On August 17, Cresco Labs (CSE: CL) reported its second quarter financial results. The company announced revenues grew by $218 million, up 1.8% year over year. Cresco stated that wholesale revenues came in at $95 million, and remained the number 1 “U.S. seller of branded cannabis products with leading share positions in flower, concentrates and vape categories.” Retail revenues came in at $123 million with same-store sales increasing 6% year over year.

All while adjusted gross profits came in at $116 million or a 53% margin, while adjusted EBITDA came in at $51 million or a 23% margin. Lastly, the company said it ended the quarter with $90 million of cash on hand and that the previously announced acquisition of Columbia Care (CSE: CCHW) has been approved, and that the deal is expected to close “around year-end.”

Cresco Labs currently has 17 analysts covering the stock with an average 12-month price target of C$12.54, or an upside of 167%. Out of the 17 analysts, four have strong buy ratings, eleven have buy ratings, and the last two analysts have hold ratings on the stock. The street high price target sits at C$31 or an upside of about 560%.

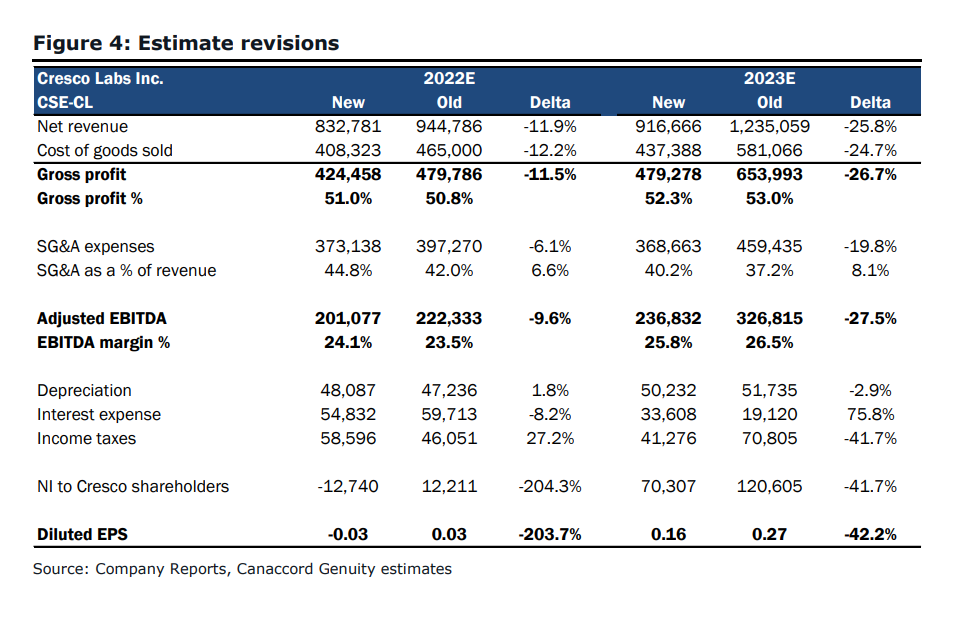

In Canaccord Genuity Capital Markets’ note on the results, they reiterate their buy rating while cutting their 12-month price target down to C$8.00 from C$9.50, saying that the price target cut comes as they are lowering their full-year estimates on the stock while also lowering their multiple.

They say they are lowering their 2022 full-year estimates to “reflect the relatively muted growth expected over the front half of the year, wholesale pricing challenges, and the shifting consumer spending habits given the elevated inflation within the overall retail market.”

On the results, Cresco Labs came in line with Canaccord’s estimates as they expected revenues to come in at C$219 million while gross profits were expected to come in at C$110.5 million. They say that Cresco was able to record industry-leading wholesale revenues of $95 million “despite a 10-30% reduction in wholesale pricing across its state footprint.”

Lastly, Canaccord expects wholesale pricing to “continue to compress over the back half of the year,” which has lowered their expectations of strong sequential revenue growth in the second half of the year.

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.