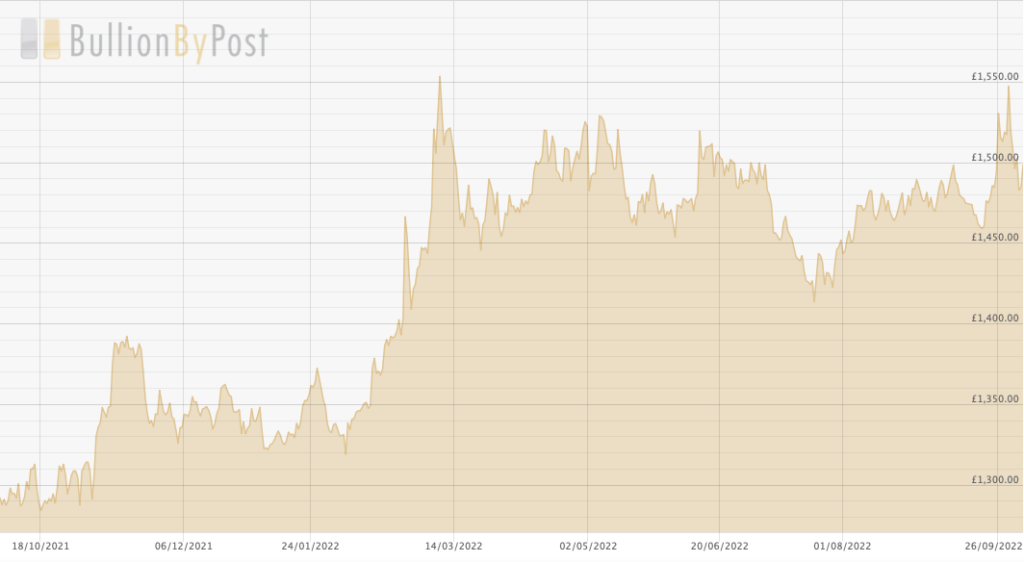

As the UK currency continued to hit all-time low records, investors turned to the apparent safety of gold as a hedge against currency debasement.

The pound was in a free fall following UK Chancellor Kwasi Kwarteng’s fiscal plan consisting of tax cuts and spending measures, exacerbated by the Bank of England refraining from raising interest rates from the current 2.25%.

Meanwhile, gold prices in UK currency have been on the rise recently, which would normally deter buyers. But British investors see the asset as more attractive, generating higher demand for gold.

“We’re seeing a lot of new UK interest,” said Adrian Ash, head of research at UK-based brokerage BullionVault. “The interest rate and inflation crisis is global, but gold is saying that the UK has put itself right in the eye of the storm.”

The firm noted that British consumers established accounts to purchase bullion at a rate that was more than double the customary this week.

The surge in demand is causing bullion traders to run out.

“Buying has increased exponentially,” stated Ash Kundra, owner of coin shop J Blundell & Sons in the Hatton Garden jewelry district. “I keep running out of coins, I keep running out of bars.”

The gold bugs in Britain won’t likely have much of an impact on world prices though. According to the World Gold Council, UK consumers purchased 15.5 tons of bars and coins last year, or slightly over 1% of the global total.

Even before the government released its newest fiscal policy, more Britons were borrowing against their gold due to concerns over rising energy prices, food inflation, and mortgage rates.

“We anticipate we will continue to see an upward trend in people using gold as loan collateral in the coming months whilst this period of extreme uncertainty exists,” said Jim Tannahill, managing director of London-based pawnbroker, Suttons and Robertsons.

He added that customers who wanted to borrow money against their gold holdings increased by 40% during the previous few weeks.

In a seemingly frail attempt to recover from the market blowback regarding the British government’s biggest tax cuts since 1972, UK Prime Minister Liz Truss walked back on the plan saying “the abolition of the 45pc rate had become a distraction from our mission to get Britain moving.”

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.