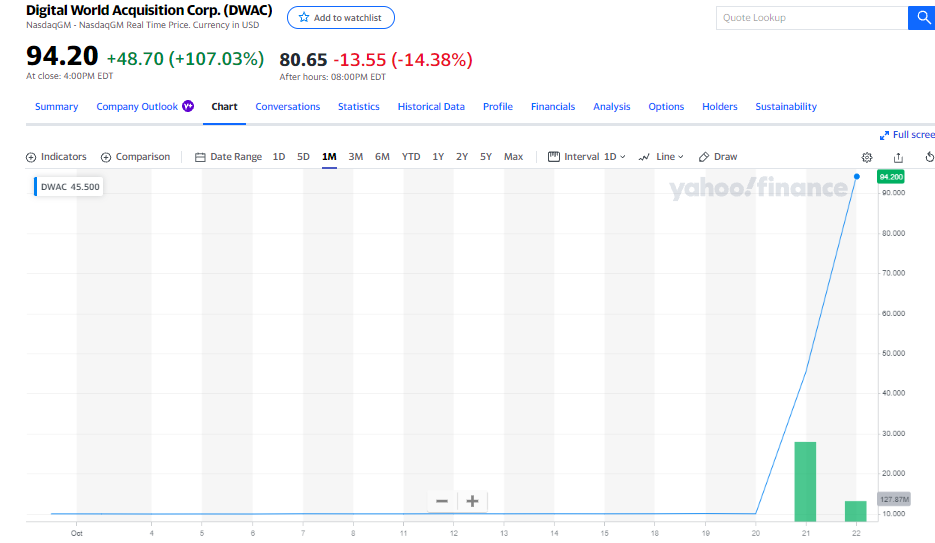

The President Trump SPAC, Digital World Acquisition Corp. (NASDAQ: DWAC), has been by far the best-performing stock in North America over the last couple of days. The SPAC soared by more than 840% over the two-day period, October 21-22, on titanic two-day volume of more than 625 million shares.

To put that in perspective, two of the most liquid securities in the world, the S&P 500 ETF (NYSE: SPY) and Apple Inc. (NASDAQ: AAPL), traded a combined 95 million and 120 million shares, respectively, over that period.

While it may be too late to invest in DWAC — the Trump social media platform has not even started operations, much less recorded one dollar of revenue, yet it may now be currently valued at up to 40% of the value of Twitter, Inc. (NYSE: TWTR) — three other possible Trump-related SPACs could be interesting speculations.

Several news organizations, including Bloomberg, report that the CEO of DWAC is Patrick Orlando, a former derivatives trader and heretofore a fairly obscure business executive and, maybe most interestingly, a man never before publicly linked to President Trump. Mr. Orlando is also the CEO of two other SPAC sponsors, Benessere Capital Acquisition Corp. (NASDAQ: BENE) and Yunhong International (NASDAQ: ZGYH). He is also listed as a director nominee at another SPAC sponsor, Maquia Capital Acquisition Corp. (NASDAQ: MAQC), which seeks to invest in growth targets in North America.

Benessere Capital raised US$100 million of capital in January 2021. According to its website, it does not appear to have yet invested any of that capital.

According to Yahoo Finance, Yunhong International raised US$60 million in 2020 and was set to invest it in a battery maker, but the deal fell through. Remarkably, Yunhong’s offices are in Wuhan, China, potentially the origin of COVID-19.

In September 2021, DWAC raised US$293 million from a group of hedge funds, many of them well known, including D.E. Shaw, Saba Capital Management, and Highbridge Capital Management. These funds will be used to initially build out the Trump media platform. The hedge funds said they did not know about the prospective Trump transaction until it was announced on October 20.

The debate is, with the overwhelming success of the Trump social media SPAC and Mr. Orlando’s DWAC providing the key source of cash in that transaction, whether President Trump might try to monetize his influence in another SPAC transaction. If he chooses to do so, that SPAC would likely rise too, at least initially. (Who would sell the stock in the first few days given DWAC’s massive run?)

Also, President Trump could choose to reward Mr. Orlando with another SPAC sponsorship. After all, Mr. Orlando facilitated the Trump social media transaction.

Digital World Acquisition Corp last traded on the NASDAQ at US$94.20.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.