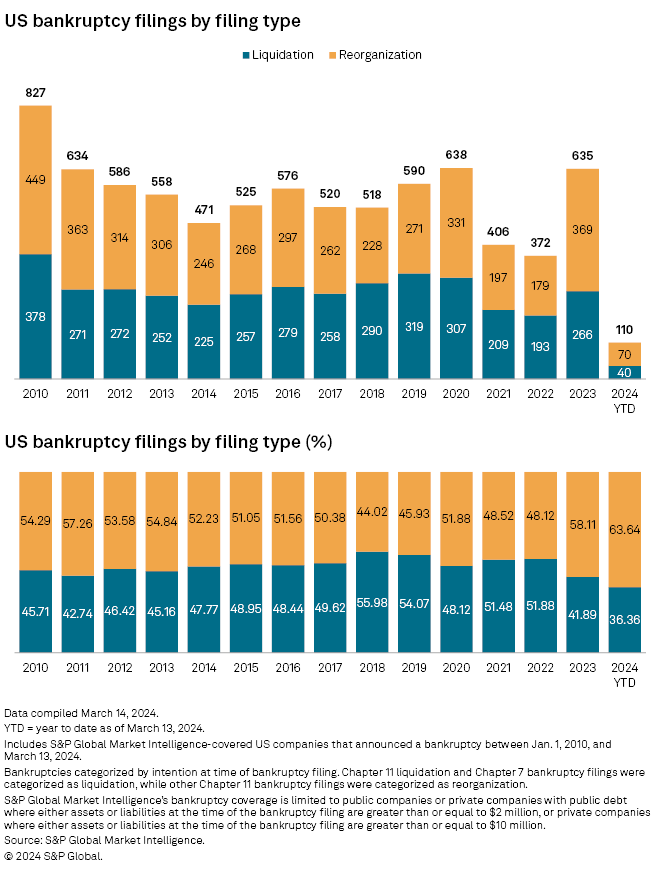

The first point, rising interest rates, is echoed by S&P Global, which noted that the increasing number of Chapter 11 bankruptcies may be due to interest payments as they “eat into companies’ profits and limit their ability to service their debt.”

Delaware has emerged as a hot spot for the recent wave of corporate restructurings, with five of the nine cases filed this week. The state’s incorporation-friendly laws have made it a hub for such proceedings. Notably, at least three of the companies negotiated deals with lenders before filing for bankruptcy, an increasingly common practice aimed at streamlining the restructuring process.

While the uptick in corporate bankruptcies may raise concerns about the overall health of the economy, some legal experts argue it does not necessarily signal a looming recession. Derek Abbott, a bankruptcy lawyer, pointed out that certain sectors like telecom, retail, and pharmaceuticals are facing unique challenges even as the broader US economy has managed to avoid a downturn so far.

S&P Global also notes an increase in the proportion of the filings for Chapter 11 or restructuring debt and finances with the goal of reemerging rather than Chapter 7 where companies face a total liquidation of assets and termination of operations.

Last year, 58.1% of all filings were Chapter 11 bankruptcies, and the trend appears to be carrying over to this year “with 63.6% of all filings as of March 14 seeking court approval to reorganize.”

Information for this story was found via Bloomberg, S&P Global Market Intelligence, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.