One of the US top subprime auto lenders, Credit Acceptance Corporation (Nasdaq: CACC), was sued on Wednesday by New York Attorney General Letitia James and the Consumer Financial Protection Bureau (CFPB) for duping thousands of low-income New Yorkers into high-interest automobile loans.

“Credit Acceptance Corporation (CAC) makes predatory loans to millions of financially vulnerable consumers trying to buy a used vehicle. CAC’s loans carry exorbitant interest rates, are loaded with expensive add-on products, and saddle borrowers with debts that even CAC believes the borrowers often cannot afford to repay in full,” the plaintiffs said in the complaint.

They added that the auto lender “aggressively markets itself as an alternative for consumers with limited credit options and touts its loans as a way for consumers to build their credit and gain financial freedom,” but is often setting up consumers to fail.

“CAC tricked people into unaffordable, high-interest auto loans, and made secret deals with car dealerships to overcharge customers to increase their profits,” James tweeted. “We’re suing to get money back for New Yorkers who were cheated and put an end to CAC’s predatory and deceptive practices.”

We're suing to get money back for New Yorkers who were cheated and put an end to CAC's predatory and deceptive practices.

— NY AG James (@NewYorkStateAG) January 4, 2023

No company should be able to profit from driving people into debt.

In a press release, CAC said it “intends to vigorously defend itself in this matter.”

The firm’s shares fell 11.6% on the day following the news.

This is not the first time the auto lender was involved in a legal battle with a state attorney’s office. Massachusetts Attorney General Maura Healey filed a lawsuit in August 2020 against CAC, “for allegedly making unfair and deceptive auto loans to thousands of Massachusetts consumers, providing investors with false or misleading information regarding auto securities they offered, and engaging in unfair debt collection practices.”

Healey claimed that CAC has neglected to disclose investors that, despite asserting otherwise in public filings, the business has topped off the pools of loans that they packaged and securitized with higher-risk loans since 2013. The complaint also alleged that CAC issued high-interest subprime auto loans to Massachusetts applicants knowing they would be unable to repay them, in violation of state law.

One year later, CAC settled the case for more than $27 million, touted by Healey as the “largest settlement of its kind.” Over 3,000 borrowers were projected to be eligible for settlement funds across the state.

Allegations

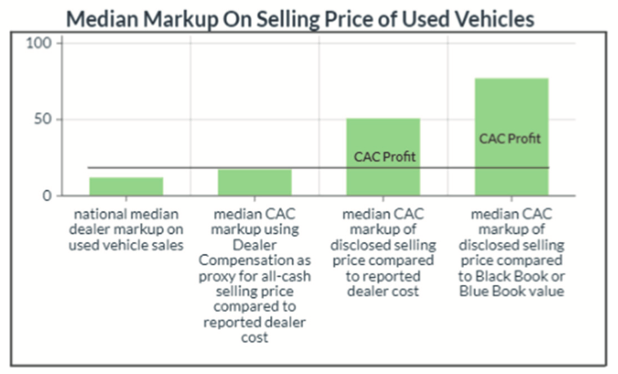

James and the CFPB noted in their complaint that CAC determines the interest rates that affiliated dealers must charge on its loans, which are often around 22%–at par or near the maximum rate allowed in many states. However, those exorbitant interest rates frequently do not reflect how much people actually pay for a CAC loan.

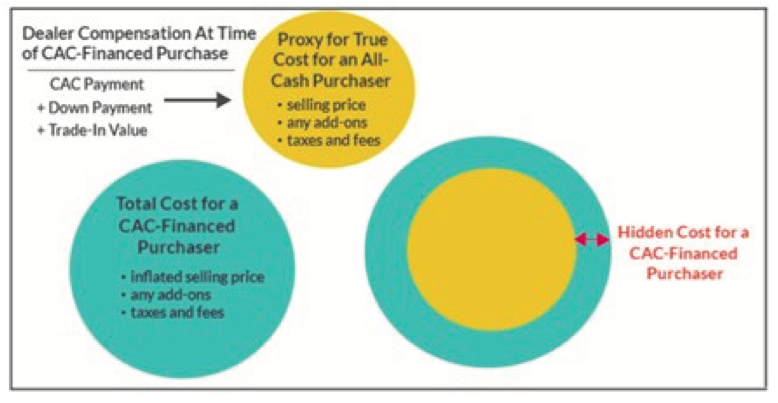

“This is because CAC’s business model pushes dealers to manipulate the prices of vehicles sold to CAC borrowers, hiding an additional cost of credit in the principal amount financed by the loan,” the plaintiffs wrote.

They also allege that the auto lender uses a complex algorithm to score each loan, but it does not use its score to determine whether to offer a loan to the consumer, whether the consumer can afford the loan, or what interest rate to offer. This algorithm, the plaintiffs claim, “is indifferent as to a consumers’ ability to repay loans in full” but is used “to predict how much money it expects to collect on the loan.”

“Because CAC sets the interest rate for the loan and that interest rate does not change based on borrower risk, CAC’s lending model incentivizes dealers to sell cars at inflated prices, which increases the amount CAC pays the dealer,” the plaintiffs added.

They said that the true cost of a CAC loan “is higher than what is disclosed” on the agreements, as a result of this web of financial instruments. In New York alone, more than 84% of CAC loans exceeded the 25% penal usury cap.

“It is unsurprising, then, that CAC predicts from the outset that many consumers will be unable to repay their loans in full. But by structuring its lending model in this way, the Company can collect more from consumers than it pays dealers regardless of whether consumers can ultimately pay off their loans,” the plaintiffs said, adding that for 39% of loans nationwide and for about 25% of New York loans, the firm’s algorithm “projected that it would not collect the full amount financed by the loan.”

“Credit Acceptance obscured the true cost of its loans to car buyers, leading to severe financial distress for borrowers and subjecting them to aggressive debt collection tactics on loans its own systems predicted that borrowers can’t afford to repay,” said CFPB Director Rohit Chopra. “The CFPB’s action with the New York Attorney General seeks to end Credit Acceptance’s unlawful practices and makes consumers whole.”

James aims to cease CAC’s abusive and deceptive activities, amend or invalidate existing CAC loan arrangements, make restitution to injured New Yorkers, and obtain penalties and damages from CAC as a result of this unethical and illegal activity through this case.

CAC was once the subject of short seller Citron Research, who claimed in March that the company’s business strategy is based on harsh debt collecting techniques. They have since removed the report from their website.

Plainsite also delved deep into CAC’s practices in a three-part report, essentially claiming that its “loan performance disclosures belie a deeply flawed business model.”

Credit Acceptance last traded at $395.44 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.