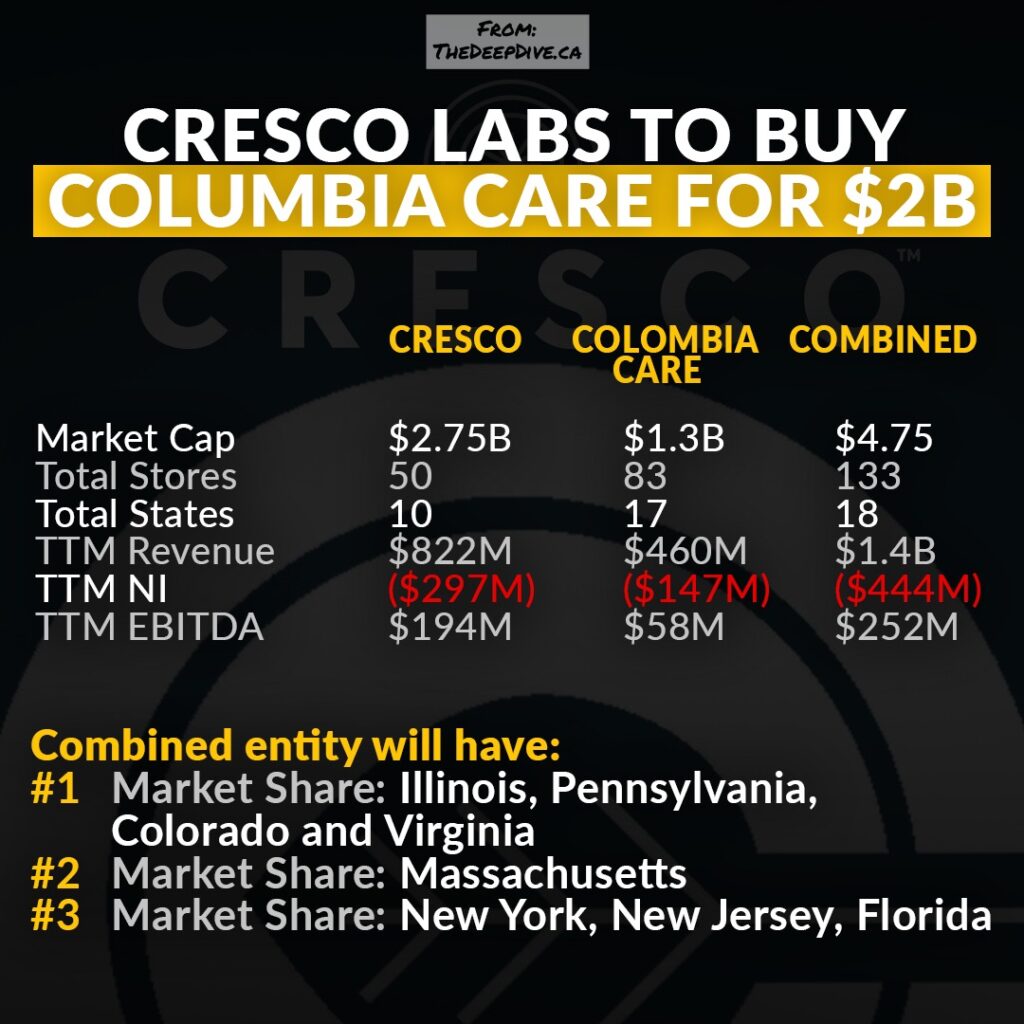

Cresco Labs (CSE: CL) released its Q4 and full-year 2021 financials, highlighting what it deems a record annual revenue of $821.7 million. This is an increase from 2020’s $476.3 million.

Gross margin for the year also increased to 49.5% coming from 43.4% from the year-ago period.

However, the firm ended with a net loss of $296.8 million for 2021, which is still primarily due to the recorded impairment losses in the past two quarters amounting to $305.9 million. This compares to 2020’s net loss of $92.8 million.

Calibrating for this impairment loss and other financial items, adjusted EBITDA for the year ended at $194.0 million, an increase from last year’s $60.8 million.

For Q4, the firm said it had a record quarterly revenue of $217.8 million, an increase from Q3 2021’s $215.5 million and Q4 2020’s $162.3 million. The quarter also ended with a net loss of $11.9 million compared to the net losses of last quarter at $263.5 million and last year at $41.2 million.

Adjusted EBITDA for the quarter came in at $57.0 million compared to last quarter’s $56.4 million and last year’s $30.0 million.

The firm ended Q4 2021 with $226.1 million in cash, cash equivalents, and restricted cash balance coming from a starting balance of $254.8 million at the beginning of the quarter. The cash burn is mainly due to spending in investing activities, most of which are tied to the firm’s recent acquisitions of Cure Pennsylvania and Laurel Harvest.

The multi-state operator also announced today the plan to acquire Columbia Care in an all-stock transaction.

Cresco Labs last traded at $8.20 on the CSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.