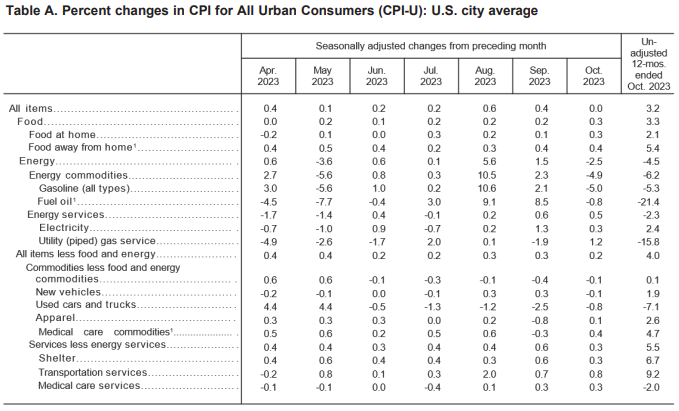

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U) remained unchanged in October on a seasonally adjusted basis, following a 0.4% increase in September. This stability comes amid a mix of rising shelter costs and declining energy prices, particularly in gasoline. Over the last year, the all items index saw a 3.2% increase before seasonal adjustment.

The overall energy index fell by 2.5% in October, while the food index saw a modest increase of 0.3%, slightly higher than September’s 0.2% rise. The food at home index also increased by 0.3%.

Excluding food and energy, the index rose by 0.2% in October, a slight decrease from September’s 0.3%. Significant contributors to this rise included rent, owners’ equivalent rent, and motor vehicle insurance, among others. In contrast, lodging away from home, used cars and trucks, communication, and airline fares saw decreases.

The 12-month period ending in October witnessed a 3.2% rise in the all items index, a deceleration compared to the 3.7% increase in the period ending September. The energy index decreased by 4.5% over the same period, with notable declines in gasoline, natural gas, and fuel oil indexes. Conversely, the food index experienced a 3.3% rise.

The report highlights the ongoing challenges in managing inflation, with the Federal Reserve maintaining a keen focus on achieving a 2% inflation rate over the long term.

Information for this story was found via the Bureau of Labor Statistics. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.